0% VAT on energy‑saving materials: what installers need to know, invoice wording and examples

Jump To...

Engineer installing an air source heat pump with a 0 percent VAT timeline overlay

Quick answer

- From 1 April 2022 to 31 March 2027, the installation of qualifying energy saving materials in homes and certain charitable buildings is zero rated for VAT. After 1 April 2027 it reverts to 5 percent unless the law changes.

- It’s the installation that’s relieved. Supply only of materials is standard rated.

- Typical qualifying tech includes heat pumps, solar panels, insulation and, from 1 Feb 2024, batteries and water source heat pumps. See the full list below and the HMRC guidance.

What counts as energy saving materials under VAT 708-6

Qualifying installations include:

- Controls for central heating and hot water systems

- Draught stripping

- Insulation

- Solar panels

- Wind turbines

- Water turbines

- Ground source heat pumps

- Air source heat pumps

- Micro combined heat and power units

- Wood fuelled boilers Additions from 1 Feb 2024:

- Water source heat pumps

- Electrical storage batteries including standalone or retrofit

- Smart diverters that direct surplus solar to hot water

- Necessary groundworks for ground or water source heat pumps

Reference guidance: HMRC VAT Notice 708/6 and Internal Manual VENSAV pages linked below.

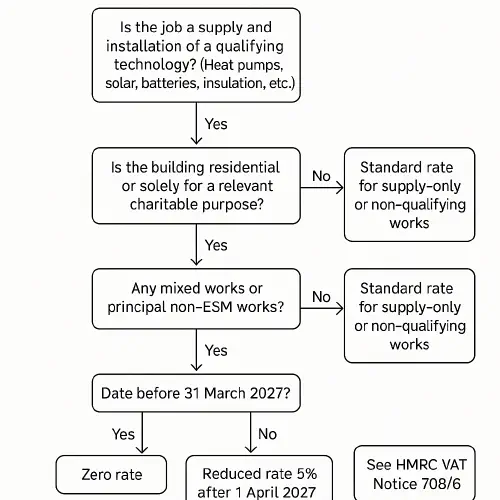

Does my job qualify A simple decision flow

Decision flowchart for choosing the correct VAT rate on energy saving materials installs

How to invoice at 0 percent VAT with wording and examples

Rules to follow:

- Show clearly which line items are zero rated and which are standard rated if you’ve a mixed invoice.

- You don’t have to issue a VAT invoice for a zero rated supply, but if you do, make the VAT position clear.

- Keep evidence that the building is residential or solely for a relevant charitable purpose if you’re using the charitable route.

Example invoice lines:

- Supply and installation of air source heat pump qualifying as energy saving materials. VAT zero rated.

- Electrical storage battery supplied and installed as qualifying energy saving materials. VAT zero rated.

- Ancillary works forming part of a single supply of qualifying energy saving materials installation. VAT zero rated.

- Supply only of heat pump outdoor unit. Standard rated at 20 percent.

Optional legal note you can add on the invoice footer:

- Zero rated under VATA 1994 Schedule 8 Group 23 to 31 March 2027.

Edge cases and gotchas

- Supply only: If you’re not installing, it’s standard rated even if the kit would qualify when installed.

- Single vs multiple supply: If the main purpose of the job is the energy saving material installation, reasonable ancillary works follow the same VAT rate. If the main job is something else, like a new extension, that wider job can be standard rated.

- Mixed use buildings: If one system serves both qualifying and non qualifying areas, you may need to apportion. Document your basis.

- Charities: From 1 Feb 2024, buildings used solely for a relevant charitable purpose can also be zero rated for qualifying installs. Keep a signed customer declaration about building use.

- Dates matter: The zero rate window runs to 31 Mar 2027. Quote and schedule so. If completion falls after that date and the law is not extended, the reduced rate of 5 percent applies.

- Northern Ireland and Great Britain: The relief is UK wide, but some technologies were added later in NI. Always check the effective dates in the HMRC table.

Common job scenarios with the likely VAT position

- Heat pump replacement in a house, including new cylinder and controls. Zero rated as a single supply of qualifying energy saving materials installation.

- Solar PV with a retrofit battery to an existing home. Zero rated for both the PV install and the battery from 1 Feb 2024.

- Battery only retrofit to an existing solar system. Zero rated from 1 Feb 2024.

- Supply only of solar panels to a self installer. Standard rated.

- Heat pump install plus new conservatory. If the principal supply is the conservatory build, the whole job may be standard rated. Split supplies may be needed. Take advice and document the scope clearly.

- Water source heat pump with trenching or dredging for pipework. The necessary groundworks are within scope from 1 Feb 2024, so zero rated to 31 Mar 2027.

Tip: Manufacturers such as Vaillant provide clear overviews of which products are in scope. Always pair this with the HMRC source links.

Evidence to keep on file

- Proof the premises are residential or a qualifying charitable building, where relevant.

- Contract, quote and job scope showing an energy saving materials installation as the principal supply.

- Commissioning sheets, photos and serial numbers that match the installed technology.

- For mixed buildings, your apportionment method and calculations.

- Customer declaration for charitable use, if used.

Pricing and quoting tips

- Use clear line items so you can split any standard rated elements from the zero rated install if needed.

- Add a note in your quote about the zero rating window ending on 31 March 2027, and that you’ll apply the rate in force on the tax point.

- Train your office team to spot supply only orders so they don’t wrongly zero rate them.

- If you sell on finance, make sure the lender documents match your VAT treatment.

- Related reads: Domestic reverse charge VAT for construction and CIS monthly return: deadlines and how to file.

Video explainer

Useful links and sources

- HMRC guidance: Energy saving materials and heating equipment VAT Notice 708/6

- HMRC internal manual table of technologies and dates: VENSAV2083

- Water source heat pumps page: VENSAV3081

- Groundworks for GSHP and WSHP: VENSAV3082

- Single vs multiple supply guidance: VENSAV3210

- Apportionment in mixed use buildings: VENSAV3320

- Federation of Master Builders explainer: 0 percent VAT measures on energy efficiency installation

- House of Commons Library briefing: VAT on solar and energy saving materials

FAQs

Does 0 percent VAT apply to batteries fitted on their own

Yes. From 1 Feb 2024, electrical storage batteries qualify for zero rating when supplied and installed in residential accommodation, even if they’re not fitted with new solar at the same time.

Are EV chargers zero rated

No. EV charge points are not on the energy saving materials list. Standard rate applies unless another relief applies.

Do I need a special VAT invoice for zero rated work

No special format is required. Usual VAT invoice rules apply. If you issue an invoice, show the zero rated lines clearly. Keep the evidence that supports your rate.

Can I zero rate if the customer supplies the kit and I only fit it

Yes, if you’re supplying and installing qualifying energy saving materials as a single supply, you can zero rate your supply of installation. The customer’s supply only purchase from a merchant remains standard rated.

What happens after 31 March 2027

Under current law, the rate for qualifying installations will revert to 5 percent from 1 April 2027. Monitor HMRC updates in case of extensions or changes.

{

"@context": "https://schema.org",

"@type": "FAQPage",

"mainEntity": [

{

"@type": "Question",

"name": "Does 0 percent VAT apply to batteries fitted on their own",

"acceptedAnswer": {"@type": "Answer", "text": "From 1 Feb 2024, batteries qualify for zero rating when supplied and installed in residential accommodation, even without new solar."}

},

{

"@type": "Question",

"name": "Are EV chargers zero rated",

"acceptedAnswer": {"@type": "Answer", "text": "No. EV ch...

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist