2026 Fast-Track Debt Recovery for UK Trades: Automate 30-Day Chasing, Interest, and Digital Court Action

Jump To...

Modern trades office running a fully digital credit control workflow, with e‑invoicing, live 30‑day countdowns and one‑click legal escalation all visible on screen.

Who this is for

- UK trades and construction firms working on public sector or large commercial jobs.

- Owners, finance leads and office managers running Xero, QuickBooks Online or Sage Business Cloud.

- SMEs who are tired of “polite chasing” and want automated, lawful and fast debt recovery.

- Anyone confused by the Procurement Act 2023, 30‑day rules, statutory interest and the new Online Civil Money Claims (OCMC) process.

What this guide covers

- The 2026 legal landscape for payments, including 30‑day terms, statutory interest and mandatory mediation.

- A step-by-step automated workflow from invoice to OCMC claim that a small trades business can actually run.

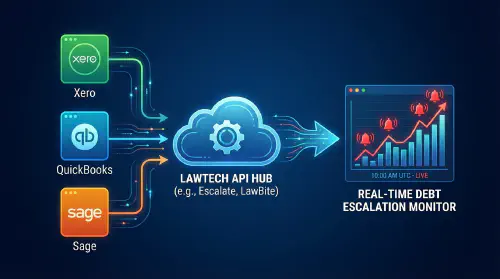

- How to wire up Xero/QuickBooks/Sage with Zapier/Make and lawtech APIs (Escalate, LawBite, etc.).

- Ready-to-use email/SMS scripts for each escalation stage, updated for 2026.

- Checklists, calculators and where to get help (including r/LegalAdviceUK and r/UKTrades).

Why 2026 is different for late payments

If you’re still treating late payment as “just part of the game”, 2026 is the year that thinking becomes expensive.

The Procurement Act 2023 has moved UK construction and trades towards hard 30‑day payment expectations, digital transparency and faster legal recourse:

- 30‑day payment terms now must be honoured on most public contracts, and that duty cascades down the supply chain. Guidance: Prompt payment policy.

- Authorities and large suppliers must publish Payment Compliance Notices (PCNs) every 6 months, exposing slow payers. Guidance: Payment compliance notices.

- From mid‑2025, most money claims are pushed through OCMC, with mandatory mediation on small claims, fully online. Guidance: MyHMCTS OCMC guide.

- The Small Business Commissioner (SBC) now runs a more visible Fair Payment Code with spot checks and board‑level scrutiny: Fair Payment Code.

The upside: if you set up your workflows properly, you finally have legal teeth and a digital trail that’s built for the new regime, not fighting against it.

Think of your credit control as another dashboarded system: live invoice ages, 30‑day flags, Payment Compliance Notices and legal status all visible at a glance, just like job progress.

2026 compliance essentials in plain English

30‑day payment terms and the supply chain

Under the Procurement Act 2023 and related guidance:

- Public bodies must pay undisputed invoices within 30 days of receipt.

- That 30‑day duty cascades to primes, main contractors and subs delivering the same public contract.

- For you as a trades SME, that means:

- You should quote and invoice on 30‑day terms as standard on public sector projects.

- Your systems must be able to prove when the invoice was received (email log, portal timestamp or e‑invoice receipt).

Official guidance: Prompt payment policy.

Statutory interest and fixed fees

Late payments between businesses are covered by the Late Payment of Commercial Debts (Interest) Act. GOV.UK guidance: Charging interest and debt recovery.

Key points for 2026:

- You can charge statutory interest = Bank of England base rate + 8%.

- With a base rate of 3.75% at 31 Dec 2025, the statutory rate for early 2026 is 11.75% per annum.

- You can also add a fixed recovery fee (£40, £70 or £100 depending on invoice size).

- These rights apply even if your contract is silent on interest.

This is not “being awkward”; it is designed to compensate you for financing someone else’s project.

Digital court and mandatory mediation (OCMC)

From 28 July 2025, most money claims must go through Online Civil Money Claims (OCMC):

- Claims are started and managed online through MyHMCTS.

- Small claims under £10,000 are automatically referred to mediation.

- The system expects you to show:

- Evidence of chasing (emails/SMS/letters).

- A proper Letter Before Action (LBA).

- A clear mediation attempt (invite, response, or non-response).

Guidance: MyHMCTS OCMC and Small claims mediation pilot.

This is exactly why an automated, timestamped workflow is so powerful: the audit trail you create in Xero/QuickBooks/Sage and your lawtech partner feeds straight into OCMC.

The real-world automated workflow for UK trades

Let’s join the dots between the law and what actually happens in a small office.

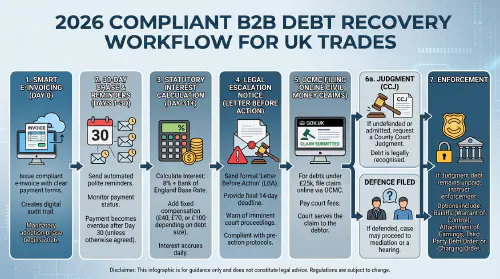

Below is the recommended 2026 workflow you can run on a typical cloud stack: Xero/QuickBooks/Sage + Zapier/Make + legal API (Escalate, LawBite, etc.).

Use this workflow infographic as a visual checklist: from e‑invoicing and reminders right through to statutory interest, mediation and OCMC filing.

Step 1 – Issue the invoice and start the 30‑day clock

- For public sector clients, send a true e‑invoice in EN 16931 format (often via PEPPOL or your accounting add‑on). GOV.UK: Electronic invoicing and payment.

- For private clients, a normal PDF/email invoice is fine, but log:

- Date sent (system timestamp).

- Delivery channel (email, portal, EDI).

In Xero/QuickBooks/Sage:

- Set due date = 30 days (or shorter if your contract allows).

- Tag the invoice with:

- Job reference / project code.

- Public contract flag (so you can report and chase appropriately).

Automation:

- A simple Zapier/Make scenario can watch for “New invoice” and:

- Start a 30‑day countdown.

- Schedule reminder messages at Day 14, Day 25 and Day 31+.

Step 2 – Gentle reminder (Day 14–16)

The first reminder is just a nudge. You’re not talking law yet; you’re preventing “forgotten” invoices.

Suggested copy:

“Hi [Contact], hope you’re well. Just a quick reminder—our invoice [INV123] for [job] is due for payment by [date]. If you need any details or a copy, let me know. Many thanks!”

Automation tips:

- Use your accounting platform’s built‑in reminders or a Zapier/Make flow that:

- Pulls invoice amount, due date and payment link.

- Sends an email and/or SMS from a consistent address or number.

- Log the reminder event against the invoice as a note or activity. This is future OCMC evidence.

Step 3 – Firm reminder with statutory interest warning (Day 25)

Now you get clearer and start referencing your rights.

Suggested copy:

“Hi [Contact]. Our invoice [INV123] for [job], due on [date], remains outstanding. Please note statutory interest at 11.75% p.a. applies after 30 days (in line with the Procurement Act 2023 and late payment legislation). If unpaid, we may begin legal recovery.”

Key points:

- Quote the current statutory interest rate (check the SBC calculator: Interest calculator guidance).

- Still offer an easy way to pay (bank details, payment link, card link).

Automation:

- Configure a second reminder template in Xero/QuickBooks/Sage for invoices 5 days before due.

- Or have Zapier/Make:

- Filter invoices where

today = due date - 5. - Send the firm reminder and log the action.

- Filter invoices where

Step 4 – Letter Before Action (LBA) (Day 31–35)

Once the invoice is overdue, move swiftly to an LBA. This is where many trades firms lose 2–4 weeks by “hoping” the client will pay.

Suggested template:

“Dear Sir/Madam,

Despite previous reminders, invoice [INV123], due on [date], remains unpaid and now attracts statutory late payment interest (11.75% p.a.) plus our entitlement to a fixed recovery fee under the Late Payment of Commercial Debts legislation.If payment is not received within 7 days, we will escalate to a claim via the HMCTS Online Civil Money Claims portal without further notice.”

Make sure the LBA includes:

- Invoice details (number, date, amount, job reference).

- Interest basis (Bank of England base rate + 8%).

- Fixed fee entitlement.

- Clear deadline (e.g. 7 days).

- Reference to OCMC and possible court costs.

Automation options:

- Use lawtech partners like Escalate or LawBite that offer an API:

- When an invoice hits “Overdue + X days”, send key data from your accounts to the legal platform.

- The platform generates and sends a compliant LBA under your branding.

- If you prefer manual control:

- Trigger an internal task or reminder at Day 31 to send an LBA from a template.

Many trades firms now compare Xero, QuickBooks and Sage not just on invoicing, but on how easily they connect into lawtech APIs for Letters Before Action and digital claims.

Step 5 – Mediation pause for small claims

If you’re still unpaid after the LBA deadline, you’re in pre‑court territory. For claims under £10,000, mediation is no longer optional noise in the background—it’s baked into the process.

In practice:

- Send a short mediation invite email:

- Offer a 30‑minute call.

- Suggest two time slots.

- Confirm you are willing to mediate in line with OCMC requirements.

- Log:

- The invite.

- Any reply (including “no response”).

For OCMC, being able to prove you offered mediation – even if ignored – is powerful. Users on r/LegalAdviceUK regularly advise that simply being organised and reasonable often helps your case when it comes before a judge.

Step 6 – Digital court filing via OCMC

If mediation fails (or the other side ghosts you), move straight to digital filing:

- Prepare:

- Copies of quotes, contracts, purchase orders.

- The invoice and delivery evidence (completion certificates, photos, site sign‑offs).

- The chase log (reminders, LBA, mediation invite).

- Interest calculation and fixed fee breakdown.

- Issue the claim through MyHMCTS (OCMC) and pay the fee by card.

- From here, status updates live in MyHMCTS, but you should mirror key dates back into your accounts or task management system so the whole team knows where things stand.

This is where lawtech partners earn their keep: several platforms can now push claims into OCMC, or at least structure the bundle for you.

Step 7 – Enforcement and recovery

After a successful judgment:

- Decide whether to pursue:

- County Court bailiffs (smaller claims, slower).

- High Court Enforcement Officers (HCEOs, faster but only above a threshold).

- Log the enforcement action so your team doesn’t keep sending routine chases to a debtor who is now in formal enforcement.

Again, automation here is more about good internal process than fancy AI. The main goal is to have one consistent playbook rather than each project manager improvising.

Tooling: accounts platforms and legal APIs compared

Your accounting platform is the engine; your legal API is the turbo.

Core accounting platforms

Most UK trades firms are on one of:

- Xero

- QuickBooks Online

- Sage Business Cloud

All three can:

- Issue invoices and reminders.

- Track due dates, ageing and payment status.

- Integrate with Zapier or Make.com for more advanced automation.

Where they differ for this use case is how easily they connect to e‑invoicing gateways and lawtech partners. For full EN 16931 / PEPPOL B2G compliance you may need an add‑on, but the underlying platforms are ready.

Legal escalation and OCMC support

Platforms like Escalate and LawBite are designed to slot into your existing stack:

Visualise your stack as a set of connected apps: QuickBooks, Xero or Sage feed live invoice data into a legal API partner, which then automates LBAs, mediation records and OCMC filing.

Typical capabilities:

- Letter Before Action templates that meet current pre‑action protocol.

- Structured evidence capture (chase logs, emails, contracts).

- OCMC claim preparation and in some cases direct filing.

- Tracking mediation outcomes and enforcement stages.

For many SMEs, the sweet spot is:

- Let Xero/QuickBooks/Sage handle 14‑day and 25‑day reminders.

- Once an invoice is 30+ days overdue, pass it via API or secure portal to your legal partner.

2026 statutory interest example (and how to automate it)

To make this concrete, take a £1,000 invoice that’s paid 20 days late in early 2026.

- Annual interest at 11.75% = £1,000 × 11.75% = £117.50.

- Daily interest = £117.50 ÷ 365 ≈ £0.32 per day.

- For 20 days late: 20 × £0.32 ≈ £6.45.

- Add the appropriate fixed recovery fee (e.g. £40 for smaller invoices).

You can:

- Add a “Statutory interest & charges” line to your invoice system.

- Use the SBC calculator to get the precise figure: SBC interest calculator guidance.

- Have Zapier/Make:

- Detect an invoice that changes to Overdue.

- Calculate the accrued interest each week and notify you if it’s worth adding a supplementary charge.

Remember, charging interest is optional – but having the option ready, with numbers you can justify, is a strong negotiating tool.

Practical scripts for each stage

You already saw the short versions; this section gives slightly richer text you can drop into templates.

Friendly reminder (Day 14–16)

Use for all clients as standard:

Subject: Reminder – invoice [INV123] due [date]

Hi [First name],

Hope everything’s going well on your side. Just a quick note that our invoice [INV123] for [job / site], due [date], is coming up.

I’ve attached a copy here with the payment link for convenience. If there’s any issue with the figures or paperwork (PO, completion photos, certificates), let me know and we’ll sort it.

Thanks again,

[Your name]

Firm reminder with next steps (Day 25)

Raise the stakes but keep it professional:

Subject: Overdue soon – invoice [INV123] for [job]

Hi [First name],

Our invoice [INV123] for [job / site], due [date], is still showing as unpaid on our system.

Under UK late payment legislation and the Procurement Act 2023 requirements around prompt payment, this invoice will begin to attract statutory interest at 11.75% p.a. plus a fixed recovery fee if it goes beyond 30 days.

Please can you arrange payment by [short date] or confirm if there’s a query we need to resolve?

Regards,

[Your name]

Letter Before Action (Day 31+)

This should be sent once, with a clear deadline:

Subject: Formal Letter Before Action – invoice [INV123]

Dear [Name or Sir/Madam],

Despite prior reminders, our invoice [INV123] for [amount], issued [invoice date] and due [due date], remains unpaid.

Under the Late Payment of Commercial Debts legislation, this debt is now accruing statutory interest at 11.75% per annum (Bank of England base rate + 8%) together with a fixed debt recovery fee.

Unless full payment of [principal], plus accrued interest and applicable fixed fee, is received within 7 days of this letter, we will commence proceedings via the HMCTS Online Civil Money Claims portal without further notice.

If you believe there is a genuine dispute, please respond in writing within this period setting out full details.

Yours faithfully,

[Your name]

[Firm name]

OCMC claim notification (post‑mediation)

Subject: Notification of court claim – invoice [INV123]

Dear [Name or Sir/Madam],

As payment for invoice [INV123] remains outstanding and mediation has not resolved the matter, we have now commenced proceedings via the HMCTS Online Civil Money Claims portal.

The claim includes the original invoice amount, statutory interest, fixed recovery fee and the court issue fee.

You will receive formal notification from the court with details of how to respond. In the meantime, if you wish to make payment in full to avoid further action, please contact us urgently.

Yours faithfully,

[Your name]

Building the automation in Xero, QuickBooks or Sage

You don’t need a developer; you just need to be systematic.

In your accounts system

Configure:

- Standard payment terms of 30 days (or stricter) for your public sector customers.

- Invoice reminders:

- Xero: 1st reminder 14 days before due, 2nd 5 days before due, final on due/overdue.

- QuickBooks: similar schedule via Automated reminders.

- Sage: use Email reminders and customer-specific terms.

Tie this into your job workflow so invoices always go out:

- As soon as milestones are hit.

- With supporting evidence attached: photos, sign‑offs, certificates.

For stronger dispute prevention, see TrainAR’s guide “Disputeproof Invoicing for Trades: Attach Site Evidence to Xero or QuickBooks and Stop Arguments Before They Start”:

https://academy.trainar.ai/disputeproof-invoicing-for-trades-attach-site-evidence-to-xero-or-quickbooks-and-stop-arguments-before-they-start

With Zapier or Make.com

Example flows:

Flow 1 – Tag overdue invoices for escalation

- Trigger: invoice becomes Overdue by 1 day.

- Action:

- Add label “Stage: LBA pending”.

- Notify your credit controller via email/Slack.

Flow 2 – Push to legal partner

- Trigger: invoice tagged “Stage: LBA pending” and still unpaid after 7 days.

- Action:

- Send invoice details and documents to Escalate/LawBite via webhook or email.

- Update invoice note with “LBA sent [date]”.

Flow 3 – Mediation logging

- Trigger: you send a pre‑configured “mediation invite” email from your CRM.

- Action:

- Log a note: “Mediation invite sent [date/time]”.

- Start a 7‑day timer to check for responses.

Training, resources and where to get help

If you’re building this into a wider credit control transformation, it’s worth investing a couple of hours getting your cash flow and documentation tight.

Useful internal resources from TrainAR:

- “13 Week Cash Flow for Trades: Simple UK Template with CIS, VAT, and Retentions” – how to line up cash inflows and outflows so late payments don’t sink payroll:

https://academy.trainar.ai/13week-cash-flow-for-trades-simple-uk-template-with-cis-vat-and-retentions - “Late Payment Fees for Trades: Charge Interest Legally + Template Wording and a Chase Flow UK” – deeper dive into statutory interest wording and recovery fees:

https://academy.trainar.ai/late-payment-fees-for-trades-charge-interest-legally-template-wording-and-a-chase-flow-uk

Government and official guidance:

- Prompt payment and 30‑day rules – GOV.UK prompt payment policy

- Payment Compliance Notices – GOV.UK PCN guidance

- E‑invoicing requirements – GOV.UK e‑invoicing guidance

- Late payment interest and costs – GOV.UK late payments

- OCMC and digital claims – MyHMCTS OCMC guide

- SBC Fair Payment Code – Small Business Commissioner Fair Payment Code

Community help and peer experience:

- Legal process and wording: r/LegalAdviceUK

- Practical credit control tactics for trades: r/UKTrades

Video walkthroughs worth a watch:

- Watch Video – “Best Invoicing Software for Small Business & Freelancers UK (2026)” – helpful for seeing which tools handle automation and e‑invoicing cleanly.

- Watch Video – “Top 10 AI Tools For Finance You MUST Know in 2026” – useful to spot emerging tools you can bolt onto Xero/QuickBooks/Sage.

FAQs

Can I really charge interest and fees on small invoices?

Yes. The Late Payment of Commercial Debts rules apply regardless of your size. Even micro‑firms can charge statutory interest and a fixed recovery fee on late B2B invoices. Whether you actually do so on every job is a commercial decision, but you should at least reference your right in firm reminders and LBAs.

Do I need to switch accounting systems to be compliant?

No. Xero, QuickBooks Online and Sage Business Cloud can all support a compliant 30‑day, reminder‑and‑escalation workflow. What you might need is:

- An e‑invoicing/PEPPOL add‑on for public sector clients.

- A legal tech partner for LBAs and OCMC claims. Your core system is the base; integrations add the “fast track”.

Is mediation just another delay tactic from slow payers?

Sometimes it can feel that way, but under the new rules, offering mediation is part of showing the court you’re reasonable. Even if the other side ignores you, the logged invite and non‑response will usually help your position with OCMC and, ultimately, the judge.

Do I need to send physical letters for LBAs?

No. A properly worded digital LBA sent by email is acceptable and fits the modern, online process. The important part is:

- You can prove it was sent (email log, system record).

- The content meets pre‑action requirements and sets a clear deadline.

What if I’m worried about upsetting a key client?

Fair point. Many firms adopt a tiered approach:

- For good payers who hit a snag, use interest as a lever you can waive once, while reinforcing expectations.

- For habitual late payers, stick to your full process – interest, fees, LBA, and OCMC if needed. Over time, you will train your client base or replace the worst offenders.

Want to slash training times and increase revenue per Engineer? Join our Waitlist: https://trainar.ai/waitlist

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist