AI cash flow forecasting for trades: set it up with Xero or QuickBooks and GoCardless

Jump To...

Trades van at site with a 13-week cash flow chart and finance app icons

Quick answer

If your jobs are in Xero or QuickBooks and you take payments by Direct Debit with GoCardless, you can get a live 13-week forecast that reacts automatically when:

- A quote becomes a job and a deposit invoice is raised.

- Progress invoices are scheduled against milestones.

- Payments are collected by Direct Debit and reconciled.

- VAT quarters, CIS deductions and supplier bills hit the plan.

Use a forecasting app that reads your accounting data and learns your patterns. Popular UK options trades use include Float, Futrli (by Sage), Agicap and Prophix. Then lock in cashflow with GoCardless mandates so future invoices collect automatically.

Who this is for

- Small builders, electricians, plumbers, HVAC, fit‑out and maintenance firms.

- Owners and office managers who use Xero or QuickBooks Online and want fewer surprises on payday and VAT quarter‑ends.

How AI forecasting helps trades

- Learns seasonality and customer behaviour to predict when money actually lands (not just invoice due dates).

- Spots gaps ahead of time so you can shift supplier buys or nudge clients sooner.

- Runs scenarios: what if a job slips 2 weeks, diesel goes up, or you add a crew?

- Surfaces outliers (a client who always pays 18 days late) and builds that into your plan.

Set up the building blocks

- Connect your accounts

- Xero: turn on bank feeds and invoice reminders. See our guides on bank feeds and reminders in Finance & Tax.

- QuickBooks: use the Cash Flow Planner and keep bank feeds connected. Intuit’s tutorial is handy.

- Take payments the low‑friction way

- Set up GoCardless Direct Debit mandates when clients accept quotes. Single mandate = you can collect each staged invoice automatically. GoCardless supports online, paper and phone mandates.

- Tag the essentials in your system

- Mark deposit, progress and completion invoices clearly so your forecast groups them.

- Use tracking categories or classes for projects so forecasts can roll up per job.

- Pick your forecasting app

- Float (for Xero/QuickBooks) is simple and trades‑friendly.

- Futrli (by Sage) adds predictive models on top of your books.

- Agicap suits firms with multiple accounts and more complex approvals.

- Prophix/Nomentia are heavier‑duty if you’re multi‑entity.

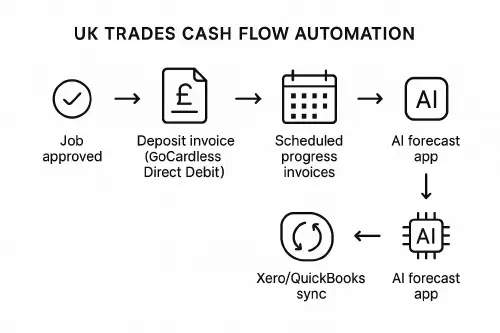

Workflow: deposits to completion, synced to your forecast

- Quote accepted → Create job and 30 to 40 percent deposit invoice.

- Get a GoCardless mandate link signed; collect the deposit automatically.

- Add scheduled progress invoices for milestones (first fix, second fix, handover). Set realistic due dates.

- Order materials against POs so supplier bills are dated correctly (your forecast needs both in and out).

- On each milestone, trigger the invoice; collection runs on the mandate; QuickBooks/Xero marks it paid on settlement.

- Your forecasting app ingests the updates and shifts the curve, including VAT and CIS timing.

Tip: Add a “retention” line on the final invoice or a separate invoice with the release date, so the forecast doesn’t assume you’ll get that cash earlier than agreed.

Pick an AI/automation-friendly forecasting tool

- Xero guide to cash flow forecasting: good overview and tool options. Xero guide

- QuickBooks Cash Flow Planner help: how it builds 90‑day projections. QuickBooks help

- Float for construction/architecture: scenario planning with Xero/QuickBooks. Float

- Futrli by Sage: UK‑focused forecasting with prediction models. Sage Futrli

- Agicap (construction sector page). Agicap

- Prophix cash flow planning (advanced). Prophix

Optional video

Tweak your invoicing terms to reduce late payers

- Use the Late Payment of Commercial Debts rules when you need them: you can charge 8 percent plus the Bank of England base rate, plus a fixed recovery fee. See GOV.UK guidance. GOV.UK guide

- Keep terms to 7 to 14 days on small works. For larger jobs, get staged payments tied to milestones.

- Collect a Direct Debit mandate upfront so you’re not chasing cards or transfers.

- For public sector clients, 30 days is the norm.

Bank Rate moves: check the current base rate on the Bank of England site before calculating interest. Bank Rate

Weekly routine to keep the forecast true

- Reconcile bank feeds daily.

- Review the 13‑week view every Friday: push any delayed invoices, shift supplier bills to the right week.

- Scan upcoming VAT and payroll weeks; top up the cash cushion if needed.

- Chase anything due within 3 days; let the mandate do the rest.

Flowchart of deposit to completion with Direct Debit and forecasting app

Useful links

- Late payments: charging statutory interest and fixed fees. GOV.UK

- Claim fixed debt recovery costs. GOV.UK

- When a payment becomes late. GOV.UK

- GoCardless mandates and taking payments by Direct Debit. GoCardless developers • GoCardless overview

- Bank of England base rate and history. BoE base rate

- RICS cash flow forecasting (construction). RICS

Related TrainAR Academy articles:

- Cash flow forecasting for trades in Xero or QuickBooks: simple setup, open banking tips and a one‑page template

- 13‑week cash flow for trades: simple UK template with CIS, VAT and retentions

- VAT bad debt relief for construction: step-by-step for Xero and QuickBooks (with templates)

FAQ

Is this overkill for a micro team? Not if late payments or VAT quarters ever catch you out. A simple Float setup pulling from Xero or QuickBooks often pays for itself the first time it helps you dodge an overdraft.

Can I do this without GoCardless? Yes, but you’ll chase more. Card readers are fine on site, but for staged jobs Direct Debit beats manual bank transfers for on‑time collection.

What about retentions? Add a separate line or invoice with the expected release date. Your forecast should treat it as future cash, not next month’s money.

Will AI get the dates wrong? Sometimes. That’s why you sanity‑check weekly. The system learns, but you still move a few lines to match real site progress.

What if my client disputes a stage? Keep photo evidence and signed variations. See our article on preventing chargebacks and disputes for workflows that protect you. Chargebacks playbook

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist