AI invoice chasing with WhatsApp: set up Xero or QuickBooks payment links and cut DSO in 14 days

Jump To...

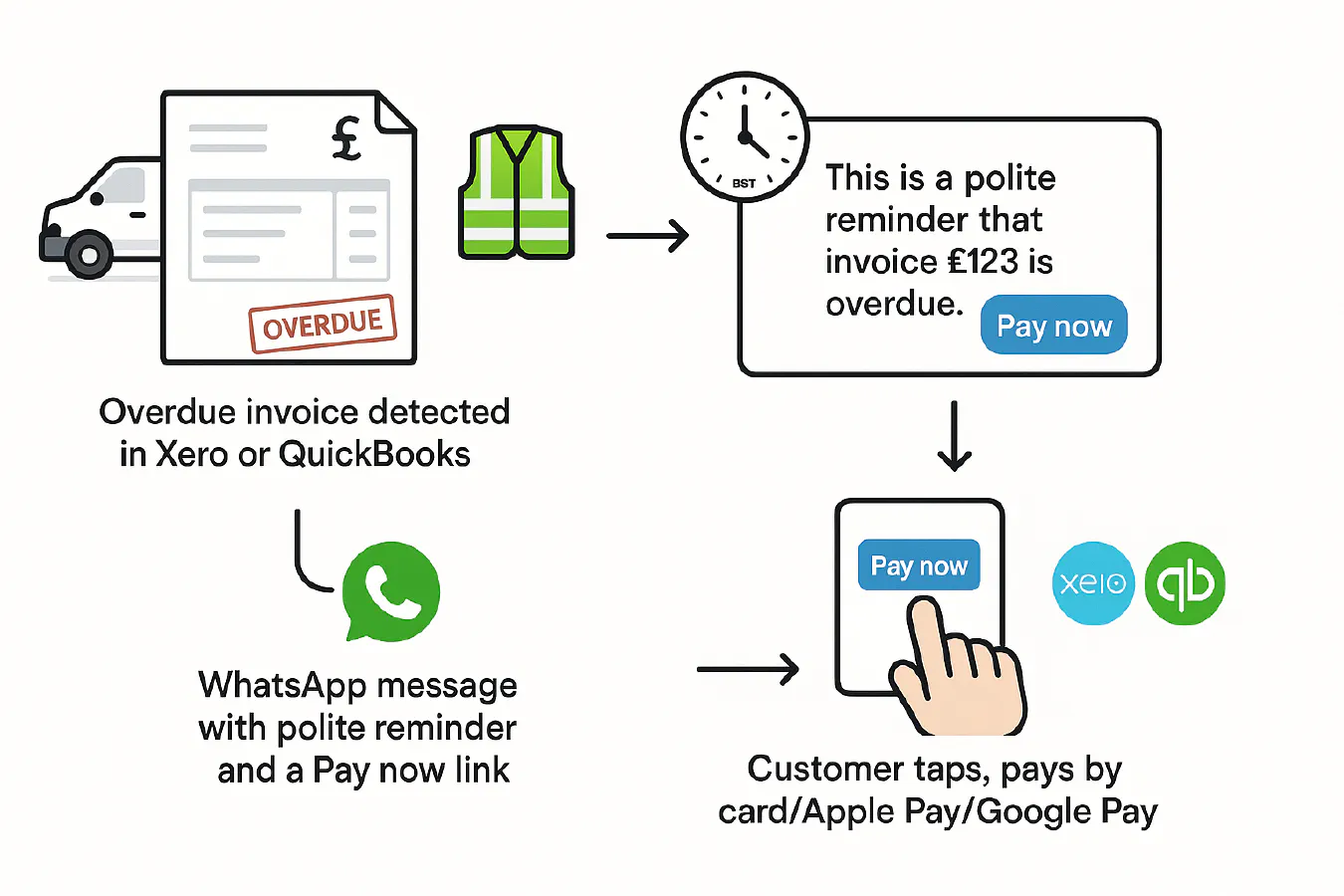

Flow from overdue invoice in Xero/QuickBooks to WhatsApp Pay now link to payment and sync back

Quick wins

- Add a Pay now button to your invoices in Xero or QuickBooks so customers can pay by card, Apple Pay or Google Pay.

- Chase by WhatsApp, not just email. Open rates are higher and replies are faster.

- Keep messages short and friendly. Add the invoice number, amount, due date and a secure payment link.

- Nudge at 1 day overdue, 7 days and 14 days. Escalate tone if needed, keeping it polite and factual.

- For bigger jobs, include a phone number and offer to help if there’s a query.

How the workflow works

- Your accounting app spots invoices that are overdue.

- A WhatsApp message is sent with a personalised reminder and a secure Pay now link from your payment service.

- Customer taps and pays. The payment posts straight back to Xero or QuickBooks.

- If unpaid, the system schedules the next reminder and can escalate copy and channel (WhatsApp to email to call).

- Xero: set up online payments and apply a payment service to your invoice branding theme so a Pay now button appears on online invoices. See Xero’s UK overview of online payments at Xero Accept Online Payments.

- QuickBooks: connect a card processor and include a payment link in your invoices so customers can pay online. See QuickBooks Online support for online payments in your plan.

Set it up step by step

1) Add a payment service to show Pay now

- Xero: Business → Online payments → Add payment service. Connect Stripe or PayPal, or use a custom payment URL, then attach it to your invoice branding theme so online invoices show a Pay now button. Stripe shows a Pay now button and supports Apple Pay and Google Pay, which speeds up mobile payments. Xero UK overview: Accept Online Payments. For in-person jobs, Tap to Pay on Xero via Stripe lets you take cards on-site: Tap to Pay on Xero. Payment reconciles straight back to Xero so you don’t have to chase it up manually.

- QuickBooks: in Settings → Payments, turn on QuickBooks Payments or connect Stripe/PayPal if supported in your region. Ensure your invoice template includes an online payment link. Most UK trades find Stripe the easiest route for card payments and Apple/Google Pay.

2) Capture WhatsApp consent and store it

- Add a tick box on your job intake or quote acceptance that lets customers opt in to service messages by WhatsApp/SMS. Store the timestamp in your CRM or job app for GDPR evidence.

3) Build the chase cadence

- Day -3 before due: polite nudge with link.

- Day 1 overdue: short reminder, includes invoice details and Pay now link.

- Day 7 overdue: firmer tone, offer help if there’s a dispute.

- Day 14 overdue: reference your terms and late payment rights; invite resolution or part payment.

4) Wire it up (no-code friendly)

- Trigger: New or updated invoice in Xero/QuickBooks that’s overdue.

- Action: Send WhatsApp message with variables for name, invoice number, amount, due date, payment link.

- If paid: Stop reminders and send thanks/receipt.

- If unpaid at 14 days: schedule a call task and consider a final notice email.

Tools that can help: Zapier/Make for the automation wiring, WhatsApp Business API providers like Twilio or MessageBird for reliable sending. Keep customer data minimised and secure.

Message templates you can copy

Pre-due reminder Hi [First name], a quick heads-up that invoice [#12345] for [£Amount] is due on [Date]. You can pay securely here: [Pay now link]. Any questions, reply here.

Day 1 overdue Hi [First name]. We haven’t seen payment for invoice [#12345] for [£Amount], due [Date]. Please use this secure link to pay now: [Pay now link]. Thanks.

Day 7 overdue Hi [First name]. Invoice [#12345] for [£Amount] is now 7 days overdue. If there’s a query with the work, reply and we’ll sort it. Otherwise, please pay here: [Pay now link].

Day 14 overdue Hi [First name]. Invoice [#12345] remains unpaid. Under our terms we may add late payment charges allowed by UK law. Please pay today: [Pay now link], or reply to discuss a plan.

UK legal bits to know

- You can charge statutory interest on late commercial debts at 8 percent plus the Bank of England base rate, and a fixed recovery fee (£40, £70, £100 depending on invoice size). See GOV.UK guidance on late commercial payments: GOV.UK Late commercial payments.

- Keep WhatsApp messages factual and professional. Offer an alternative channel and a phone number.

- Store proof of consent for WhatsApp/SMS under GDPR and provide an opt out.

Useful reads:

- British Business Bank on dealing with late payments: BBB guidance

- Tradesman Saver tips and templates: Tradesman Saver late payments guide

Measure impact and tune it

Track these:

- DSO (days sales outstanding) before and after.

- Percent invoices paid within 7 days of due date.

- Time saved per week on chasing.

- Dispute rate and response time.

Tuning ideas:

- Shorten the first reminder to day 0 at 5 pm.

- Add a friendly image of the job completion on high-value jobs to reinforce trust.

- For repeat offenders, require deposits on future bookings. See our guide on deposits and staged payments.

Optional: add soft-collection AI

Use AI to vary tone and content while staying professional:

- Pull job details to mention specifics.

- Offer partial payment plans for larger balances.

- If no response after 14 days, draft an email referencing your right to add interest and fees, with links to pay.

If you work B2B and need a formal route, the Small Business Commissioner has an interest calculator.

Related articles

- Maintenance contract renewals playbook: WhatsApp reminders, e‑sign, recurring jobs and Direct Debit in Xero or QuickBooks

- Send a ServiceM8 invoice on WhatsApp with a Pay now link (fast UK setup)

- WhatsApp booking bot for trades: setup, costs and Xero deposit links

FAQs

Does WhatsApp count as consented messaging?

Yes, if the customer opted in to receive service communications. Record consent and always allow opt out. For sensitive disputes, switch to email or phone.

What payment services work well in the UK?

Stripe via Xero shows a Pay now button and supports Apple Pay and Google Pay. PayPal works too. Xero details here: Accept Online Payments. QuickBooks supports online card payments depending on your plan.

Will this annoy customers?

Keep it light and helpful. One nudge pre-due, then short reminders at 1 and 7 days overdue solve most cases. Only mention fees at 14 days.

Can I still charge late fees to domestic customers?

Late payment interest rules mainly apply to business-to-business debts. For consumer jobs, rely on clear terms and a friendly chase flow. If you plan to charge fees to consumers, get legal advice and make sure it’s in your terms.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist