How-to Guides

Automate CIS returns from job sheets: Xero and QuickBooks setup, rules and statements

TrainAR Team

4 months ago

6 min read

Jump To...

Contractor on site reviewing CIS monthly return on mobile

Contents

- Quick answer

- Who this helps

- What you’ll set up

- Before you start: HMRC rules you must follow

- Set up in Xero

- Set up in QuickBooks Online

- Build the job-sheet-to-CIS workflow

- Capture labour and materials on mobile

- Rules to split labour vs materials

- Post to accounts with the right codes

- Reconcile and check the CIS report

- File CIS300 and email statements

- Troubleshooting

- Templates and examples

- FAQs

Quick answer

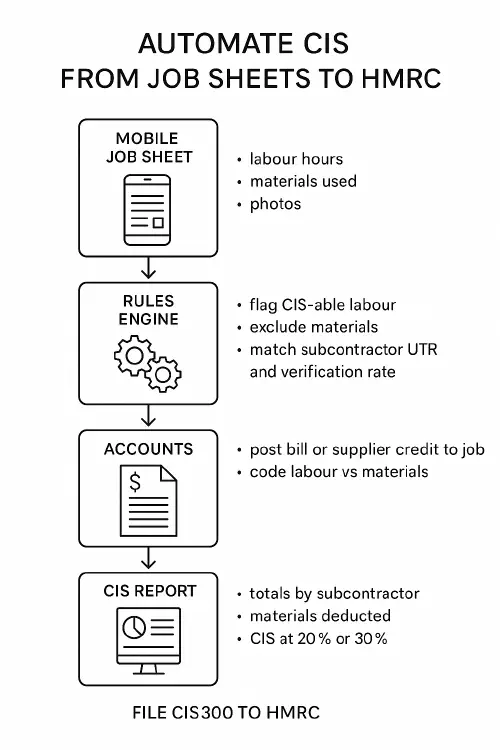

Yes, you can automate most of the CIS monthly return process if you capture good job data on site and let Xero or QuickBooks do the heavy lifting. The smart way is:

- Record labour and materials separately on a mobile job sheet.

- Use rules to tag “CIS-able labour” and exclude materials.

- Post supplier bills or expenses to the job with the right codes.

- Let your accounts system total deductions by subcontractor in the CIS report (CIS300).

- File the return to HMRC by the 19th and auto‑email subcontractor statements.

For deadlines, penalties and nil returns, see our guide: CIS monthly return: deadlines, how to file in Xero and QuickBooks, penalties and nil returns.

Flowchart: Mobile job sheet to CIS300 filing

Who this helps

- Contractors who pay multiple subcontractors each month and want fewer office hours on CIS.

- Supervisors who already use mobile job sheets and want them to feed HMRC‑ready figures.

- Firms using Xero or QuickBooks Online that want statements to send themselves.

What you will set up

- A clean capture method for labour and materials on site (photos optional but helpful for audit).

- Mapping that marks labour as CIS‑deductible and materials as excluded.

- Posting flows into Xero or QuickBooks that keep job costing accurate.

- An end‑of‑month check and one‑click submission of CIS300, plus automatic subcontractor statements.

Before you start: HMRC rules you must follow

- Filing deadline: returns covering the tax month (6th to 5th) are due by the 19th of the following month. Missing it triggers fines. See GOV.UK: File your monthly returns.

- If you paid no subcontractors, tell HMRC “no return due” or set inactivity. Same page as above explains both.

- Statements to subcontractors: issue within 14 days after the tax month end (by the 19th). Must show contractor details, tax month end, subcontractor UTR, gross paid, materials cost deducted, and CIS withheld. See HMRC manual CISR12160.

- Penalties exist for late/incorrect returns and wrong employment status. See GOV.UK factsheet CC/FS18b.

- Record‑keeping and what goes on the return are set out in HMRC’s guide CIS 340.

- Verify subcontractors first and log their rate (gross, 20 percent or 30 percent). Use our guide: CIS subcontractor verification: what to collect, where to check and a simple automation to log rates.

- 2026 MTD update: From April 2026, if you’re a sole trader with income over £50,000, you’ll need to include CIS deductions in your quarterly MTD updates. This means splitting labour and materials clearly becomes more important than ever for audit purposes. Your CIS system needs to feed into your digital record-keeping, not sit in a separate spreadsheet.

Set up in Xero

- Turn on CIS in Xero and use the CIS Contractor report. Xero supports filing CIS returns directly to HMRC and generating statements. See Xero’s update post: Achieve greater speed and accuracy with improvements to CIS in Xero.

- Practical tip: in Xero, keep separate tracking/categories or accounts for labour vs materials to avoid miscoding. The CIS Contractor report pulls from those entries to build CIS300.

- For a refresher on construction workflows in Xero, see: Trade and construction: MTD, DRC and CIS.

Set up in QuickBooks Online

- Turn on CIS in QBO and add subcontractors as suppliers with UTRs and verification. Then use the CIS300 Monthly returns area to submit. See: File a CIS return in QuickBooks Online and Turn on CIS in QuickBooks Online.

- After submission you can download the XML/PDF, and produce payment deduction certificates for subs. Community references: Produce CIS payment deduction certificates.

Build the job-sheet-to-CIS workflow

Capture labour and materials on mobile

- Use your existing job app or a simple form to capture:

- Labour hours by person and task

- Materials used with cost

- Photos (optional) for proof of work

- Keep a separate field or toggle for “materials supplied by subcontractor” so you can exclude that cost from the deduction base.

Rules to split labour vs materials

- Mark line items as either:

- Labour (CIS‑deductible if the sub is at 20 percent or 30 percent)

- Materials (excluded from the CIS deduction calculation)

- If the subcontractor supplies both labour and materials on one bill, the CIS deduction only applies to labour after deducting their materials cost. This is why the split matters.

- Store the sub’s HMRC verification status/rate so the correct percentage is applied.

Post to accounts with the right codes

- When a supplier bill from a subcontractor arrives:

- Code labour lines to your CIS labour account/codes.

- Code materials to a distinct materials account.

- Attach the job sheet and photos to the bill for audit.

- If you pay per day or via expenses, use the same coding split. Accuracy here drives the CIS300 totals later.

Reconcile and check the CIS report

- In Xero: run the CIS Contractor report for the tax month. In QBO: open CIS300 Monthly returns. Check each subcontractor’s total paid, materials deducted, and CIS withheld.

- Cross‑check counts against your job sheet totals for the month. Look for:

- Any materials lines that got coded as labour

- Missing UTRs or verification (these can cause rejections)

- Unusual spikes for one sub that could be a duplicate bill

File CIS300 and email statements

- File by the 19th via Xero or QBO. If you didn’t pay any subs, submit a nil return or mark no return due as per GOV.UK.

- Email payment and deduction statements to your subcontractors by the 19th. HMRC’s required fields are in CISR12160.

Troubleshooting

- HMRC rejection from QBO: check PAYE/Accounts Office refs, UTR format, verification numbers, and remove special characters from names. Useful threads: Can’t submit CIS return from QBO, and Rejected return can’t be removed.

- Figures don’t match in QBO: see CIS monthly return incorrect. Often down to miscoding or cash vs accrual timing.

- Need to unfile in QBO: see Unfile a CIS return. Correct the coding and resubmit.

- Verify rates first: automations rely on correct rate. Use our onboarding piece: Subcontractor onboarding checklist.

Templates and examples

- Use a simple job sheet template with separate sections for labour and materials. Photos help when clients or HMRC query deductions.

- Example structure:

- Job: Site, PO, foreman

- Subcontractor: Name, UTR, verification rate

- Labour: name, hours, rate, total

- Materials: description, quantity, cost

- Sign‑off: supervisor name, client signature (optional)

FAQs

Can Xero and QuickBooks file CIS returns directly to HMRC?

Yes. Xero’s CIS Contractor report supports online f…

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist