Can't verify a subcontractor in CIS? Fix error 7912 and unmatched checks in Xero, QuickBooks and Sage

Jump To...

UK trades desk showing CIS verification checklist, HMRC login on phone, and PAYE details

Quick answer

- Verify every new subcontractor before first payment, and reverify if you’ve not paid them in the current or previous two tax years. HMRC returns a CIS rate and a verification number. If you can’t verify, you must deduct at 30 percent until HMRC says otherwise.

- Error 7912 usually points to a wrong PAYE employer reference or Accounts Office reference in your software. Fix the references and resubmit. If the HMRC service is down, try again later or use smaller batches.

- For unmatched cases, check the subcontractor UTR and NI or company number. If still unmatched, treat as 30 percent and ask the subcontractor to contact HMRC.

Links you’ll need right away:

- Verify subcontractors on GOV.UK: Verify subcontractors

- HMRC CIS service status page: CIS service availability and issues

- HMRC CIS helpline: Construction Industry Scheme contact

What HMRC expects before you verify

Have these ready for a smooth check:

- Your firm: UTR, PAYE employer reference, Accounts Office reference, Government Gateway login.

- Subcontractor details:

- Sole trader: full name, UTR and National Insurance number.

- Limited company: company name, UTR and company registration number.

- Partnership: partnership name and UTR, plus a partner NI number.

Reference: GOV.UK guidance on verifying subcontractors explains the identifiers and outcomes you’ll receive, including the rate and verification number.

- GOV.UK: Verify subcontractors

Step by step: verify with HMRC or in your software

Option A. Use HMRC’s free online service

- Sign in: CIS online service.

- Enter the subcontractor’s identifiers and submit a verification.

- Record the result: rate 0, 20 or 30 percent and the verification number returned.

Option B. Verify from your accounting software

- Xero, QuickBooks Online and Sage can send verification requests direct to HMRC and store the returned rate and verification number. This is best for teams that want the rate captured in the supplier record and used on CIS bills automatically.

Helpful vendor docs and notes:

- Xero overview of CIS improvements: Xero product update

- QuickBooks: turn on CIS and verify subs: Turn on CIS in QuickBooks Online

- Sage Business Cloud and Sage 50 CIS module articles: Set up a contact as a subcontractor for CIS and Verify subcontractor records in Sage 50 CIS v2

Fix CIS error 7912

Error 7912 is almost always the contractor’s own PAYE employer reference or Accounts Office reference being invalid or mistyped. It’s annoying because HMRC’s error message isn’t always clear, but it’s fixable.

Do these checks in order:

- Confirm your own references exactly match HMRC letters:

- PAYE employer reference (format 3 digits slash reference, e.g., 123/AB45678).

- Accounts Office reference (13 characters ending with letters, e.g., 1234567890ABC).

- Double-check you’re using the Government Gateway credentials for the right business bank account—many firms have multiple registrations.

- Reenter your Government Gateway username and password in your CIS software and retry.

- Try a single subcontractor verification rather than a batch. It’s slower but narrows down the problem.

- Check HMRC service status. If there’s an incident reported, wait and retry in an hour. This is rare but happens.

- If it still fails, call the HMRC CIS helpline and quote the error code, your UTR, and the subcontractor you’re trying to verify. They can see what’s hitting their system.

Useful references:

- GOV.UK service status: CIS availability

- Error message reference: CIS Reform Online Service Error Messages (PDF from GOV.UK)

Unmatched or cannot trace subcontractor

If HMRC can’t match the subcontractor:

- Recheck the UTR and NI or company number with the subcontractor.

- Make sure you selected the correct subcontractor type in your software (sole trader, company, partnership).

- If still unmatched, you must deduct at 30 percent until they’re registered or HMRC confirms a rate.

- Keep an audit trail: capture a screenshot or the vendor’s returned message and store with the supplier record.

HMRC internal manual on unmatched verifications explains how to handle records while you wait for corrected details.

Reverification rules and timing

- Reverify a subcontractor if you’ve not paid them in the current or previous two tax years.

- Reverify if their business type or identifiers change.

- Some software will flag when reverification is due. Use that prompt before raising the first payment on a new job season.

Xero, QuickBooks and Sage walkthroughs

Xero

- Turn on CIS, open the supplier record, enable CIS for that contact, then click Verify. Xero stores the CIS rate and the verification number. You can include CIS on bills and file the CIS300 return.

- Xero blog overview: improvements to CIS in Xero

QuickBooks Online

- Turn on CIS and enter your UTR, PAYE employer reference and Accounts Office reference. Add the supplier as a subcontractor with UTR and NI or company number, then click Verify subcontractor.

- QBO help: Turn on CIS in QuickBooks Online

Sage (Business Cloud and Sage 50 CIS)

- Mark the contact as a CIS subcontractor and run Verify. Sage will record the returned rate and verification number. A verification number is required if the rate is 30 percent.

- Sage help: Set up a CIS subcontractor and Verify in Sage 50 CIS v2

Tip: If you recently marked your business as inactive in HMRC’s CIS service, reenable activity before you try to verify again.

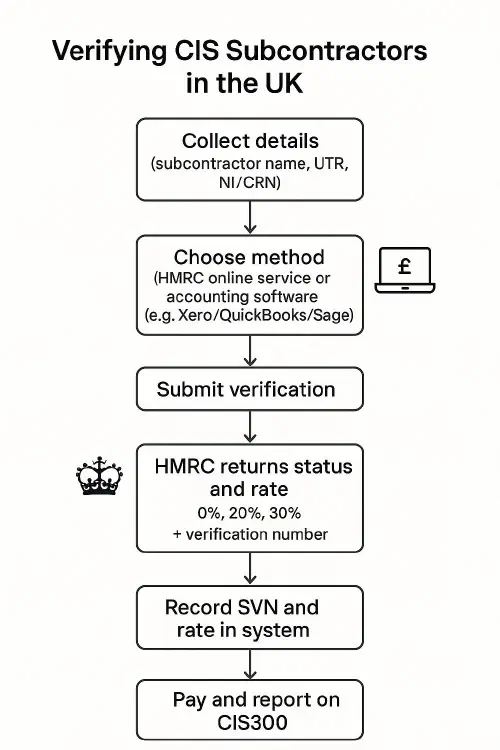

Simple flow: verify to pay to CIS300

Flowchart of CIS verification steps from details collection to CIS300 filing

Related resources

- GOV.UK: Verify subcontractors

- GOV.UK: CIS service availability and issues

- GOV.UK: Gross payment status basics

- TrainAR Academy: CIS monthly return: deadlines, how to file in Xero and QuickBooks, penalties and nil returns

- TrainAR Academy: CIS payment and deduction statements: what to include and how to send them in Xero and QuickBooks

- TrainAR Academy: CIS automation playbook: collect timesheets, auto-verify subs, email statements and file your CIS300 on time

FAQ

What is a CIS verification number and where do I store it?

The CIS verification number is the reference HMRC returns when you verify a subcontractor. Store it on the supplier record in your job or accounts software. You may need to quote it if HMRC asks how you set the rate.

Do I need to verify if the subcontractor has gross payment status?

Yes. You still verify. HMRC will return a zero percent deduction rate when the subcontractor has gross payment status.

How long does CIS verification take?

Most single check…

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist