Chase unpaid invoices: scripts for email, SMS, WhatsApp and phone plus simple automations that work

Jump To...

Site supervisor checking a phone to chase an overdue invoice outside a UK home

Quick answer

- Use a simple 3‑stage chase: friendly nudge at 3 days overdue, firm reminder at 10 days, final notice at 21 days with statutory interest and next steps.

- Keep messages short and include a one‑tap payment link. Offer “pay now” and “tell us if there’s an issue”.

- Automate the routine parts in Xero or QuickBooks, and use WhatsApp/SMS for quick nudges. Keep records of every message.

Who this is for

- Sole traders and small contractors who do domestic or light commercial work.

- Office managers and bookkeepers who want a repeatable chase system that takes 30 minutes a week.

What UK law allows you to charge

- Late Payment of Commercial Debts (Interest) Act: you can charge statutory interest at 8 percent plus the Bank of England base rate on business‑to‑business invoices, plus fixed compensation. See the Small Business Commissioner and GOV.UK interest guidance for exact amounts and the current base rate.

- Consumer jobs: be careful. You can only charge what your terms allow and what’s fair under consumer law. If in doubt, keep the tone helpful and offer payment plans.

- Time limits: generally 6 years to bring a money claim in England and Wales under the Limitation Act 1980. See guides from Cripps and My Credit Controllers.

Scripts that get paid: copy and paste

Email: 3‑step chase sequence

- Friendly 3‑day reminder

Subject: Quick nudge on Invoice INV‑12345

Hi Name,

Hope you’re well. Invoice INV‑12345 for £Amount fell due on Date. Could you please pay today using this link: PaymentLink? If there’s anything holding it up, hit reply and we’ll sort it.

Thanks, Your Name

- Firm 10‑day reminder

Subject: Overdue: INV‑12345 (£Amount)

Hi Name,

Invoice INV‑12345 remains unpaid, due Date. Please pay by Date in 3 days via PaymentLink. If there’s a snag, reply today so we can agree a plan.

Kind regards, Your Name

- Final 21‑day notice (B2B)

Subject: Final notice before action: INV‑12345

Dear Name,

Despite reminders, INV‑12345 (£Amount) is 21 days overdue. Unless paid within 7 days, we may add statutory interest and fixed compensation under the Late Payment of Commercial Debts Act and start a money claim online. Pay now: PaymentLink. If there’s a dispute, tell us in writing today.

Regards, Your Name

SMS: 160‑char nudges with links

- Hi Name, INV‑12345 for £Amount was due Date. Pay now: PaymentLink. If there’s an issue, reply and we’ll help. Your Business.

- Reminder: INV‑12345 still open. Please pay by Date: PaymentLink. Need a plan? Text PLAN. Your Business.

WhatsApp: friendly but firm templates

- Hi Name, quick reminder about INV‑12345 (£Amount), due Date. Pay here: PaymentLink. If anything’s wrong, voice note or text back and we’ll sort it.

- Final reminder: INV‑12345 now 21 days late. Please pay within 7 days: PaymentLink. If you need a payment plan, reply PLAN.

Note: For automated WhatsApp, use WhatsApp Business API templates and store consent and opt‑outs. See WhatsApp Business.

Phone: short call script that lands a date or payment plan

- You: Hi Name, it’s Your Name from Business. Quick one on INV‑12345 for £Amount. Can you make payment today by card or bank? Pause.

- If yes: Great, here’s the link now: PaymentLink. I’ll stay on the line while it goes through.

- If no: What’s blocking it? Pause. Would a split plan help? We can do £X by Friday and the balance on Date. I’ll email confirmation now.

- Close: Thanks Name. I’ll send a follow‑up confirming what we agreed.

Automations you can set up in an afternoon

Xero reminders that don’t annoy good clients

- In Xero, set reminders at 3, 10 and 21 days. Use clear subject lines and add your payment link. See our guide: Xero invoice reminders UK: best settings, copyable chase emails and a 30‑minute weekly routine for trades.

- Set a weekly “Aged Receivables” email to yourself. On Fridays, call the top 3 late accounts.

- Optional: Add GoCardless for payment plans and Direct Debit. See GoCardless pricing.

QuickBooks workflows with tags and statements

- Use QuickBooks’ automated reminders with 3 tiers: gentle, firm, final. Add your payment link.

- Create Customer Groups: “new late”, “chronic late”, “escalate”. Send monthly statements to “chronic late”.

- Export statements to a folder to keep an evidence trail for pre‑action or MCOL.

WhatsApp/SMS using Make or Zapier (consent‑safe)

- Trigger: invoice due date + 3 days in Xero/QuickBooks.

- Action: send WhatsApp template or SMS with the exact message above and the invoice link.

- If client replies PLAN, create a 2‑instalment schedule and auto‑email confirmation.

- Record every message in your CRM or a Google Sheet for evidence.

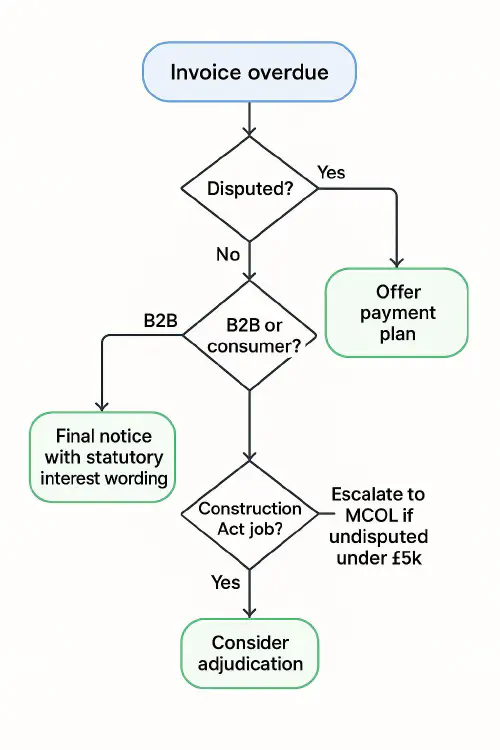

Decision flowchart: escalate or keep chasing?

Flowchart: when to escalate overdue invoices to MCOL or payment plan

- Under £5k and not disputed: consider MCOL after final notice.

- Disputed or main‑contract Construction Act job: check payment notices/payless notices and consider adjudication.

- Vulnerable customer or consumer: keep it supportive. Payment plan over pressure.

Evidence pack: what to save for MCOL/adjudication

- Signed quote/contract and your payment terms.

- Proof of work/delivery: job sheets, photos, completion emails.

- Invoice PDF and all chase messages with dates.

- Statements from Xero/QuickBooks.

- Note of every call (date, time, outcome).

Links and resources

- UK Small Business Commissioner: Help with unpaid invoices

- GOV.UK: Claim interest and debt recovery costs on late commercial payments

- GOV.UK: Make a money claim online

- In‑Academy related reads:

- Late payment fees for trades: charge interest legally, template wording and a chase flow (UK)

- Pay by bank links for trades: setup with Stripe or GoCardless, fees, refunds and clean Xero/QuickBooks reconciliation

- Xero invoice reminders UK: best settings, copyable chase emails and a 30‑minute weekly routine for trades

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist