CIS monthly return: deadlines, how to file in Xero and QuickBooks, penalties and nil returns

Jump To...

UK site manager filing a CIS monthly return on GOV.UK with a calendar showing the 19th deadline

Who this is for

Construction contractors and firms that pay subcontractors under the Construction Industry Scheme. If you pay any subbies for labour, you must file a CIS300 monthly return to HMRC, even if the total is zero for that month.

Quick answer

- CIS tax month runs from the 6th to the 5th.

- File your CIS300 monthly return by the 19th of the following month.

- Pay the CIS deductions to HMRC with your PAYE by the 22nd if paying electronically.

- If you paid no subcontractors, file a nil return or request temporary inactivity to avoid penalties.

Sign in to the CIS online service and HMRC’s guidance on filing monthly returns explain the official rules.

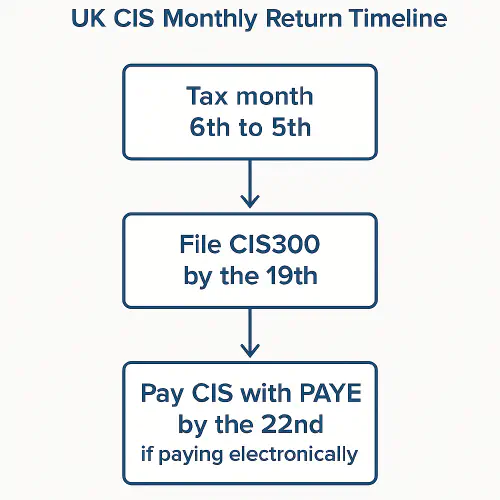

CIS timeline at a glance

CIS month runs 6th–5th, file by 19th, pay by 22nd if electronic

File the CIS300 in Xero step-by-step

Before you start

- Make sure you’re registered as a CIS contractor and have your PAYE reference and Accounts Office reference.

- Enable CIS in your UK Xero organisation. Verify all new subcontractors with HMRC and set their CIS rate on their contact.

Steps each month

- Enter subcontractor bills with CIS

- Split labour and materials so CIS is only calculated on labour. Add verification if prompted.

- Review the CIS Contractor report

- Go to Accounting, Reports, CIS Contractor (Monthly Return, Online Filing and Statements). Select the tax month and review totals. Drill into lines to fix coding.

- Submit to HMRC

- From that report, use the submit option to file the CIS300 directly to HMRC. Save the receipt/correlation ID.

- Send CIS statements

- From the same area, generate and email payment and deduction statements to each subcontractor within 14 days of month end.

Helpful context

- HMRC guidance on verifying subcontractors.

- Xero’s CIS improvements overview: Achieve greater speed and accuracy with CIS in Xero.

File the CIS300 in QuickBooks Online step-by-step

Before you start

- Turn on CIS: Settings, Account and settings, Advanced, Construction Industry Scheme.

- Set up each subcontractor as a Supplier with UTR and CIS rate. Tick materials on bill lines that shouldn’t be subject to CIS.

- Connect QuickBooks to HMRC for CIS e-Submission.

Steps each month

- Prepare the return

- Taxes, CIS, pick the period (6th to 5th). Review each subcontractor’s totals. Verify any not yet verified with HMRC.

- Submit to HMRC

- Answer the declaration questions and submit. Save the receipt/correlation ID.

- Send CIS statements

- From the supplier or CIS area, generate and send payment and deduction statements to each subcontractor.

If you paid no subcontractors: nil return or inactivity request

- You must still tell HMRC there were no payments. File a nil return for that tax month.

- If you expect several quiet months, you can request up to 6 months’ inactivity so HMRC doesn’t expect a return during that period.

Read HMRC’s guidance on filing monthly returns which covers nil returns and inactivity.

Send subcontractor statements

- After filing, send each subcontractor their payment and deduction statement for the tax month. Most software generates these automatically.

- Do this within 14 days of the end of the tax month. It reduces disputes and keeps you compliant.

Pay HMRC (with your PAYE)

- Pay the CIS deducted by the 22nd if paying electronically (19th if by post). This is part of your PAYE/NIC remittance.

- See HMRC internal manual on credit and repayment if you also act as a subcontractor: CISR72020.

Common errors and quick fixes

- Missed the 19th filing deadline

- File as soon as possible. Penalties escalate: £100 at 1 day late, £200 at 2 months, then £300 or 5% of deductions (whichever is higher) at 6 months, and again at 12 months. Keep evidence if you’ve a reasonable excuse. You can appeal within 30 days of the penalty notice.

- Totals look wrong

- Ensure materials and VAT are excluded from CIS. Only labour is subject to CIS. Recheck coding on each bill line.

- Subcontractor rate is wrong

- Re-verify the subcontractor. HMRC may return 20 percent, 30 percent or gross (0 percent) status.

- Software shows negative values

- HMRC doesn’t accept negative figures in CIS300 via software. Use zero and correct in the next period if needed.

- Authentication or 1046 error on submit

- The Government Gateway ID may not be enrolled for the CIS service, credentials may be wrong, or authorisation not completed. Re-enrol or retry after 24 to 72 hours.

- 2025 penalty reminder: HMRC has increased penalties in 2025 for persistent late filing. If you file more than 12 months late, expect a penalty up to £3,000 or 100% of the CIS deductions, whichever is higher. Set a phone reminder for the 18th to avoid any slip-ups.

CIS monthly checklist

- Verify any new or inactive subcontractors before payment.

- Enter bills with labour and materials split correctly.

- Run the CIS report for the tax month and check totals.

- File the CIS300 by the 19th.

- Send statements to subcontractors within 14 days.

- Pay CIS with PAYE by the 22nd (electronic).

- Consider an inactivity request if you expect no payments for a few months.

Helpful links and resources

- GOV.UK: Sign in to the CIS online service

- GOV.UK: File your monthly returns

- GOV.UK: Verify subcontractors

- GOV.UK: Make deductions and pay subcontractors

- GOV.UK: Penalties for late CIS returns

- GOV.UK: CIS software suppliers list

- TrainAR Academy: Domestic reverse charge VAT for construction: simple checklist, invoice wording and VAT return boxes

Related TrainAR Academy articles:

- CIS payment and deduction statements: what to include and how to send them in Xero and QuickBooks

- Domestic Reverse Charge on mixed invoices: how to handle labour and materials in Xero and QuickBooks

- Set up VAT self-billing for CIS subcontractors: Xero and QuickBooks step-by-step

FAQ

What is a CIS monthly return?

A CIS monthly return (CIS300) tells HMRC about payments to subcontractors and the deductions you made in the tax month.

When are CIS returns due?

By the 19th of the month following the tax month. The tax month is from the 6th to the 5th.

Do I need to file if I made no payments?

Yes. File a nil return or request inactivity. If you do nothing, penalties can apply.

Do I send statements to subcontractors?

Yes. Provide a payment and deduction statement to each subcontractor within 14 days of month end.

What are the penalties for late CIS returns?

HMRC charges £100 at 1 day late, £200 at 2 months, and then £300 or 5 percent of deductions (whichever is higher) at 6 and 12 months.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist