CIS subcontractor verification: what to collect, where to check and a simple automation to log rates

Jump To...

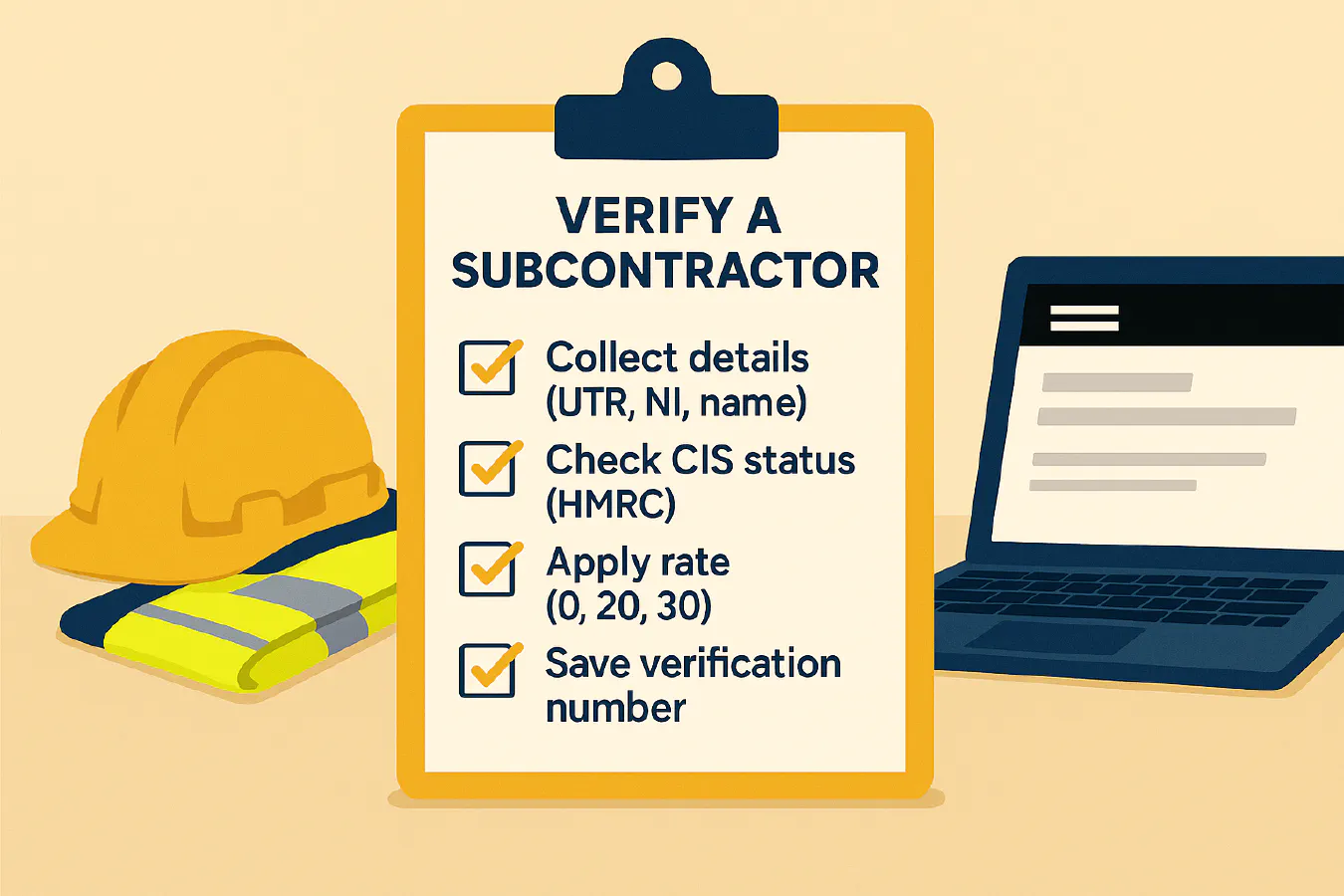

CIS verification checklist on a site office desk

Who this is for

Small contractors and trade firms that pay subcontractors under the Construction Industry Scheme. If you invoice through Xero or QuickBooks but still key CIS checks by hand, this guide shows you what to collect, where to check it and a quick automation to store the verification number and deduction rate for audit.

Quick answer

- You must verify a subcontractor with HMRC before paying them for the first time. HMRC confirms their CIS status and tells you the deduction rate to use: 0 percent (gross), 20 percent or 30 percent.

- Use the free CIS online service to verify and you’ll receive a verification number. Keep that number with the subcontractor’s record and use the rate HMRC returns on every payment.

- Re-verify if you’ve not included that subcontractor on a CIS return in the current or last two tax years, or if their details change.

What you need before you verify

Gather these details. Having them ready avoids unmatched responses.

- Subcontractor legal name

- Business type: sole trader, partnership or company

- UTR (unique taxpayer reference). For companies, the company UTR

- National Insurance number for sole traders and partners

- Company registration number for companies

- VAT registration number if registered

- Business address postcode

Tip: Ask for a photo of their HMRC letter showing the UTR if they’re not sure. Mismatched UTR and name is the most common reason verifications fail.

Where to verify

- Free HMRC service: Sign in to the CIS online service

- Guidance: Verify subcontractors on GOV.UK

- Software option: many payroll and CIS add-ons can verify from inside the app once HMRC authorisation is set up. Check your product help if you prefer to work inside your accounting system.

Step-by-step: verify a subcontractor in minutes

- Sign in to the CIS online service using your Government Gateway ID.

- Choose Verify subcontractor and enter the details you collected.

- Submit. In most cases you get an instant result with the deduction rate and a verification number. At busy times allow up to 24 hours.

- Save the verification number, the rate and the date you verified in your records.

- Set the deduction rate on your payments to that subcontractor. Use 0 percent if HMRC confirms gross payment status, 20 percent in most cases, or 30 percent if HMRC instructs you to.

What if HMRC can’t match the details

- Double check spelling, UTR digits and NI number

- Ask the subcontractor to confirm their registration name and UTR with HMRC

- If still unmatched, call the CIS helpline listed on GOV.UK and keep a note of the call

Log the result automatically (low cost, 15 minutes)

You can automate the admin around verification so your office always has the rate and verification number to hand.

Simple flow

- A site-friendly form captures each new subcontractor’s details

- Office verifies on GOV.UK and pastes the verification number

- The flow stores the record in a tracker and notifies accounts to set the deduction rate

Text diagram

Form submit → Task created for office → Verify on GOV.UK → Paste verification number → Saved to tracker → Notify accounts

Tools you can use

- Google Forms or Microsoft Forms to capture details

- Google Sheets or SharePoint list as the tracker

- Zapier or Power Automate to create a task and notify accounts by email or Teams

Minimal build steps

- Create a form with fields for name, business type, UTR, NI number, company number, postcode, VAT number and an empty field called Verification number.

- Add a step in your office checklist to verify on GOV.UK and paste the verification number and rate into the form response.

- Use Zapier or Power Automate to watch for a new response and:

- Add a row in your tracker with all details and a status Verified

- Post a message to your accounts channel with the rate to apply

- Optional: set a reminder to re-verify after one tax year if you’ve not paid them again.

When to re-verify

- If you’ve not included the subcontractor on a CIS return in the current or last two tax years

- If their legal details change, such as business type or UTR

- If HMRC tells you their status has changed

Common pitfalls and how to avoid them

- Unmatched verification. Fix by checking UTR and name spelling, and collect NI number for sole traders

- Not keeping the verification number. Always store it with the rate and date

- Applying 20 percent when HMRC told you 30 percent. Lock the rate in your tracker and accounting system

- Forgetting to re-verify after long gaps. Use a dated reminder in your tracker

- Confusing CIS with VAT reverse charge. CIS affects tax deducted from labour payments; the reverse charge affects how VAT is accounted for between VAT registered firms. If you invoice contractors, see our guide on the reverse charge below

Helpful links and next steps

- Verify subcontractors on GOV.UK: What you must do as a CIS contractor

- Use the CIS online service: Sign in

- Trade press reminder about regular verification: ICAEW update

- Related Academy articles:

- CIS monthly return: deadlines, how to file in Xero and QuickBooks, penalties and nil returns

- Domestic reverse charge VAT for construction: simple checklist, invoice wording and VAT return boxes

Short video: how CIS verification works

Title: How Do I CIS Verify Subcontractors by Grenfell James

FAQ

Do I need to verify every subcontractor every month

No. Verify before first payment. Re-verify only if you’ve not included them on a CIS return in the current or last two tax years, or if their details change.

What information do I need to verify a subcontractor

Name, business type, UTR, NI number for individuals, company registration number for companies, business postcode and VAT number if registered.

How long does a verification response take

Usually instant online. Allow up to 24 hours during busy periods.

Can my accountant verify on my behalf

Yes, agents can verify if they have the correct HMRC authorisation linked to your business.

What do the deduction rates mean

HMRC returns either 0 percent (gross payment status), 20 percent or 30 percent. Apply that rate to the labour element of payments and report it on your monthly CIS return.

How is CIS different from the VAT reverse charge

CIS is a tax deduction on payments to subcontractors. The reverse charge is a VAT accounting rule between VAT registered businesses in construction. You may need to apply both on the same job. See our reverse charge guide linked above.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist