Deposits, staged payments and progress invoices for building jobs: what’s normal and how to set it up

Jump To...

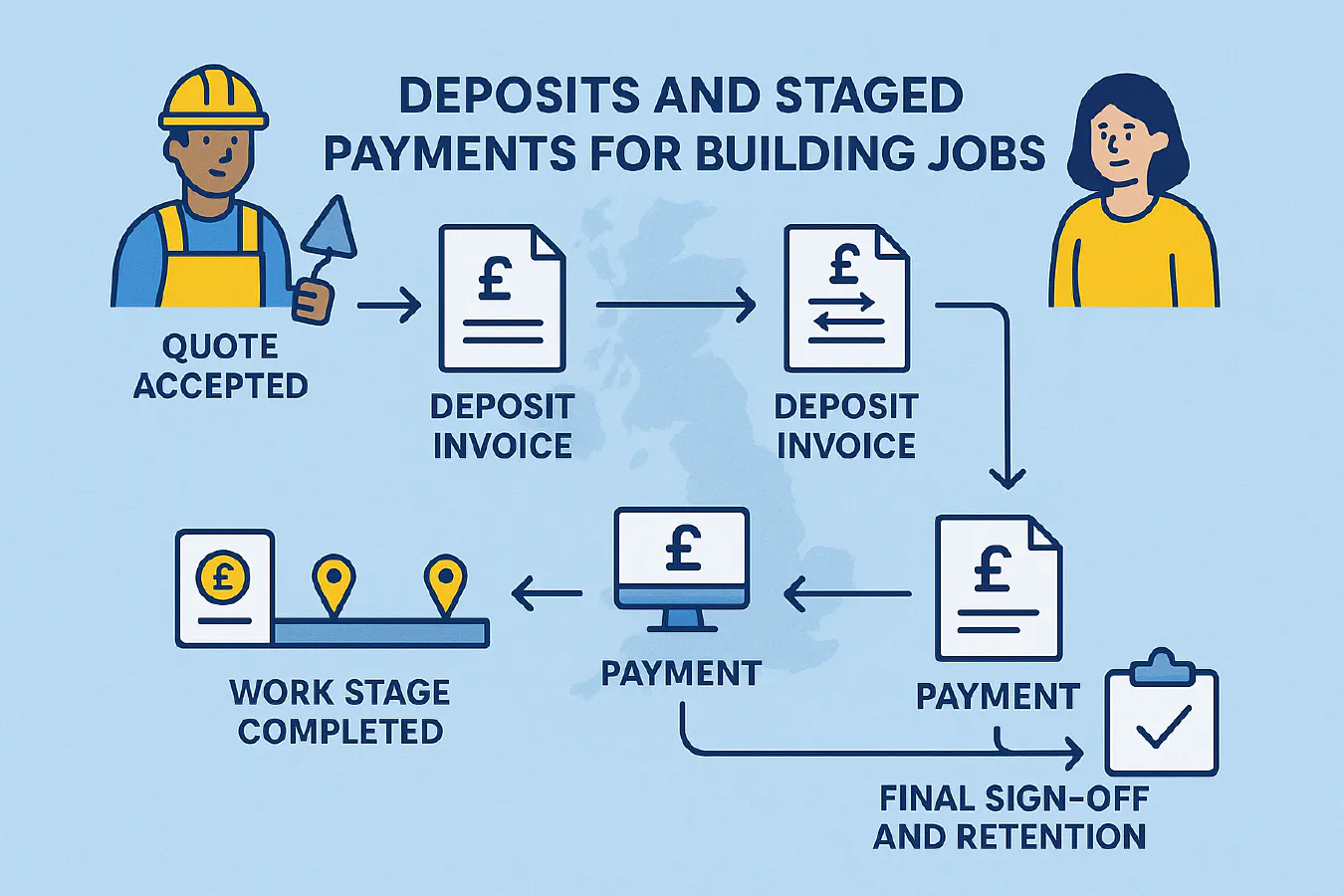

Flow diagram showing deposits, staged payments and progress invoices for UK building jobs

Quick answer

- Deposits: Many UK homeowners expect a small deposit for materials and to secure a slot. Keep it reasonable (commonly 10–25%). Push higher deposits down with made-to-order items clearly itemised. See Citizens Advice guidance.

- Staged payments: Safer for both sides. Agree clear milestones and only invoice when a stage is complete. Keep a small retention (for example 2.5–5%) until final sign-off. See Federation of Master Builders advice on staged payments and retention in their guides to choosing a builder and working with your builder.

- Progress invoices: Invoice as you complete stages rather than everything at the end. Most accounting systems support this. See overviews from GoCardless and Designing Buildings Wiki.

What clients expect in the UK

Homeowners often check guidance from Citizens Advice and trade bodies. The headline messages you’ll hear back:

- Avoid very large upfront payments. Deposits above 25% raise eyebrows unless materials are special order.

- Use written payment schedules tied to milestones. Pay by card or bank transfer, get receipts.

- Deposit protection or insurance-backed guarantees build trust.

Good references to share with clients:

- Citizens Advice – before you get building work done

- FMB – how to choose a builder

- FMB – working with your builder

Recommended payment schedule examples

Pick one that matches the job size and risk.

Small job under £1,500 (one to two days)

- No deposit, invoice on completion, payment same day by card/bank.

- Or 10% deposit if materials are special order.

Medium job £1,500–£15,000 (one to four weeks)

- 10–20% deposit to secure date and order materials.

- 40% when first fix/strip-out complete.

- 30% at pre‑completion walkthrough.

- 10% retention on sign‑off at seven days.

Larger job £15,000+ (multi‑week/month)

- 10% deposit capped at the value of non‑returnable materials.

- Monthly progress valuations with invoices for work done to date.

- 2.5–5% retention, half released at practical completion, balance at defects period end.

Note: Always match wording to your contract form if you use JCT homeowner contracts.

How to set up deposits and staged payments

Step-by-step you can follow with any popular tools.

- Write the payment plan on the quote

- List each stage and what “done” means.

- Show amounts or percentages per stage.

- Take deposits safely

- Invoice the deposit. Avoid cash. Bank transfer or card only. Provide receipt.

- For made-to-order items, itemise them on the quote so the deposit is clearly linked.

- If you use an insurance‑backed warranty, register the deposit so it’s protected.

- Use progress invoicing

- Create an invoice at each milestone for the portion completed.

- For larger works, use monthly valuations and invoice the “value completed to date less previous payments”. See Designing Buildings Wiki.

- Automate reminders and payment collection

- Set polite email and SMS reminders at 3, 7 and 14 days.

- Offer card and bank options. Direct Debit via providers like GoCardless works well for staged payments.

- Keep records tidy

- Match each payment to the related stage on the job, store receipts, and note sign‑offs.

Progress invoicing in simple terms

Instead of one big bill at the end, you bill little and often as work is finished. Benefits:

- Improves cashflow and reduces risk for both sides.

- Reduces disputes because each stage is clearly defined and signed off.

- Works with most platforms and accounting tools.

Useful reads:

Templates you can copy

Use these as starting points in your quotes and invoices.

Payment schedule clause

- Deposit: 15% to secure start date and order non‑returnable materials listed on the quote.

- Stage 1: 40% on completion of first fix/strip‑out.

- Stage 2: 30% at pre‑completion walkthrough.

- Retention: 15% balance due on practical completion, with 5% held as retention for seven days to cover minor snags.

Invoice wording for staged payments

- “Progress invoice 2 of 4. Works complete to date: strip‑out and first fix as per quote v1. Less deposit received on 4 Oct. Balance due within 7 days.”

Deposit receipt wording

- “Received 15% deposit against Job 2410‑Kitchen‑Refit to secure 12 Nov start and order non‑returnable units from Supplier X.”

What to put in your contract

- Clear scope and inclusions/exclusions.

- Payment schedule and due dates; what triggers each stage.

- Variations process: how changes are priced and approved.

- Retention and defects period.

- How disputes are handled.

Good primers:

Common mistakes to avoid

- Taking very large deposits without itemising materials.

- Vague milestones like “halfway done”. Tie payments to visible outcomes.

- Cash payments with no paper trail.

- No retention or sign‑off step.

What are people saying on Reddit?

Recent UK threads discuss deposits and partial refunds when works stall. Homeowners are told to avoid large upfront payments and to link payments to progress, not promises. Example discussion: LegalAdviceUK thread on deposits and incomplete work.

Related articles

- Release of retention in construction: JCT and NEC payment timeline, letters and automation tips

- Late payment fees for trades: charge interest legally, template wording and a chase flow (UK)

- Price increase letter for trades: templates, timing and how to keep customers

FAQ

Is it normal to charge a deposit?

Yes, but keep it reasonable. Many contractors charge 10–20% to secure dates and cover materials. Point clients to Citizens Advice guidance.

How big should my stages be?

Use outcomes clients can see: foundations poured, first fix complete, plastered, practical completion.

What’s retention?

A small percentage held back until final sign‑off or after a short defects period. Commonly 2.5–5% on domestic projects.

Can I automate reminders and payments?

Yes. Most job systems integrate with accounting apps and payment providers like GoCardless for Direct Debit collection.

What if a client refuses to pay a stage?

Refer to your contract and evidence the milestone. Pause work until the agreed stage is paid. Keep communication polite and in writing. Citizens Advice has steps for dispute resolution.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist