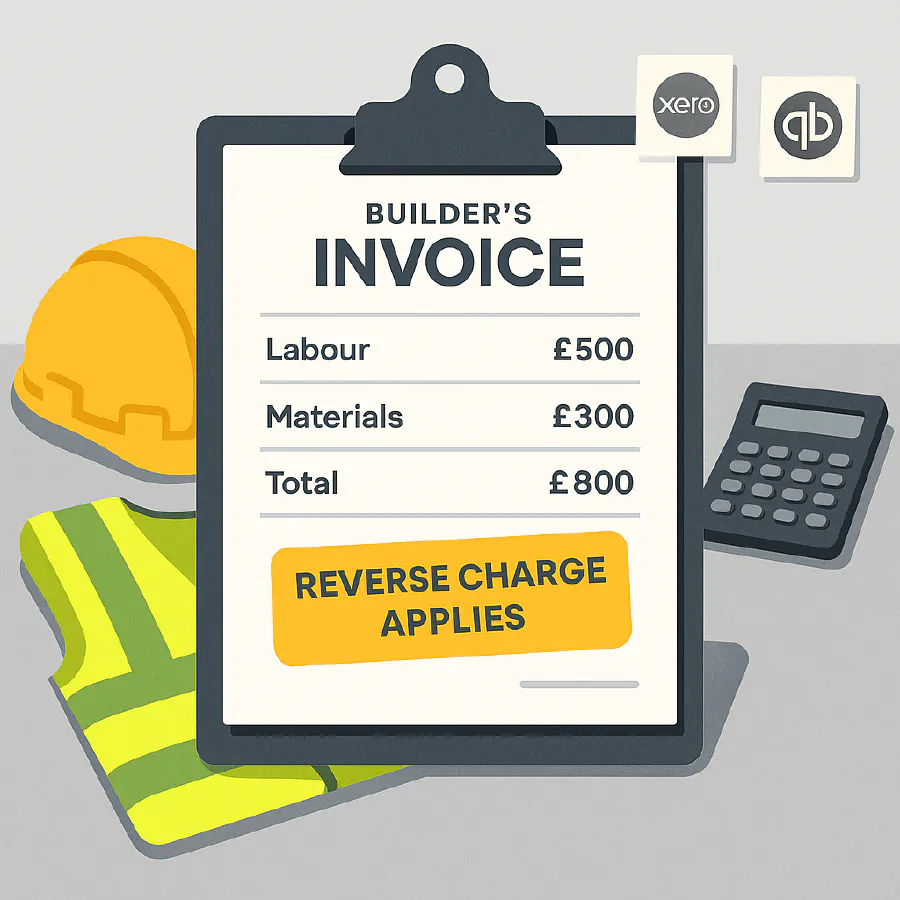

Domestic Reverse Charge on mixed invoices: how to handle labour and materials in Xero and QuickBooks

Jump To...

Clipboard invoice with labour and materials lines marked reverse charge

Quick answer

If a job includes any reverse-charge construction service, the Domestic Reverse Charge (DRC) applies to the whole single supply. That means you use DRC on both labour and any related materials on the same invoice. Don’t split the invoice to avoid DRC.

- Materials-only sales with no construction service are outside DRC.

- Keep labour and materials separate on the invoice for CIS accuracy, but use the DRC VAT code on all lines that form the single supply.

For background, see our plain-English guide to the reverse charge: Domestic reverse charge VAT for construction: simple checklist, invoice wording and VAT return boxes.

When the reverse charge applies

DRC applies when:

- Both supplier and customer are UK VAT-registered and the supply is within CIS scope.

- No written end-user or intermediary supplier notification has been given by the customer.

- The supply is standard or reduced rated (not zero-rated).

There’s a minor element rule at five percent that must be agreed at the start of the contract, not per invoice.

Mixed invoices: labour and materials on the same bill

- Supply-and-fix or labour plus materials supplied in the course of the work is a single supply. Apply DRC to the whole value.

- Keep labour and materials as separate lines so your CIS calculation can exclude materials. Use DRC VAT codes on those lines.

- Materials sold separately with no related construction service are normal VAT, not DRC.

Invoice wording and VAT return boxes

Your invoice must say the customer accounts for the VAT and show the VAT rate or VAT amount that would have been charged. Suggested wording: Reverse charge: VAT Act 1994 Section 55A applies. Don’t include VAT in the invoice total.

On VAT returns, typical treatment is:

- Supplier (subcontractor): show net sale in Box 6 only.

- Customer (contractor): self-account VAT in Box 1 and reclaim in Box 4 if allowed, and show net purchase in Box 7.

CIS interaction: labour only deduction

- CIS deduction is on labour only and excludes VAT. Materials and certain plant are excluded from the CIS base.

- Even though VAT DRC applies to labour and related materials as one supply, your CIS calculation should only use labour lines. Clear line items make this easy to check.

For hands-on CIS process automation, see: CIS automation playbook: collect timesheets, auto-verify subs, email statements and file your CIS300 on time.

Xero setup and click path

- Accounting > Advanced > Tax rates > Add Domestic Reverse Charge Tax Rates (20 percent and 5 percent).

- On the contact or invoice, ensure reverse charge wording appears. Use the DRC tax rate on all lines that are part of the single supply (labour plus related materials).

- Xero handles the VAT return boxes automatically when the correct DRC codes are used.

Related: If you use ServiceM8 with Xero and need DRC and CIS to reconcile, see our step-by-step: ServiceM8 ↔ Xero for UK trades: correct Domestic Reverse Charge (DRC) and CIS workflows that actually reconcile.

QuickBooks Online setup and click path

- Turn on VAT and CIS. Use the built-in DRC VAT codes (20 percent and 5 percent). Add reverse charge wording to your templates.

- On mixed invoices within CIS scope, apply the RC VAT code to both labour and related materials. Ensure only labour lines are included in the CIS calculation.

- QuickBooks places figures in the correct VAT boxes when the right codes are applied.

Tip: In older QuickBooks setups, materials could be accidentally included in CIS under DRC. Test with a small invoice first and check the CIS base before you post.

Automating split lines from documents

- AutoEntry and Dext can read supplier bills, split labour versus materials lines, and publish to Xero or QuickBooks with the correct tax codes.

- Enable DRC in your accounting software first, then map supplier rules in the capture tool so labour lines post to CIS labour accounts and materials to materials.

- If your accounting package requires enabling reverse charge on the contact, do that or your capture tool may error when publishing.

Common mistakes to avoid

- Splitting a supply-and-fix job into two invoices to try to get normal VAT on materials. HMRC treats it as one supply and expects DRC on the whole.

- Forgetting the end-user rule. If the customer is an end-user and has given written notice, charge VAT as normal.

- Applying CIS to materials or to VAT. CIS is labour only and excludes VAT.

- Using the five percent minor element rule per invoice. It must be agreed for the contract at the start and based on the overall contract value.

Useful links

- HMRC overview: https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services

- HMRC technical guide: https://www.gov.uk/guidance/vat-reverse-charge-technical-guide

- HMRC internal manual on materials in a single supply: https://www.gov.uk/hmrc-internal-manuals/vat-reverse-charge-for-building-and-construction-services-manual/vatrevcon23000

- CIS 340: https://www.gov.uk/government/publications/construction-industry-scheme-cis-340/construction-industry-scheme-a-guide-for-contractors-and-subcontractors-cis-340

- Xero overview for DRC: https://www.xero.com/uk/initiative/domestic-reverse-charge-vat/

- QuickBooks help for DRC in construction: https://quickbooks.intuit.com/learn-support/en-us/help-articles/vat-domestic-reverse-charge-for-building-and-construction/00/340752

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist