Domestic reverse charge VAT for construction: simple checklist, invoice wording and VAT return boxes

Jump To...

UK construction invoice with Domestic Reverse Charge highlighted next to hard hat and HMRC document

Who this is for

Owners, office managers and bookkeepers at UK construction and building services firms who invoice other contractors or commercial clients and need a clear, practical way to handle the VAT Domestic Reverse Charge under CIS.

If you use job software with accounting integrations, see our related guides for tool-specific setups:

- ServiceM8 ↔ Xero for UK trades: correct Domestic Reverse Charge and CIS workflows that actually reconcile

- Tradify ↔ Xero (UK): how to stop duplicate invoices and contacts before they snowball

What the reverse charge is

The VAT Domestic Reverse Charge for building and construction shifts the VAT accounting from the supplier to the customer for most CIS‑reportable construction services at the standard or reduced VAT rates. Brought in March 2021 to reduce VAT fraud, it applies when both supplier and customer are VAT‑registered and the supply is within the scope of CIS.

Authoritative guidance:

- HMRC overview and “how to use” pages: GOV.UK guidance

- HMRC technical guide including examples, invoice wording and errors: Technical guide

- HMRC VAT Notice 735 updated 27 February 2025: Domestic reverse charge procedure (latest guidance on who registers for VAT and reverse charge scope)

Quick checklist

Work through these in order for each job or customer:

- Are you and your customer both VAT‑registered and CIS‑registered? If not, the reverse charge won’t apply.

- Is the supply a construction service in scope of CIS, not just materials only? Materials that are part of the service are fine. Pure materials‑only sales are out of scope.

- Is the customer an end user or an intermediary supplier? If the customer confirms in writing that they’re an end user or intermediary supplier, you invoice with normal VAT.

- If no end user/intermediary confirmation and the job is in scope, apply the domestic reverse charge.

- Put the correct legend on your invoice, show the VAT rate or VAT amount to be reverse charged, but don’t include VAT in the invoice total.

- Post to the right VAT Return boxes for supplier and for customer.

Helpful HMRC notes on end user notifications and invoice wording: Technical guide.

When it does not apply

The domestic reverse charge doesn’t apply when any of the following are true:

- The customer is not VAT‑registered.

- The supply is zero‑rated, outside the scope of VAT, or is not a CIS construction service.

- The supply is to an end user or an intermediary supplier and they have confirmed this in writing. HMRC accepts simple wording by email, letter, contract clause or purchase order.

- It’s a consumer job where you invoice a homeowner or other non‑business customer.

For edge cases and examples, use the HMRC technical guide: HMRC DRC technical guide.

Invoice wording examples

You must state clearly that the reverse charge applies and that the customer must account for the VAT to HMRC. HMRC doesn’t prescribe exact words, but any of the following meet the requirement.

Copy‑and‑paste legends you can add to your invoice template:

- “Reverse charge: VAT Act 1994 Section 55A applies. Customer to pay the VAT to HMRC.”

- “Reverse charge: S55A VATA 94 applies. Customer to account for VAT.”

- “Domestic reverse charge applies. Customer to pay VAT to HMRC.”

If your system can’t show the reverse‑charge VAT amount, show the VAT rate and add a note such as:

- “Customer to account to HMRC for the reverse‑charge VAT on items marked reverse charge.”

Example end user notification your customer can send you to disapply the reverse charge:

- “We confirm we are an end user for the purposes of the VAT domestic reverse charge for building and construction services. Please invoice us under normal VAT rules.”

Official wording guidance and examples: HMRC technical guide and VAT Notice 735.

VAT Return boxes

Get the VAT return postings right on both sides.

Supplier making a reverse‑charge supply:

- Box 1: don’t include output tax for that sale

- Box 6: include the net value of the sale

Customer receiving a reverse‑charge supply:

- Box 1: include the output VAT due under the reverse charge

- Box 4: reclaim the same VAT as input tax, subject to normal rules

- Box 7: include the net value of the purchase

- Don’t put the purchase value in Box 6

HMRC references: VAT Notice 735 and How to fill in your VAT return.

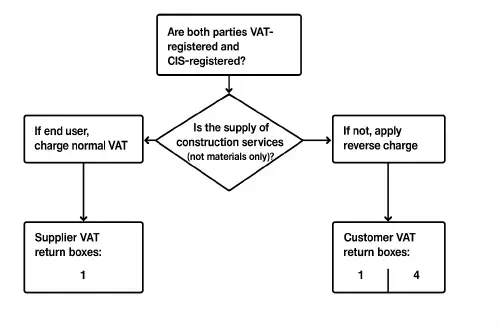

Flowchart

Use this at the desk to decide quickly whether to apply the reverse charge.

Decision flowchart for VAT Domestic Reverse Charge in construction

Common mistakes and how to avoid them

- Missing end user confirmation. If you think the client is the end user, ask them for a one‑line email. File it against the customer record.

- Showing VAT in the invoice total. For reverse‑charge lines, show the VAT amount or rate, but don’t add it to the invoice total.

- Posting to the wrong boxes. Remember: suppliers use Box 6 only for the net; customers use Box 1 and Box 4 for the VAT and Box 7 for the net.

- Treating materials‑only sales as reverse charge. Materials supplied without a construction service are out of scope.

- Software not set up. If you use Xero or job software, test one job end‑to‑end. For ServiceM8 with Xero, follow our correct DRC and CIS workflow.

Useful references

- HMRC main guidance: VAT domestic reverse charge for building and construction services

- HMRC technical guide with examples and errors: Technical guide

- VAT Notice 735: Domestic reverse charge procedure

Short video explainer

A clear five‑minute walkthrough of the CIS reverse charge concept and when it applies.

FAQs

Does the reverse charge apply to work for homeowners?

No. If the customer is not VAT‑registered, such as a homeowner, you invoice under normal VAT rules that apply to your business.

What if part of the job is reverse charge and part is not?

You can show separate lines. Clearly mark reverse‑charge lines and include normal VAT on lines where DRC doesn’t apply. Keep notes on why.

Do I need the customer’s VAT number on the invoice?

It’s good practice to record it. If you’re applying the reverse charge, ensure you’ve confirmed they’re VAT‑registered and in CIS.

Can I apply the reverse charge on materials only?

No. Materials supplied on their own are outside the DRC. DRC is for construction services in scope of CIS, which can include associated materials.

Where do the figures go on the VAT Return?

Supplier: Box 6 only for the net. Customer: Box 1 and Box 4 for the VAT, and Box 7 for the net. See VAT Notice 735.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist