Hiring an Apprentice in 2026: UK Pay, Funding, NICs and Onboarding (Construction-Friendly Guide)

Jump To...

Quick answer

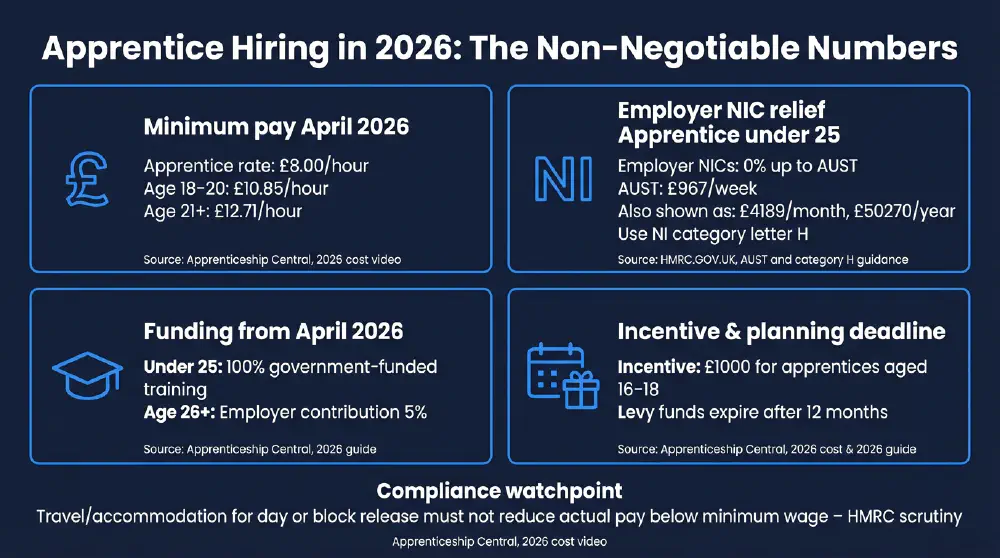

- From April 2026, the National Minimum Wage apprentice rate is £8 per hour (Apprenticeship Central). Minimum wage age bands in 2026 include 18-20 at £10.85 per hour and 21+ at £12.71 per hour (Apprenticeship Central).

- If your apprentice is under 25 and earns under the Apprentice Upper Secondary Threshold of £967 per week, you do not pay employer NICs on their earnings up to that threshold (HMRC/GOV.UK).

- Budget for more than wages: day or block release creates travel (and sometimes accommodation) costs, and you must handle these in a way that does not push pay below minimum wage (Apprenticeship Central notes HMRC scrutiny).

- Funding has shifted in 2026: apprentices under 25 get 100% government-funded training; for 26+, employers contribute 5% (Apprenticeship Central).

- Expect tighter planning under levy reforms: levy pot expiry is now 12 months and funding can be used more flexibly for shorter modular training, not only full apprenticeships (Apprenticeship Central).

Who this is for

- Owners, contracts managers and site supervisors in UK trades and construction who want to take on a first (or next) apprentice without compliance surprises

- Payroll and admin teams who need the 2026 wage, NIC and evidence rules straight before the first pay run

- SMEs planning around the Growth and Skills Levy changes and the new 12-month levy pot expiry

- Anyone who has had an apprentice hire go wrong and wants a repeatable recruitment and onboarding process

What this guide covers

- What you must pay an apprentice in 2026, and where employers commonly slip into minimum wage breaches

- How 2026 training funding works (under-25s fully funded; 26+ co-investment) and how levy changes affect planning

- Employer NIC relief for apprentices under 25: the exact earnings threshold and how to evidence it

- A practical recruiting and onboarding workflow that protects safety culture, retention and audit trails

- Common myths that create payroll errors, funding issues and failed starts

Pay in 2026: the rate is the easy part - the deductions are where HMRC bites

Most employers ask one question first: “What will it cost?” The honest 2026 answer is that wages are only the visible line item. The hidden cost is the time and admin required to stay compliant when training time, travel, and site realities collide.

Apprenticeship Central summarises the 2026 wage picture clearly: from April 2026, the National Minimum Wage apprentice rate is £8 per hour. They also highlight the wider minimum wage age bands in 2026, including 18-20 at £10.85 per hour and 21+ at £12.71 per hour. Those bands matter because not every apprentice is paid the apprentice rate in every situation - and employers get caught when they assume “apprentice” automatically equals the lower rate forever.

The sharp end is expenses and deductions. Day release or block release can mean travel, overnight stays, or simply long unpaid journeys. Apprenticeship Central warns that HMRC is scrutinising cases where travel or accommodation arrangements effectively drag actual pay below minimum wage. That scrutiny is not theoretical: minimum wage enforcement tends to focus on what the apprentice actually takes home for the hours counted as working time, not what the employer intended.

If you want to avoid a minimum wage headache, treat the apprentice wage as a floor, then build your budget around the training reality: what hours are worked, what time is off-the-job, and what costs are being shifted onto the apprentice.

Funding and levy changes in 2026: plan earlier or you lose money

2026 is not just “same scheme, higher wages.” The system is changing shape. Apprenticeship Central’s 2026 overview explains that the Apprenticeship Levy is evolving into the Growth and Skills Levy, with more flexibility to fund short modular training and not only full apprenticeships. That can be a genuine win for construction firms that need targeted skills fast, but it also increases the need for deliberate planning.

Two funding rules from the research should be on every employer’s whiteboard. First: all apprentices under 25 get 100% government-funded training from April 2026. Second: for apprentices aged 26 and over, the employer contribution is 5%. The immediate implication is that “older apprentice” routes still work in 2026, but you need to price the co-investment, and you need to confirm the funding position with your provider before you promise a candidate anything.

The biggest planning trap is expiry. The research notes that levy pot expiration has been cut to 12 months. If your business pays the levy, you now have a shorter runway to turn that money into training. If you miss the window, you lose it. This is why onboarding and training calendars are now finance decisions, not just HR decisions.

Payroll and NICs: the 2026 threshold that saves money (and the evidence you must keep)

There is a meaningful payroll upside to hiring apprentices, but only if you set it up correctly. HMRC’s guidance confirms that employers do not pay Class 1 secondary (employer) National Insurance for apprentices under 25 on earnings up to the Apprentice Upper Secondary Threshold (AUST). For the 2025-26 tax year, AUST is £967 per week (also shown as £4,189 per month and £50,270 per year on GOV.UK). HMRC also states that payroll should use National Insurance category letter H for apprentices under 25, and that you should keep evidence such as a signed apprenticeship agreement showing the standard/framework and start/end dates, or evidence of government funding.

This intersects directly with the cost breakdown in the Apprenticeship Central research: “No employer NICs for apprentices earning under £967/week and under 25.” The point is not the headline saving - it is the operational control. If someone in payroll uses the wrong NI category, or your evidence is missing in an audit, you can lose the benefit and inherit a messy correction exercise. For a plain-English refresher, see Payroll Basics For Small Builders.

Finally, the compliance risk returns to minimum wage. Apprenticeship Central flags HMRC scrutiny when travel or accommodation spend reduces effective pay. Payroll and site leadership need a shared approach to expenses and working time so that a well-meaning training arrangement does not create an enforcement issue.

Recruitment and onboarding that actually works on site: structure beats hope

The most expensive apprentice is the one who leaves. The research highlights a recurring failure mode: employers “rely solely on training providers” or post generic adverts, then wonder why the match is wrong. Apprenticeship Central’s hiring-mistakes video is blunt that multi-channel recruitment and digital outreach are now essential, not optional, if you want candidates who fit your trade, your travel radius, and your safety expectations.

They also connect onboarding quality to morale and safety culture. A loose start does not only risk dropout, it signals to the rest of the team that standards are flexible. On a construction site, that is exactly the wrong message.

Their proven six-step workflow is worth adopting as written: discovery call, mapping training options, multi-channel recruitment, screening (including commitment to health and safety checks), shortlist and interviews, work trials, then structured onboarding. Notice what is missing: “hope for the best.” The process forces you to test fit before you commit. For a site-ready flow you can adapt, use the Construction Site Induction Checklist.

Build mentoring into the job, not as an afterthought. The research repeatedly points to proactive mentoring as a retention lever: involvement from the team during recruitment and a named mentor during the first weeks reduces drift, ambiguity, and unsafe improvisation.

Off-the-job time, assessment pressure, and keeping records: what apprentices say they need in 2026

One of the most useful parts of the compiled research is the live Q&A from the Chartered Institute of Payroll Professionals. It is not theory, it is apprentices describing what breaks first when work gets busy: off-the-job hours get squeezed, evidence gets backfilled at the last minute, and deadlines become stress points instead of development milestones.

The panel discussion surfaces practical themes employers can act on. Apprentices emphasise employer support, diary planning, and spreading study to stay compliant. They also describe the 2026 assessment structure and evidence expectations: project reports, presentations, and portfolio evidence. For employers, the takeaway is simple: if you do not protect time and create a routine for evidence capture, the apprentice will carry the stress and the business will carry the risk. A practical approach to planning and recording protected training time is covered in Off The Job Training How To Track.

The Q&A also touches contracts and continuity - apprentices may move between employers, use multiple training providers, and require break-in-learning support when life happens. That is exactly why the research stresses compliant contracts, safeguarding requirements, and clean provider relationships as part of onboarding, not as a paperwork afterthought.

In construction terms: treat apprenticeship management like a live programme, not a folder on a shelf.

Costs and incentives: what to include in your 2026 apprentice budget

A solid budget stops apprentice hiring becoming a quarterly panic. Based on the research set, your 2026 budget needs to include wages at the correct rate for the apprentice’s situation, plus the operational costs created by training delivery.

Apprenticeship Central highlights two concrete numbers employers should not miss. The first is the £1,000 government incentive for apprentices aged 16-18. The second is training funding: from April 2026, government covers 100% training costs for apprentices under 25; for 26+, the employer pays 5%.

Then there is the “extras” category that breaks forecasts: travel for day release, accommodation for block release, and the management time needed to keep reviews, mentoring, and evidence capture running. Importantly, the research flags that these arrangements must not reduce pay below minimum wage in practice. When you budget properly, you can decide upfront whether you will reimburse travel, provide accommodation, or adjust hours so the apprentice is not subsidising their own training through underpayment.

Common misconceptions (and the 2026 correction)

Misconception: “If they’re an apprentice, we can always pay the apprentice rate.” Correction: The research highlights 2026 minimum wage age bands (18-20 at £10.85/hour; 21+ at £12.71/hour) alongside the apprentice rate (£8/hour from April 2026). Employers must pay the correct minimum for the individual’s circumstances (Apprenticeship Central).

Misconception: “The training provider handles compliance, so we’re covered.” Correction: The hiring-mistakes research warns that relying solely on providers and generic adverts leads to poor fits and weak onboarding. Employers still own recruitment quality, site induction, mentoring and record discipline (Apprenticeship Central).

Misconception: “Travel and accommodation are the apprentice’s problem.” Correction: Apprenticeship Central explicitly flags HMRC scrutiny where day/block release and travel/accommodation arrangements reduce effective pay below minimum wage. If costs or time treatment drag pay under the legal floor, it becomes an employer risk.

Misconception: “NIC relief just happens automatically.” Correction: HMRC requires correct payroll setup (NI category letter H) and evidence (signed apprenticeship agreement or funding evidence). The relief applies up to the AUST of £967/week for under-25 apprentices (HMRC/GOV.UK).

Misconception: “We can use levy funds whenever we’re ready.” Correction: The research states levy pot expiry is now 12 months, so delaying recruitment or onboarding can mean funding is lost (Apprenticeship Central).

FAQs

What is the apprentice minimum wage in 2026?

From April 2026, the apprentice rate is £8/hour (Apprenticeship Central).

What are the 2026 minimum wage rates for older apprentices?

The research notes 18-20 at £10.85/hour and 21+ at £12.71/hour (Apprenticeship Central).

When do employers stop paying employer NICs for apprentices under 25?

HMRC says employer NICs are not due up to the AUST for apprentices under 25 on approved apprenticeships; in 2025-26 the AUST is £967/week (GOV.UK).

What NI category letter should payroll use for an apprentice under 25?

HMRC guidance specifies NI category letter H for eligible apprentices under 25 (GOV.UK).

Do we get any government incentive for hiring a young apprentice?

The research includes a £1,000 government incentive for apprentices aged 16-18 (Apprenticeship Central).

How does apprenticeship training funding work in 2026?

Research states: under 25s get 100% government-funded training from April 2026; for 26+ the employer contribution is 5% (Apprenticeship Central).

What is most likely to make an apprentice hire fail?

The research points to generic recruitment, poor candidate fit, and unstructured onboarding without team buy-in or mentoring, which harms morale and retention (Apprenticeship Central).

What do apprentices say employers should do to help them succeed?

In the CIPP Q&A, apprentices stress diary planning, protected off-the-job time, and steady evidence capture for projects, presentations and portfolios - plus practical employer support when workloads spike.

Useful communities

Training and resources

- HMRC (GOV.UK) - Paying employer National Insurance contributions for apprentices under 25 (guidance on employer NIC relief, evidence requirements, NI category H)

- GOV.UK - Rates and thresholds for employers 2025 to 2026 (AUST £967/week; also shows £4,189/month and £50,270/year)

- Apprenticeship Central - Research video insights compiled in: wage rates for April 2026 (£8/hour apprentice rate; 18-20 £10.85/hour; 21+ £12.71/hour); incentive (£1,000 for 16-18); 2026 funding split (under 25 100% funded; 26+ 5% employer contribution); levy pot expiry now 12 months; compliance watchpoint on travel/accommodation affecting minimum wage (see embedded videos in this guide).

- Chartered Institute of Payroll Professionals - National Apprenticeship Week 2026 panel Q&A insights compiled in: off-the-job planning, assessment evidence expectations (project reports, presentations, portfolio), break-in-learning and contract support considerations (see embedded video in this guide).

Want to slash training times and increase revenue per Engineer? Join our Waitlist: https://trainar.ai/waitlist

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist