HMRC mileage rates 2025 for trades: what to claim, VAT on fuel and simple Xero/QuickBooks automations

Jump To...

UK trades van at a site with an engineer logging mileage on a phone

Quick answer: the rates you can use in 2025 to 2026

There are two sets of HMRC rates that trades businesses use for mileage. Which one you use depends on whether the vehicle is owned by the worker or is a company vehicle.

Using your own car or van for business (Approved Mileage Allowance Payments, also called AMAP or MAP):

Cars and vans: 45p per mile for the first 10,000 business miles in the tax year, then 25p per mile after that

Motorcycles: 24p per mile

Bicycles: 20p per mile

Source: HMRC rates and allowances for travel and mileage on GOV.UK

Company cars (Advisory Fuel Rates, AFR, and Advisory Electricity Rate, AER): used for reimbursing fuel/electricity when the employee drives a company car for business, or for calculating private fuel use paid back by employees. HMRC updates these quarterly.

Example rates effective around June and September 2025 are shown on GOV.UK. Always check the current table:

These rates are still in force for the 2025 to 2026 tax year at time of writing. If HMRC updates AFR/AER during the year, use the latest table.

Who this applies to

- Sole traders and limited company directors using their own vehicle for site visits, merchants and client meetings: claim using AMAP at 45p/25p (car/van), 24p (motorcycle), 20p (bicycle).

- Employees using a personal vehicle for work travel: employer can pay AMAP rates tax-free, and you can claim tax relief if paid less than AMAP.

- Company vehicles: use AFR/AER for fuel/electricity reimbursement or to work out the amount an employee should repay for private use.

- Note: commuting from home to your usual base is not business mileage. Trips to temporary worksites and between jobs usually are.

What HMRC expects in your mileage records

Keep clear, contemporaneous records. HMRC can ask for evidence for up to 6 years. Your log should include:

- Date of the journey

- From and to (start and destination)

- Purpose of the trip (job reference or client/site)

- Odometer start and end, or miles travelled

- Vehicle registration and fuel type (useful for AFR and VAT workings)

- Driver name (if you run a team)

Apps are fine, but even a shared Google Sheet works if it captures the above consistently. For mixed personal and business use, odometer readings are the simplest audit trail.

A simple spreadsheet that gets the calculation right

Create a sheet with columns: Date, From, To, Purpose, Odometer start, Odometer end, Miles, Rate, Amount.

- Miles formula:

=MAX(0, [Odometer end] - [Odometer start])

- AMAP reimbursement for cars/vans (first 10,000 miles at 45p, then 25p):

=IF([YTD miles]<=10000, [Miles]*0.45, 10000*0.45 + ([YTD miles]-10000)*0.25)

- Optional total for motorcycles or bicycles:

=[Miles]*0.24 // motorcycle

=[Miles]*0.20 // bicycle

Tip: Maintain a YTD miles running total per person to apply the 10,000-mile threshold correctly.

Three easy setups to automate mileage claims

A. Xero Expenses: mileage claims in-app

- Install the Xero Expenses app and enable mileage. Set the per‑mile rate to match AMAP (45p/25p) for personal vehicles, or use AFR/AER for company cars if that’s your policy.

- Staff create a Mileage claim in the app, enter trip details and submit. Finance approves and pays through the normal process.

- Useful guide video:

Watch on YouTube: Xero tips — How to add expenses (360 Chartered Accountants)

B. QuickBooks: built-in mileage tracker

- The QuickBooks mobile app can auto‑track trips and lets you classify business vs personal with a swipe.

- Set your mileage rate and export reports for payroll or expense reimbursement.

- Works well for owner‑drivers and small teams who are already on QuickBooks.

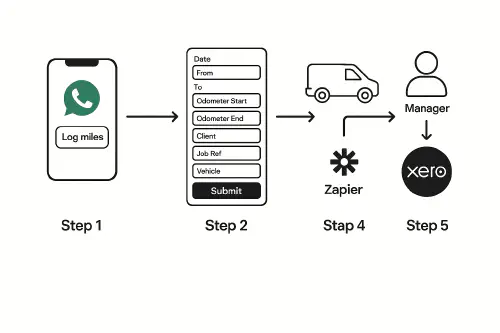

C. WhatsApp to Sheets to Xero via Zapier

If you don’t want another app, set up a lightweight flow your engineers will actually use:

- A WhatsApp “Log miles” shortcut opens a short form (Date, From, To, Odometer start/end, Job ref, Vehicle).

- On submit it lands in Google Sheets and calculates the amount due.

- A Zapier Zap creates a Xero Expenses mileage claim, assigns it to the engineer for approval and payment.

Flowchart: WhatsApp to form to Google Sheets to Xero mileage claim

VAT on mileage: what you can reclaim and how to work it out

This part trips many firms up. The rule depends on who owns the vehicle and what you’re reimbursing.

- Employees using their own car/van on business: you can reclaim the VAT on the fuel element of the mileage you pay, provided you’re VAT‑registered and hold valid VAT fuel receipts. Use HMRC’s Advisory Fuel Rates to estimate the fuel portion per mile for the engine size, then extract the VAT.

- Example: 1,600cc to 2,000cc petrol AFR 14p/mile. On 100 business miles, the fuel element is £14. VAT to reclaim is £14 ÷ 6 = £2.33.

- Sole traders who use AMAP for tax can’t also claim actual running costs for the same vehicle. Pick one method.

- Company cars: use AFR/AER. If the company pays for all private fuel, a car fuel benefit could arise. Many employers ask staff to repay private fuel using AFR to avoid the benefit.

Official references:

Electric vans and EVs: how the rules differ

- AMAP still applies if an employee uses their own electric car for business — you can pay 45p/25p per mile tax‑free. There’s no separate AMAP for EVs.

- For company electric cars, use the Advisory Electricity Rate (AER) on the HMRC AFR page for business reimbursements or private use repayments. Check the current pence per mile before you process payroll or expenses.

- Electricity is not treated as “fuel” for VAT fuel scale charges. Keep proper charging invoices if you intend to reclaim VAT on business electricity costs.

Link: Advisory fuel rates (includes AER)

Common mistakes and quick fixes

- Paying 45p all year for high‑mileage drivers and forgetting to drop to 25p after 10,000 miles. Fix: track YTD miles per person; most apps do this.

- No purpose or job reference in the log. Fix: make Job Ref a required field in your form/app.

- Trying to reclaim VAT on the full 45p. Fix: reclaim VAT only on the fuel element using AFR; keep fuel receipts.

- Claiming commuting as business mileage. Fix: set “usual workplace” in your policy; trips to temporary sites are okay.

- No odometer readings. Fix: require start/end once a week at minimum to sanity‑check totals.

What people are asking on Reddit

Real questions give a steer on what HMRC may challenge and what staff worry about:

- Do you’ve to prove your mileage to HMRC? Practical evidence and record‑keeping concerns: https://www.reddit.com/r/UbereatsUK/comments/1lqb2dw/do_you_have_to_prove_your_mileage_to_hmrc/

- Personal mileage claim changed from 45p to 20p? Confusion about rates and when they apply: https://www.reddit.com/r/UKPersonalFinance/comments/1lou6oz/personal_mileage_claim_changed_from_45p_to_20p/

- P87 — vehicle mileage reports lost, am I screwed? Replacing evidence and making late claims: https://www.reddit.com/r/UKPersonalFinance/comments/1mo5b54/p87_vehicle_mileage_reports_lost_am_i_screwed/

Summarised takeaways: HMRC wants consistent logs with purpose and dates, you only reclaim VAT on the fuel element, and 45p doesn’t run forever — track that 10,000‑mile switch‑over.

Handy links

- GOV.UK — Travel — mileage and fuel rates and allowances

- GOV.UK — Advisory fuel rates

- TrainAR Academy — Automate CIS returns from job sheets: Xero and QuickBooks setup, rules and statements

- TrainAR Academy — [Domestic Reverse C…

Related TrainAR Academy articles:

- VAT bad debt relief for construction: step-by-step for Xero and QuickBooks (with templates)

- HMRC Advisory Fuel Rates made simple for construction firms: vans vs company cars, EV home vs public charging, and clean Xero/QuickBooks workflows

- CIS payment and deduction statements: what to include and how to send them in Xero and QuickBooks

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist