JCT application for payment: timeline, notices and how to record it in Xero or QuickBooks

Jump To...

Quick answer

Under JCT, most jobs follow this rhythm each month:

- Application for Payment on or before the Interim Valuation Date.

- Due date is 7 days after that date (or 7 days after a late application is received).

- Payment Notice must be issued within 5 days after the due date.

- Final date for payment is 14 days after the due date.

- If paying less, the payer must serve a Pay Less Notice no later than 5 days before the final date for payment.

Sources you can check: JCT explains interim payments, Mills & Reeve overview, RICS interim valuations.

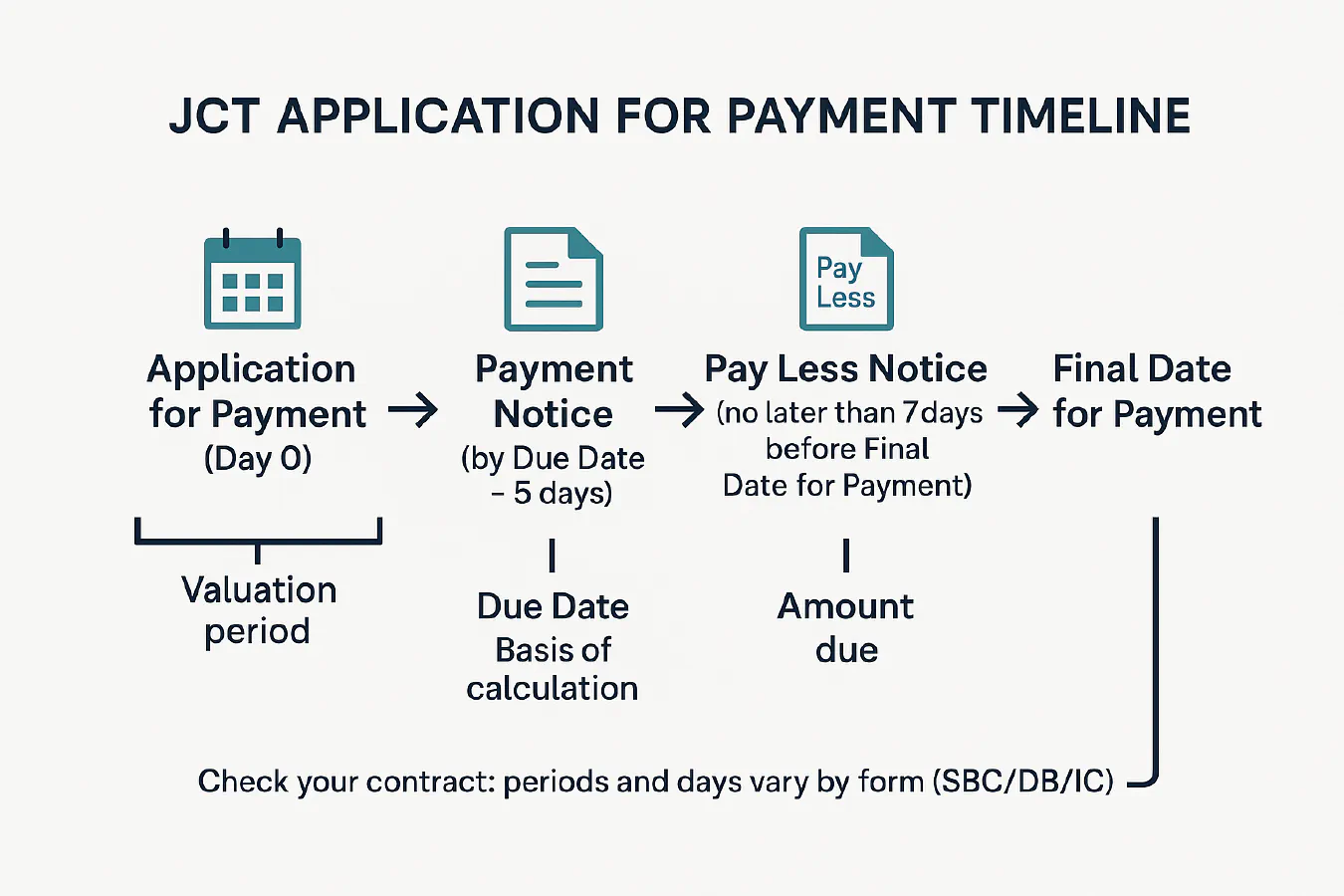

JCT application for payment timeline diagram

JCT payment timeline made simple

- Interim Valuation Date (IVD): the date listed in your Contract Particulars, then usually the same date each month.

- Due date: usually 7 days after the IVD. If your AfP lands late, the due date shifts to 7 days after receipt.

- Payment Notice: must be served no later than 5 days after the due date. If it’s missed, a properly prepared AfP becomes the default “notified sum.”

- Final date for payment: typically 14 days after the due date.

- Pay Less Notice: if the payer wants to pay less than the notified sum, they must serve it no later than 5 days before the final date for payment.

Make sure your AfP states both the sum due as at the due date and the basis of its calculation. That’s what makes it capable of becoming the notified sum if no Payment Notice is issued. See: RICS Black Book – interim valuations and JCT’s explainer.

Important note on forms

Timings above are typical for JCT Design and Build and Standard Building Contract (2016 and kept in 2024). Always check your Contract Particulars. If your contract is silent or non‑compliant, statutory fallback under the Scheme is often 17 days final date for payment and Pay Less no later than 7 days before that. See: NBS construction payments overview.

What to include in your Application for Payment

Your AfP should be capable of becoming a default Payment Notice if the payer misses theirs. Include:

- Project and contract details: JCT form/version, parties, AfP number and period, IVD, due date, final date for payment.

- Valuation to the IVD: measured work, prelims, design fees (if any), variations, loss/expense, materials on site, off‑site materials with vesting certificates.

- Deductions with basis: retention, previous certified/paid, agreed contra‑charges, LADs if applicable.

- Summary math: gross to date, less prior, equals net this period. Show VAT separately. State the “sum due at the due date” and the basis of calculation.

- Substantiation: measurement build‑ups, photos, delivery tickets, vesting certs, marked‑up drawings, sub‑apps, dayworks, programme snippets.

Example summary block (you can mirror this structure in a spreadsheet):

AfP No: 5 | Period: 01–31 May 2025 | IVD: 31 May 2025

Due date: 7 Jun 2025 | FDFP: 21 Jun 2025 | Contract: JCT DB 2016

Gross valuation to date £210,000

Less previously certified £160,000

Equals this period (net of ret.) £50,000

Less retention this period (3) £1,500

Sub‑total £48,500

VAT 20 £9,700

Sum due this period £58,200

Basis of calculation: see attached valuation build‑up and measurement notes.

Record it correctly in Xero

Goal: raise an invoice that mirrors your AfP, posts to the right job, handles retention, CIS and VAT correctly, and will reconcile easily on payment.

- Job tracking

- Use Xero Tracking Categories or Xero Projects to tag every sales invoice and supplier bill to the job. This gives you a live job P and L.

- Progress invoice structure

- Create a customer invoice titled “Application for Payment – AfP 5 (to 31 May 2025).”

- Lines: use headings like Measured work to date, Variations, Materials on site, Retention this period.

- Show retention as a negative line this period (so revenue and retention are visible and auditable). Some firms also run a Retentions control account via journals; either approach is fine if consistent.

- VAT and CIS

- VAT: use standard UK VAT rates on taxable lines. Domestic Reverse Charge still applies on many construction supplies subcontracted in the UK; apply the right VAT treatment on purchase bills so your VAT return is correct. See our cash flow guide with VAT pointers: 13‑week cash flow for trades.

- CIS: if you’re the contractor invoicing the employer, CIS doesn’t apply to sales; CIS applies when you pay your subcontractors. If you’re a subcontractor invoicing a contractor, set the correct CIS treatment in your customer contact and invoice template so statements match what they will deduct.

- Posting retention

- Option A: keep retention as a deduction line on each progress invoice and track the balance in a Retentions tracking report or separate control code.

- Option B: raise a separate retention invoice at practical completion or at the retention release milestones (e.g. 50 percent at PC, 50 percent at end of defects period). Link to your contract’s schedule.

- Reconcile quickly

- Set bank rules for common remitters. Match receipts to the exact AfP invoice so aged receivables reflect reality.

Tip: if you operate both payroll and CIS, set them up cleanly first so CIS deductions on supplier side flow correctly. See: Xero and QuickBooks: PAYE payroll and CIS set up.

Record it correctly in QuickBooks Online

- Turn on Projects and Progress Invoicing

- Gear icon > Account and settings > Sales > Progress invoicing ON.

- Use Projects to tag all income and costs to the job.

- Create the progress invoice

- From the job’s estimate or directly from invoice, title it “Application for Payment – AfP 5 (to 31 May 2025).”

- Add lines for measured work, variations, materials on site. Add a negative line Retention this period to show the deduction clearly.

- VAT and CIS

- VAT: select the correct UK VAT codes per line. If you’re under Domestic Reverse Charge as a subcontractor, ensure supplier bills are posted correctly; your sales to the employer will usually be standard VAT.

- CIS: QBO UK supports CIS. Turn it on in Taxes > CIS then set customers/suppliers correctly so statements and monthly returns reconcile.

- Retention tracking

- Many UK firms track retention in a Retentions liability account; post the negative line to that code. At release, create a new invoice for the retention and journal from the liability to sales.

- Reconciliation

- Match the payment to the correct AfP invoice. Keep Pay Less adjustments documented against the same invoice cycle.

Common mistakes and quick fixes

- Missing the IVD: your due date shifts and cash hits a cycle later. Fix: diarise IVDs for all live jobs and submit one business day early.

- AfP lacks “basis of calculation”: you lose default notice protection. Fix: attach a short build‑up and label the AfP clearly.

- Event‑linked payment terms (e.g. “FDFP on receipt of VAT invoice”): risky and often non‑compliant. Fix: keep FDFP as a fixed period after due date.

- Pay Less arrives late and you ignore it: if it was not served on time, the notified sum still stands. Fix: challenge out‑of‑time notices fast and in writing.

- Retentions not tracked: months later no one knows what’s due. Fix: keep a retentions log by job and milestone. When you’re ready, see our deep‑dive on getting retention released: Release of retention in construction.

Light automations that save hours

- Email to ledger: set a rule so “AfP” emails and PDFs from site drop into Dext or Hubdoc with the job code in the subject, auto‑coding to your Projects/Tracking category.

- Date maths: a simple spreadsheet formula can auto‑calculate due date, Payment Notice deadline, Pay Les…

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist