Late payment fees for trades: charge interest legally, template wording and a chase flow (UK)

Jump To...

Tradesperson viewing an overdue invoice on mobile with UK late payment interest and fixed fee overlay

Who this is for

Small construction trades businesses and subcontractors who invoice other businesses and want a simple, legal way to charge late fees, chase overdue invoices professionally and get money in faster.

If your customer is a consumer, the statutory late payment rules below don’t apply. You can still set fair terms in your contract, but the Late Payment of Commercial Debts rules are for business to business only.

Quick answer

- You can charge statutory interest on late B2B invoices at 8 percent plus the Bank of England base rate, and add a fixed compensation per invoice of £40, £70 or £100 depending on the debt size. See the official guidance on GOV.UK.

- A payment is late on the agreed due date. If nothing is agreed, it’s late 30 days after you supply the work or your customer gets the invoice, whichever is later.

- Add late payment terms to your quotes and invoices. Chase on a set timetable. If still unpaid, send a Letter Before Action and then use Money Claim Online.

What the law says (plain English)

- The Late Payment of Commercial Debts rules give you the right to add interest and fixed compensation on late B2B invoices. Official guidance: Late commercial payments.

- Statutory interest rate: 8 percent plus the current Bank of England base rate. As of early 2026, the base rate is at 4.75% (check the Bank of England for the latest figure). This means your statutory rate is currently around 12.75% on late trade debts.

- Fixed compensation per late invoice:

- £40 for debts up to £999.99

- £70 for debts £1,000 to £9,999.99

- £100 for debts £10,000 and over

- You can also claim reasonable extra recovery costs if your costs exceed the fixed sum.

- Public sector buyers usually have 30 day terms by law. For B2B, terms beyond 60 days are only allowed if both parties agree and it’s fair.

- Consumers: these statutory rights don’t apply to consumer debts. Use clear contract terms and a fair late fee policy instead. HMRC interest rates for your own late tax payments can differ, so don’t confuse the two.

How to calculate interest and the fixed fee

- Annual interest rate = Bank of England base rate + 8 percent.

- Daily rate = annual rate ÷ 365.

- Interest owed = invoice amount × daily rate × number of days late.

- Add the fixed compensation once per late invoice (see bands above).

Worked example

- Invoice £2,000, due 1 August, paid 31 August. Assume Bank Rate is 5.25 percent.

- Annual rate = 5.25 + 8 = 13.25 percent.

- Daily rate = 0.1325 ÷ 365 = 0.000363.

- Days late = 30.

- Interest = £2,000 × 0.000363 × 30 ≈ £21.78.

- Fixed sum = £70 (because the debt is between £1,000 and £9,999.99).

- Total late charges = £21.78 + £70 = £91.78.

Helpful calculator: the UK Small Business Commissioner has an interest and compensation calculator.

Template wording you can copy

Include this on quotes and invoices

- “Payment terms: 14 days from invoice date. For business customers, we reserve the right to charge statutory interest on late payments at 8 percent plus the Bank of England base rate, and a fixed compensation fee as set out by UK law.”

7 day friendly reminder (text or email)

- “Hi Name, just a reminder Invoice INV-123 for £Amount is now 7 days overdue. Could you let me know when payment will be made. If there’s a query, reply here and we will fix it today.”

14 day firm chaser (email)

- “Subject: Second reminder Invoice INV-123 Hi Name, Invoice INV-123 for £Amount fell due on Date and is now 14 days overdue. Under UK late payment rules, statutory interest and the fixed compensation fee may be added if unpaid. Please pay today or reply with an update.”

30 day notice of charges applied

- “Subject: Late payment charges applied to Invoice INV-123 Hi Name, as of today Invoice INV-123 remains unpaid. We’ve applied statutory interest at 8 percent plus the Bank of England base rate and a fixed compensation fee in line with UK law. New balance: £X. Please make payment within 7 days to avoid formal action.”

Letter Before Action (post and email)

- “This is a Letter Before Action. Amount due £X relating to Invoice INV-123. Unless paid in full within 7 days, we will file a claim via Money Claim Online without further notice. We will claim the principal sum plus statutory interest, fixed compensation and court fees.”

A chase flow that works for trades

Follow a timetable. Send messages and keep a record. Stop work on site if contract allows when invoices are overdue.

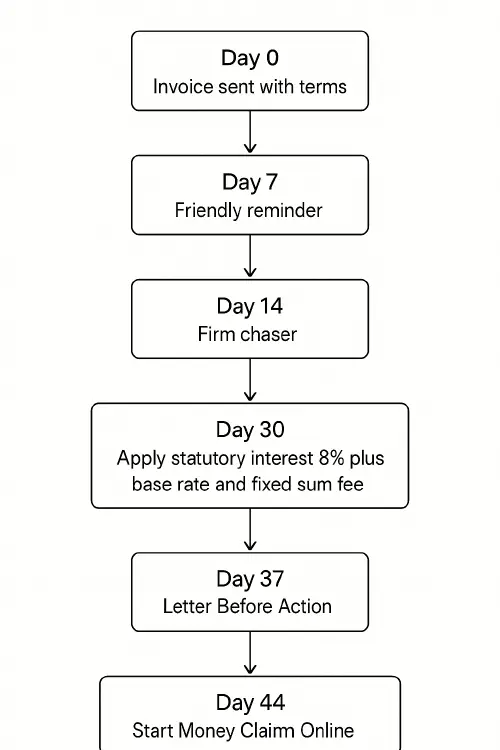

Flowchart showing a UK late payment chase process from invoice to Money Claim Online

Suggested timetable

- Day 0: Send invoice with clear due date and bank details.

- Day 7: Friendly reminder by SMS or email.

- Day 14: Firm chaser by email. Offer to resolve any disputes.

- Day 21: Phone call. Agree a pay date in writing.

- Day 30: Apply statutory interest and fixed compensation. Send updated statement.

- Day 37: Send Letter Before Action by email and post.

- Day 44: File a claim on Money Claim Online if still unpaid.

Automations and tools that save hours

- Xero reminders: Set automatic reminder emails and use a weekly 30 minute routine. See our guide with copyable templates: Xero invoice reminders UK.

- Direct Debit for repeat customers: Tools like GoCardless let you collect on due dates and reduce chasing.

- SMS reminders: Many job apps and VOIP systems can send scheduled texts. Keep it simple and polite.

- Keep an audit trail: Log every reminder, call and promise to pay. If you do go to court, this helps.

Optional explainer video

If the video doesn’t load on your device, watch it on YouTube: Can I charge interest for late business payments.

When to escalate and how

- Pause new work and collections activity on site. Keep communications professional and written.

- Send a Letter Before Action giving at least 7 days.

- File a claim on Money Claim Online. You can claim the debt, statutory interest, fixed compensation and court fees.

- For construction supply chain disputes, keep all purchase orders, variations, site instructions, photos and sign-offs together. It strengthens your position.

Common mistakes to avoid

- No terms agreed. If you don’t set a due date, you wait longer before you can apply interest.

- Chasing randomly. Use a timetable and templates. It feels easier and gets better results.

- Not adding the fixed compensation. You’re entitled to it on B2B debts, per late invoice.

- Letting small amounts slide. Small debts add up. Be consistent.

- Applying statutory interest to consumer jobs. The commercial late payment rules don’t apply to consumers.

Related reading

FAQ

Can I charge a “late fee” to homeowners on domestic jobs

You can only use the statutory 8 percent plus base rate and fixed compensation on B2B debts. For consumers, set fair contract terms up front and make sure your quotes and invoices are clear.

Do I have to mention interest on the invoice for it to apply

No. You can claim statutory interest even if you did not write it on the invoice, as long as it’s a business to business debt. Stating it helps avoid arguments.

Do I add the fixed fee once per customer or per invoice

Per late invoice.

Can I charge my real recovery costs as well

Yes, if your reasonable recovery costs are higher than the fixed sum, you can claim the extra. Keep receipts and records.

Where do I find the current base rate

On the Bank of England site: Bank Rate.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist