Maintenance plan payments for trades: Direct Debit vs Open Banking VRP, setup and when to switch

Jump To...

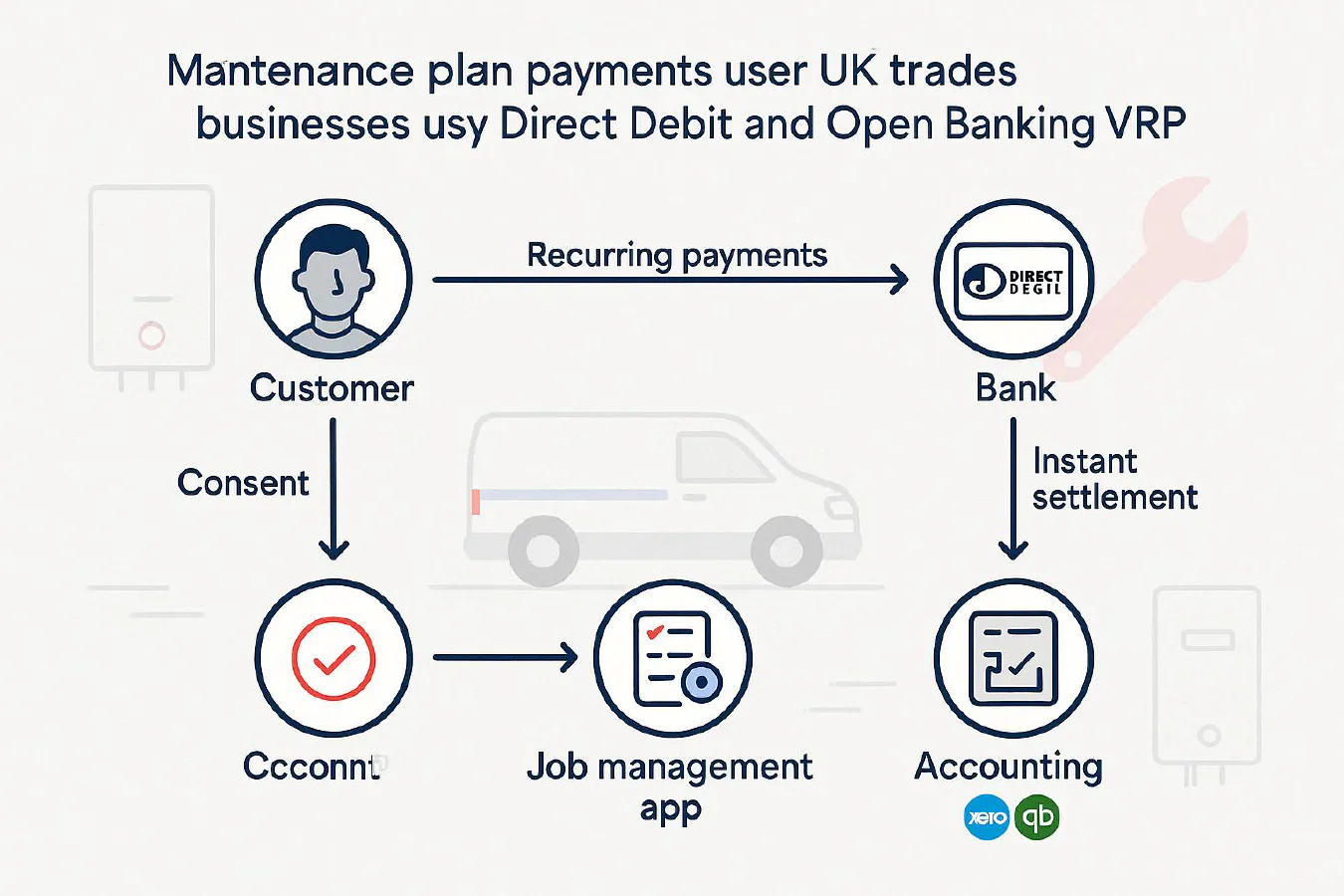

Flow diagram showing customer consent, payment provider, bank, job app and accounting for recurring payments

Quick answer

- If you run fixed-price service plans (e.g. boiler service), Direct Debit via a provider is the practical default today. It supports variable amounts and automated retries, with the Direct Debit Guarantee, but settles on the Bacs 3-working-day cycle.

- Standing orders are simple and cheap but manual. Customers forget to update them and you get no automatic failure alerts.

- Open Banking VRP (Variable Recurring Payments) brings instant bank-to-bank settlement with customer-set caps and one-time Strong Customer Authentication. Commercial VRP is rolling out in waves; many trades will get access later. Build your stack so you can switch on VRP when your sector is included.

What is VRP in plain English

VRP lets a customer approve a recurring payment “permission” with limits (for example, up to £60 per month for the next 12 months). After that, payments flow automatically by Faster Payments, usually in real time, without card details. There’s no Direct Debit Guarantee, but normal UK payment rules still protect consumers from unauthorised payments.

- Background and definitions: Open Banking on VRPs

- Regulator updates: Payment Systems Regulator on expanding VRP and FCA statement on next steps for open banking

Direct Debit vs Standing Order vs VRP

Here’s a simple comparison focused on common trade use cases.

| Use case | Standing order | Direct Debit (Bacs) | Open Banking VRP |

|---|---|---|---|

| Fixed monthly plan | Works if price never changes | Works well | Works well when available |

| Occasional extras (parts, call-out) | Manual separate payment | Supported as variable amounts | Supported within consent caps |

| Setup effort | Customer sets in their bank app | Customer signs a mandate; provider handles | Customer authorises consent with Strong Customer Authentication |

| Failure handling | No automatic alerts | Automated failure codes and retries | Instant success or failure response |

| Settlement speed | Near-instant (Faster Payments) | Bacs 3-working-day cycle | Real time (Faster Payments) |

| Consumer protection | Standard bank protections | Direct Debit Guarantee | Standard open banking protections |

- Faster Payments explainer: Pay.UK

- Bacs timing and notices: Direct Debit cycle overview

- Comparing VRP to other methods: NatWest support guide

Set up now: Direct Debit that plugs into Xero or QuickBooks

Direct Debit is still the best “works everywhere” option for UK trades. Most job and accounting stacks pair well with providers like GoCardless.

- Create a GoCardless account and connect Xero or QuickBooks.

- Add Direct Debit as a payment option on your maintenance plan invoices.

- Use plan items or price books so annual uplifts are easy to apply.

- Turn on automated emails for mandate setup and payment notifications.

- Map payouts cleanly to your accounting platform for reconciliation.

Practical links:

- GoCardless with Xero: set up and reconciliation guidance from GoCardless

- GoCardless with QuickBooks: enable Direct Debit collections from QBO invoices

Tip for one-off extras on site: use pay-by-bank links for instant account-to-account payment while you’re with the customer. See our guide: Pay by bank links for trades.

Plan ahead: be VRP-ready without redoing everything later

Commercial VRP is being rolled out in phases. To avoid rework later:

- Choose a payments provider that offers Direct Debit today and supports open banking payments, with a roadmap for VRP.

- Store plan logic (billing frequency, caps, uplift rules) in your job or accounting app, not hard-coded in a card terminal.

- Use consistent product codes and descriptions so your invoices look identical across Direct Debit and VRP.

- Keep a clear consent record for each customer: when consent was granted, amount caps, end date, and how to revoke.

Regulatory context and timelines:

- Open Banking overview of VRPs and roadmap: Open Banking insights

- PSR and FCA on expanding access: PSR update and FCA statement

Fees, cash flow and settlement speed

- Standing order: no scheme fee, but manual chasing. Settlement is near-instant via Faster Payments.

- Direct Debit: provider fee per transaction; settlement follows the Bacs cycle. You get strong automation, retries, and the Direct Debit Guarantee for customers.

- VRP: pricing is still being finalised as commercial VRP rolls out. Payments settle in real time over Faster Payments, so cash hits your account quicker.

Integrations that UK trades actually use

- Accounting: Xero, QuickBooks Online.

- Job management: ServiceM8, Tradify, simPRO, Jobber. Most support adding a payment link on quotes and invoices.

- Payments: GoCardless for Direct Debit; Stripe and open banking partners for pay-by-bank and, in time, VRP.

Linking it together:

- Job app generates the plan invoice. 2) Customer signs a Direct Debit mandate once. 3) Collections run automatically. 4) Payouts land and reconcile in Xero or QBO.

Customer comms templates

New plan setup (Direct Debit) Hello [First name], To start your [Plan name], please set up Direct Debit using this secure link. You’ll get an email before each collection and you’re protected by the Direct Debit Guarantee. Any questions, reply to this message.

Price change notice Hello [First name], From [date], [Plan name] will be £[new amount] per [month/year]. No action needed if you pay by Direct Debit. If you prefer to change or cancel, reply and we will help.

Move to VRP when available Hello [First name], We now offer bank-to-bank payments with the same monthly amount, but funds clear instantly and you can set spending caps in your bank app. If you would like to switch from Direct Debit, reply and we will send a secure link.

Implementation checklist

- Decide your plan structure: frequency, inclusions, travel limits, and price uplift rules.

- Pick your provider stack: Direct Debit now; open banking partner that supports pay-by-bank and has a VRP roadmap.

- Configure price books in your job app so quotes and invoices are consistent.

- Create Direct Debit email and SMS templates and set automated reminders.

- Test a full run: create a test customer, sign a mandate, collect, reconcile, and issue a refund.

- Document consent storage: where you keep mandates or VRP consents and how customers can revoke.

- Train your office and engineers on how to spot failures and re-send links while on site.

Risks, consent and compliance

- Direct Debit requires advance notice for changes and adherence to the scheme rules. Learn the basics from your provider and Bacs resources.

- VRP uses customer-set caps and open banking consent. There’s no Direct Debit Guarantee; however, unauthorised payments are still covered by UK payment regulations. Keep clear records and offer a simple way to cancel consent.

- Always use secure links from your provider; don’t collect or store card details in ad-hoc ways.

Video: VRP explained

If the video doesn’t play, watch it on YouTube: NatWest VRP Intro.

Useful links

- Open Banking on VRPs: openbanking.org.uk

- PSR next steps on VRP: psr.org.uk

- FCA statement on open banking: fca.org.uk

- Faster Payments overview: [wearepay.uk](https://www.wearepay.uk/wha… Related TrainAR Academy articles:- Pay by bank links for trades: setup with Stripe or GoCardless, fees, refunds and clean Xero/QuickBooks reconciliation

- Send a ServiceM8 invoice on WhatsApp with a Pay now link (fast UK setup)

- Maintenance contract renewals playbook: WhatsApp reminders, e‑sign, recurring jobs and Direct Debit in Xero or QuickBooks

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist