Making Tax Digital for Income Tax for self‑employed trades: deadlines, software and a simple setup

Jump To...

Tradesperson at van desk organising receipts with MTD quarterly deadlines on a laptop screen

Quick answer

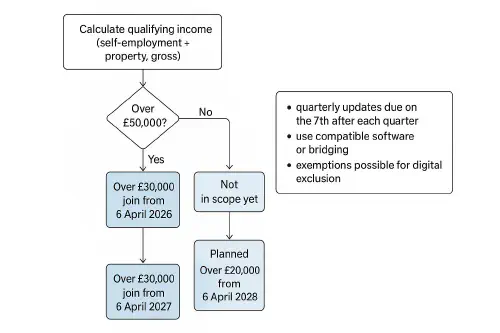

- If your combined gross income from self‑employment and/or property is over £50,000, you’ll need to use MTD for Income Tax from 6 April 2026. Over £30,000 joins from 6 April 2027. Government has stated an intention to bring in over £20,000 from April 2028. See the latest from GOV.UK.

- You’ll keep digital records and send 4 simple quarterly updates via compatible software, then make a Final Declaration by 31 January after the tax year. Guidance: Use Making Tax Digital for Income Tax.

- You can use full bookkeeping software (easiest day‑to‑day) or keep spreadsheets with approved bridging software (must have digital links, no copy‑paste). Find options on HMRC’s software list.

What MTD ITSA actually is

Plain English version: MTD for Income Tax is just Self Assessment done little‑and‑often with software.

- During the year you send 4 updates with totals for income and expenses (no big tax adjustments yet).

- After year‑end you make any accounting/tax adjustments in software and submit your Final Declaration by 31 January.

Useful pages:

- Quarterly updates explained: Send quarterly updates

- Adjustments and finalise: Finalise your income tax position

Work out your qualifying income

“Qualifying income” is your total gross income from self‑employment plus property (before expenses). Employment, dividends and pensions don’t count for the threshold.

- Over £50,000: in from April 2026

- Over £30,000: in from April 2027

- Planned over £20,000: not before April 2028

Check the official definition and examples: Qualifying income.

Flowchart: calculate qualifying income and when you must join MTD for Income Tax

Examples for trades:

- Plumber with £44k self‑employment + £9k rental = £53k. Joins April 2026.

- Electrician at £28k + no property = £28k. Not in scope until at least April 2027, maybe later.

- Builder with fluctuating income: thresholds are checked using your latest Self Assessment figures. HMRC will write to you when you’re in scope.

Deadlines and the 4 updates

You can report by tax‑year quarters or choose calendar quarters. Deadlines are always the 7th of the month after the quarter ends.

| Quarter option | Period | Due date |

|---|---|---|

| Tax‑year Q1 | 6 Apr – 5 Jul | 7 Aug |

| Tax‑year Q2 | 6 Jul – 5 Oct | 7 Nov |

| Tax‑year Q3 | 6 Oct – 5 Jan | 7 Feb |

| Tax‑year Q4 | 6 Jan – 5 Apr | 7 May |

| Calendar Q1 | 1 Apr – 30 Jun | 7 Aug |

| Calendar Q2 | 1 Jul – 30 Sep | 7 Nov |

| Calendar Q3 | 1 Oct – 31 Dec | 7 Feb |

| Calendar Q4 | 1 Jan – 31 Mar | 7 May |

Key points:

- Updates are year‑to‑date, so corrections flow into the next update naturally.

- Jointly let property: you can leave joint property out of in‑year updates and include it when you finalise. See HMRC’s small business review outcome on easements: policy note.

Pick software: full bookkeeping or bridging

Two routes that work for trades:

- Full bookkeeping software (recommended for most): bank feeds, receipt capture, quotes, invoices and MTD submissions in one place. Examples with UK focus include Xero, QuickBooks and FreeAgent. Check HMRC’s compatible list.

- Spreadsheet + bridging software: keep your spreadsheet, then use bridging software to send updates, provided there are digital links between sheets and the bridge (no re‑typing or copy‑paste). HMRC’s guidance on digital records and links: Create digital records.

Tip: If you already use a job system or quoting app, choose accounting software that integrates cleanly to avoid double entry.

Related Academy reads:

- Taking card payments and reconciling to your job system: Tap to Pay on iPhone for trades: SumUp vs Dojo setup, fees and job‑system reconciliation

- Handy automations on the phone you already have: iPhone Shortcuts for trades: 3 fast automations you can set up today

Simple 60‑minute setup for trades

Follow this once and you’ll be ready for your first quarter:

- Choose your quarters: tax‑year or calendar quarters. Put the 7th of Aug, Nov, Feb, May in your diary.

- Pick software: shortlist from HMRC’s list. If unsure, trial one of the big three above.

- Connect bank feed: pull business transactions automatically. Avoid mixed personal spending.

- Turn on receipt capture: snap receipts on site. Create rules for fuel, materials and parking.

- Map categories: set up sensible expense categories for materials, subbies, fuel, tools and small plant.

- Create an invoice template: include clear descriptions and payment terms to reduce disputes. See our guide to reducing chargebacks: Stop chargebacks on site.

- Link your job app if you use one: quotes and invoices flow straight into accounts.

- Do a dummy submission: most software has a sandbox or preview so you can practice the first update.

Optional but useful:

- Auto‑forward PDF receipts from your email to your software’s inbox.

- Set up mileage tracking, or keep a simple log if you claim HMRC mileage rates.

Exemptions and special cases

- Apply for an exemption if it’s not practical for you to use software due to age, disability, location or on religious grounds. See: Apply for an exemption.

- Under the threshold: if your qualifying income drops below the threshold, check HMRC’s eligibility page for your ongoing duty and timing: Eligibility and timing.

- Partnerships are not yet mandated; timeline to be set later.

- Joint property easement: you may leave jointly owned property out of quarterly updates and include it before finalising.

Common mistakes to avoid

- Copy‑pasting numbers into the bridge: you need digital links throughout.

- Missing the 7th deadline after each quarter.

- Mixing personal and business transactions in one bank account.

- Forgetting year‑end adjustments in software before your Final Declaration.

- Leaving setup until April: do a small trial now so there are no surprises.

What people are saying on Reddit

Recent threads show the real concerns tradespeople have:

- Confusion on start dates by income: https://www.reddit.com/r/UKPersonalFinance/comments/1n2xcpb/i_am_self_employed_sole_trader_when_does_mtd/

- Choosing software and whether free tools will do: https://www.reddit.com/r/smallbusinessuk/comments/1n87ggw/mtd_software_any_suggestions_as_to_the_best/

- Bridging software frustrations and digital links: https://www.reddit.com/r/smallbusinessuk/comments/1i5dyxf/rant_and_help_on_bridging_software_for_making_tax/

- What counts as “qualifying income”: https://www.reddit.com/r/UKPersonalFinance/comments/1k55kse/making_tax_digital_qualifying_income/

Themes: start dates depend on your gross business and property income, bridging is fine but digital links are a must, and most sole traders want simple software that captures receipts on the go.

Handy official links

- Overview and who must join: [Use Making Tax Digital for Income Tax](https://www.gov.uk/guidance/use-making-tax-digital-for-income-tax/introduction…

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist