MTD 2026 for UK Trades: What Changes, Who It Hits, and How to Get Compliant Without Losing Weekends

Jump To...

Quick answer: what changes in 2026 (and what you need to do)

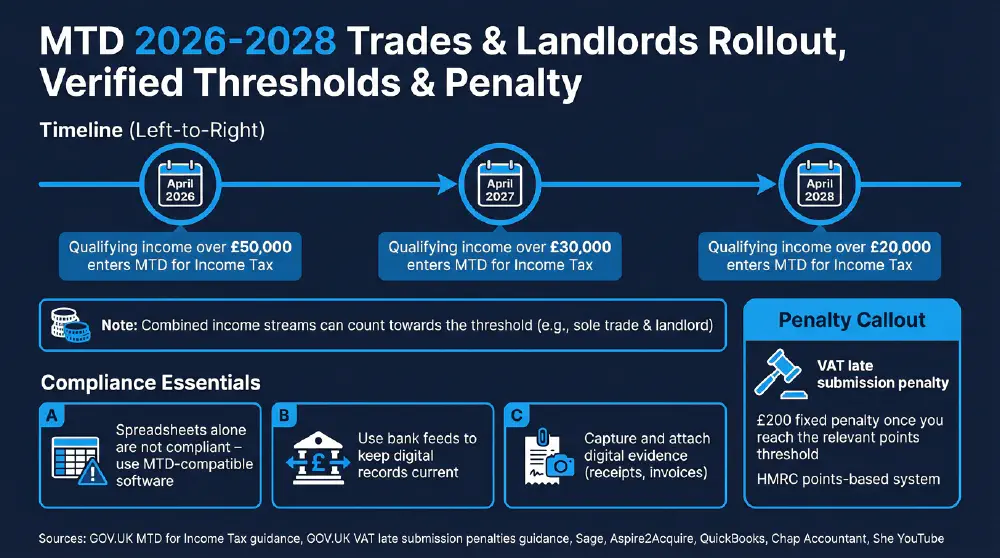

- From April 2026, Making Tax Digital (MTD) for Income Tax starts for sole traders and landlords with qualifying income over \u00a350,000 - with quarterly updates, not just an annual return (GOV.UK guidance).

- Thresholds roll down after that: \u00a330,000 from April 2027 and \u00a320,000 from April 2028, and combined income streams count towards the threshold (as highlighted in the Aspire2Acquire 2026 explainer).

- Spreadsheets on their own will not be compliant - you need MTD-compatible software that can maintain digital records and submit to HMRC (reinforced in the Sage Q&A and GOV.UK guidance).

- The practical win for trades is routine: bank feeds + receipt capture + clean job records (CIS/VAT/materials) means quarterly updates become a 15-minute habit instead of a lost weekend.

Who this is for

- Sole traders in construction and building services (including CIS workers) who currently run on spreadsheets, paper receipts, or \u201cbank statements and hope\u201d.

- Small limited companies or owner-operators who also have rental income and want clarity on how thresholds and reporting interact.

- VAT-registered trades who already do MTD for VAT, but need to understand what MTD for Income Tax adds in 2026.

- Anyone switching to Xero, QuickBooks or Sage in 2026 and wanting a setup that survives HMRC scrutiny.

What this guide covers

- MTD 2026 scope, thresholds and the rollout timetable (2026-2028) in plain trade English.

- What \u201cdigital records\u201d and \u201cdigital evidence\u201d mean on real jobs - materials, mileage, subcontractors, CIS and VAT.

- A practical migration approach from spreadsheets to software, including bank feeds, categories, and avoiding duplicate entries.

- Quarterly update rhythm: what you submit, when you submit it, and how penalties build up if you don\u2019t.

- How Xero, QuickBooks Sole Trader and Sage fit different trade working styles - and what to copy from each setup.

MTD 2026 in one minute: the rollout that catches trades

If you are a sole trader and your qualifying income is over \u00a350,000, MTD for Income Tax starts from April 2026. The key change is behavioural: HMRC expects digital record-keeping and quarterly updates, instead of everything being reconstructed at the end of the year (GOV.UK: \u201cUse Making Tax Digital for Income Tax - Introduction\u201d).

The phased rollout matters because trade income is lumpy. A good year, a big contract, or adding a rental can push you over the line without you noticing until it is too late. The Aspire2Acquire seminar makes the point in trade terms: combined income streams can count towards the threshold, so \u201csole trade plus landlord\u201d is a common way people accidentally qualify.

In trade forums and Reddit-style discussions, the loudest pain point is not the tax itself - it is the admin rhythm change. Quarterly updates feel like \u2018more paperwork\u2019, until the system is set up so your bookkeeping is simply what happens while you run the business: bank feed in, receipt captured, transaction categorised, job noted. That is the whole game.

Quarterly updates: what actually changes in your diary

Quarterly updates are not a quarterly tax bill. They are regular submissions that keep your records and running totals current. The GOV.UK quarterly updates guidance sets out how the update cycle works and when updates are due (GOV.UK: \u201cSend quarterly updates\u201d).

For trades, the operational impact is simple: you cannot leave materials, fuel, and small cash spends until \u2018end of year\u2019 if you want the numbers to mean anything. You also cannot rely on a memory-based tidy-up when a client query, a CIS deduction mismatch, or a VAT question lands mid-project.

The HMRC enforcement discussion in Your Accountant\u2019s video mirrors what tradespeople report in online threads: it is not just fraud they are targeting. HMRC\u2019s data matching (CIS, bank movements, online sales, rental income) makes poor records expensive, because you cannot quickly evidence what a transaction was for. Quarterly updates push you towards a tidy, defensible audit trail by default.

Digital records and \u2018evidence\u2019: what HMRC will expect you to be able to prove

The phrase that trips people up is \u201cdigital records\u201d. In practice, it means you can show what you earned, what you spent, and why, without retyping from paper into a spreadsheet at year-end. Your Accountant\u2019s 2025 warning video frames it bluntly for owner-operators: if you cannot produce a clear digital audit trail, even honest mistakes can turn into quick penalties and prolonged queries.

For trades and construction, the records that most often need cleaning up are also the ones that protect your margins:

Bank activity that matches the real world - materials, plant hire, fuel, small tools, and merchant accounts.

Sales invoices that reflect job stages, variations, and retentions (not just a single end-of-job number).

CIS-related payments and deductions that need consistent categorisation and supporting paperwork.

A habit of attaching receipts and supplier invoices so you are not relying on \u2018it was probably that job\u2019.

This is where Reddit-style pain points show up: people migrating from spreadsheets often double-enter (manual input plus bank feed), miscode materials versus tools, or forget to attach evidence until months later. The solution is not more admin - it is a workflow that prevents the mistake in the first place.

Choosing software: Xero vs QuickBooks Sole Trader vs Sage, through a trades lens

MTD compliance is not about picking the fanciest app - it is about picking the one you will actually use weekly. The best platform is the one that makes the right actions the easiest actions.

Xero (as shown in the 2026 Xero Beginner Guide) shines when you want a fast daily overview. The video\u2019s most trade-friendly idea is the dashboard you can check in 10 seconds: cash trend, invoices owed, bills outstanding. It also flags a classic spreadsheet-migration trap: duplicate entry and messy categorisation when bank feeds are turned on but old habits remain.

QuickBooks Sole Trader (Aaron Patrick\u2019s walkthrough) is built around reducing friction for one-person operations: connect a separate business bank account, let bank data suggest categories, and capture receipts on your phone so evidence attaches to the transaction. The video explicitly calls out CIS needs and shows the quarterly update flow in the real app UI.

Sage\u2019s short Q&A with Mark Millar is useful because it answers the questions trades actually ask: \u2018Do I really need this?\u2019 and \u2018Can I just keep using spreadsheets?\u2019 The clear message: spreadsheets alone will not be compliant, and adopting digital earlier (2025/26) reduces stress, keeps running tax estimates accurate, and avoids last-minute panic.

As covered in our guide to MTD For VAT For Trades, the practical difference for many VAT-registered trades is that MTD for Income Tax adds another reporting rhythm on top of your existing VAT cadence.

Migration from spreadsheets: the failure points trades keep repeating (and how to dodge them)

Most MTD \u2018failures\u2019 are not software problems. They are process problems that software makes visible. Across YouTube guidance and the kind of trade pain points that show up in Reddit threads, the same patterns repeat: people import a spreadsheet, turn on bank feeds, then unknowingly create two versions of the truth.

A safer migration approach looks like this:

Start from the bank feed, not from historical guesswork. Get the feed running cleanly, then reconcile week by week.

Build categories that match trade reality (materials, tools, fuel, plant hire, subcontractors) so quarterly updates are not a reclassification exercise.

Standardise your invoicing and bills workflow so purchases land in forecasting and VAT correctly (the Xero guide is strong here).

Capture evidence at source. If you wait until month end, you will miss receipts and lose context.

If you are VAT-registered, remember MTD for VAT is already established, and late submissions can trigger the points-based penalty regime with a \u00a3200 fixed penalty once you reach the relevant point threshold (HMRC guidance). MTD for Income Tax adds another cadence on top, so clean weekly habits become the only realistic way to stay calm.

If CIS is part of your world, use a record structure that survives deduction statements and job-by-job tracking - see our CIS For Subcontractors Guide.

A simple compliance rhythm you can keep on a building schedule

The best MTD setup is boring: the same small actions, repeated. Mark Millar\u2019s Sage Q&A nails the mindset: go digital early and remove the drama. When the routine is embedded, quarterly updates stop feeling like \u2018extra reporting\u2019 and start feeling like \u2018the books are always ready\u2019.

A trade-proof rhythm is:

Daily (2-5 minutes): reconcile bank feed items and attach any receipts you have in hand.

Weekly (10-20 minutes): raise invoices for completed stages, chase overdue invoices, and enter supplier bills so materials are not invisible.

Monthly (30 minutes): sanity-check categories (materials vs tools), review CIS-related income lines, and confirm VAT coding if relevant.

Quarterly: submit the update from within your MTD-compatible software, with confidence that the numbers reflect reality.

That is also why spreadsheets alone struggle. Even if you are organised, spreadsheet workflows often break the \u2018digital link\u2019 HMRC expects. The Sage video calls this out directly, and the Aspire2Acquire explainer warns that spreadsheet plus bridging software is a risky fallback if you are already fighting duplicates and missing evidence.

If you want a trade-friendly chart of accounts and job-costing habits you can lift directly, see Xero For Trades Setup.

Common misconceptions (and the correction)

- Misconception: \u201cMTD is only for big firms.\u201d Correction: The 2026 rollout explicitly targets sole traders and landlords over the income thresholds, including jobbing trades (Sage Q&A; GOV.UK guidance).

- Misconception: \u201cQuarterly updates mean I\u2019ll pay tax four times a year.\u201d Correction: Quarterly updates are regular submissions to keep records up to date; they are not automatically quarterly payments (GOV.UK quarterly updates guidance).

- Misconception: \u201cI can just keep spreadsheets and send them in.\u201d Correction: Spreadsheets alone are not compliant - you must use MTD-compatible software to maintain digital records and submit to HMRC (Sage Q&A; GOV.UK guidance).

- Misconception: \u201cIf I\u2019m under \u00a350k trade turnover, I\u2019m safe.\u201d Correction: Combined income streams can count, so trade income plus landlord income can push you into scope (Aspire2Acquire explainer).

- Misconception: \u201cHMRC only cares if you\u2019re evading.\u201d Correction: Poor or missing digital evidence can escalate routine checks into penalties and prolonged queries, even for honest traders (Your Accountant video).

FAQs

When does MTD for Income Tax start for trades?

From April 2026 if your qualifying income is over \u00a350,000, with further rollouts at \u00a330,000 (April 2027) and \u00a320,000 (April 2028) (Sage Q&A; GOV.UK MTD for Income Tax guidance).

Do CIS workers need to care about MTD?

Yes - the change is about how you keep and submit records. The QuickBooks Sole Trader walkthrough explicitly references CIS needs and shows a trade-friendly category workflow.

Can I do MTD with spreadsheets?

Not with spreadsheets alone. You need MTD-compatible software to keep digital records and send updates to HMRC; bridging approaches are often treated as a risky fallback in practice (Sage Q&A; Aspire2Acquire explainer).

What\u2019s the single most important setup decision?

Connect a dedicated business bank account and turn on bank feeds. Both the Xero and QuickBooks videos show why this reduces duplicate entry and makes quarterly updates realistic.

What should I attach as evidence?

Receipts, supplier invoices, and sales invoices, tied to the right transactions and (ideally) the right job. Your Accountant\u2019s guidance is clear: evidence and structure protect you when checks happen.

I already do MTD for VAT - what extra is 2026?

MTD for Income Tax adds quarterly updates and a digital record-keeping expectation across your trading/rental income, not just VAT reporting (GOV.UK guidance).

What happens if I miss submissions?

For VAT, HMRC operates a points-based late submission system with a \u00a3200 fixed penalty once you hit the relevant point threshold (HMRC guidance). For Income Tax MTD, follow GOV.UK guidance closely and assume that repeated slippage will create avoidable risk.

Useful communities

Training and resources

GOV.UK

- Use Making Tax Digital for Income Tax (Introduction)

- Use Making Tax Digital for Income Tax (Send quarterly updates)

- Making Tax Digital for VAT (collection overview)

- VAT Notice 700/22: Making Tax Digital for VAT

- Penalty points and penalties if you submit your VAT Return late (points-based system and \u00a3200 fixed penalty)

YouTube research used in-body

Accountant She: Xero beginner guide 2026 edition.

Aaron Patrick - The QuickBooks Chap: QuickBooks Sole Trader MTD setup.

Sage: Mark Millar MTD explainer.

Aspire2Acquire: MTD 2026 explained.

Your Accountant: MTD enforcement 2026.

Want to slash training times and increase revenue per Engineer? Join our Waitlist: https://trainar.ai/waitlist

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist