Offer finance to customers: interest‑free plans vs Kanda, Vendigo and Novuna explained

Jump To...

Small builder and homeowner agreeing a quote with 0 percent monthly instalments

Quick answer

You’ve two clean routes to let customers spread the cost of work:

- Self‑funded interest‑free plan: If you let a customer pay by instalments with no interest or fees, with 12 or fewer repayments and all due within 12 months, that agreement is exempt under Article 60F of the Regulated Activities Order. You can do this without FCA authorisation. You still need clear terms and fair treatment if they miss payments. See the law on legislation.gov.uk.

- Third‑party lender: If you introduce a customer to a lender or platform, that’s credit broking under Article 36A. You usually need FCA permission or to operate as an Appointed Representative or Introducer Appointed Representative of an authorised firm. See Apply to become a consumer credit broker and credit broking rules.

Who this is for

- Small builders, heating and plumbing, electrical, glazing, kitchens and bathrooms, roofing, landscaping and other home improvement trades.

- Firms doing quotes from £1,000 to £25,000 who want to win more work and improve cash flow without risky workarounds.

How customer finance works for trades

Customer finance is any arrangement that lets the customer pay later. In the UK there’s a clear dividing line:

- Your own interest‑free plan for your job only. If it meets Article 60F conditions, it’s outside FCA consumer‑credit regulation.

- Any introduction to a lender or platform to fund the job. That’s regulated credit broking unless you’re exempt or appointed under a Principal.

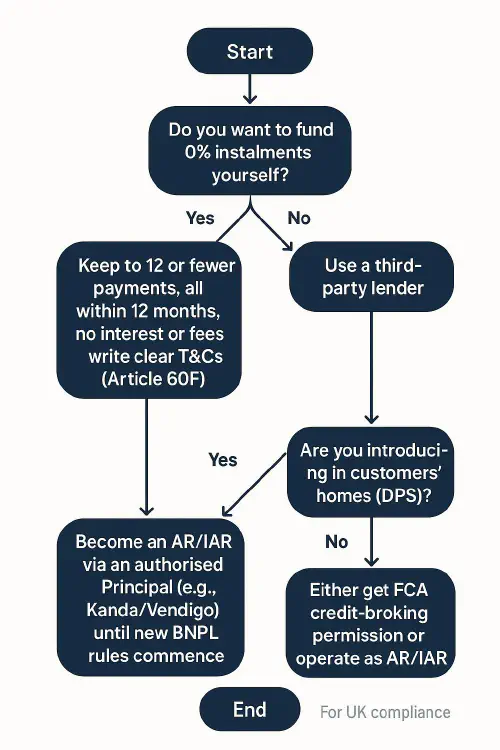

Flowchart showing decision between self‑funded 0 percent up to 12 months and third‑party lender routes

Option A: Self‑funded 0 percent plan up to 12 months (Article 60F)

Article 60F says a fixed‑sum borrower–lender–supplier agreement is exempt if:

- there’s no interest and no other charges, and

- there are 12 or fewer repayments, and

- all repayments fall within 12 months of the agreement date, and

- the credit only finances your goods or services for that customer.

Source: Regulated Activities Order, Article 60F.

Common mistakes that break the exemption:

- Adding any fee for the plan. Don’t charge an admin fee or setup fee.

- Letting terms run past 12 months or more than 12 instalments.

- Rolling multiple jobs into one plan that’s not linked to a specific supply.

Good practice on self‑funded plans:

- Keep T and Cs short and plain English. Include total price, deposit, instalment dates, no interest or fees, missed payment process, and your right to suspend work for non‑payment.

- Use a simple standing order or open banking payment link for each instalment. See our guide to pay by bank links for trades.

- Be fair on arrears. You can apply reasonable default charges in line with your contract, but avoid anything that could be seen as unfair.

Option B: Third‑party lenders and broking (Kanda, Vendigo, Novuna)

Introducing customers to finance is usually a regulated broking activity under Article 36A. Domestic premises suppliers who sell in the customer’s home often need the full‑permission route unless they operate under a Principal as an AR or IAR. See the legal framework in the RAO and FCA CONC scope for broking.

Practical options that trades use today:

- Kanda. Platform that can appoint you as an IAR so you can introduce customers to its lender panel. Offers interest‑free and interest‑bearing options. Pricing and info at getkanda.com.

- Vendigo. Finance platform for home improvements. Can work with directly authorised firms or appoint you under a Principal. See Vendigo customer terms.

- Novuna Consumer Finance. Lender brand used widely in retail and home improvement. Typically requires you to be authorised for broking or operate as an AR via a Principal. See Novuna guidance on authorisation.

What this route changes operationally:

- You follow your Principal’s scripts and disclosures when introducing finance.

- You don’t advertise finance beyond what your Principal approves.

- You track outcomes and keep training records. See FCA guidance for credit broking firms.

BNPL rule changes: what to watch in 2025 to 2026

Government has confirmed it will bring third‑party buy‑now‑pay‑later into FCA regulation. Draft legislation amends Article 60F so covered third‑party interest‑free credit becomes regulated. Timings point to consultation and FCA rulemaking through 2025 with application likely around 2026. See the consultation on GOV.UK.

There’s also a policy update that domestic premises suppliers won’t need broking permission to offer BNPL as a payment option once the new regime takes effect. Check commencement and scope before changing your process. See the update on GOV.UK.

Until commencement, stick with the current routes: either self‑funded 60F or operate under a Principal/your own authorisation for broking.

Set it up in a weekend: step‑by‑step checklist

- Decide your route. Self‑funded 0 percent up to 12 months or third‑party lender via AR/IAR.

- If self‑funded 60F:

- Draft one‑page T and Cs covering total price, deposit, number of payments, due dates, no interest or fees, late payment steps, right to suspend.

- Build a simple schedule in your quote template and invoice software.

- Set up collection. Use standing order or open‑banking link. See our pay by bank links guide.

- If using a platform/lender:

- Choose your Principal. Compare Kanda, Vendigo and direct lender programmes like Novuna.

- Complete onboarding as an AR/IAR, get your scripts and approved wording.

- Update your quote template and website with approved finance messaging.

- Train your team. 20‑minute toolbox brief on when to mention finance, what you can and can’t say, and how to record outcomes.

- Monitor. Track acceptance rate, average order value uplift, and arrears. Adjust deposit percent and terms so.

Templates: wording for quotes and your website

Use these plain‑English examples as a starting point. Adapt to your exact setup and get legal review where needed.

Self‑funded interest‑free plan (Article 60F)

Payment plan option (interest‑free)

Total job price: £7,200 including VAT

Deposit: £1,800 due on acceptance

Balance by 8 equal monthly payments of £675 from 1 Nov to 1 Jun

No interest and no fees apply. This plan is for the goods and services in Quote Q‑1457 only. If a payment is missed, we will contact you to agree a new date. If two payments are missed, we may suspend work until payments are up to date. Default charges may be applied for our reasonable costs of chasing unpaid amounts.

Link to the legal basis in your internal notes, not in the customer wording. Keep the customer copy simple.

Third‑party lender wording (under Principal)

Finance available on orders over £1,000. We act as an introducer to selected lenders who provide finance for our products and services. Finance is subject to status, T and Cs apply. Ask for details.

We only introduce you to lenders we work with and do not offer advice. We do not charge you a fee for the introduction. Our Principal firm authorises us for these activities.

Replace with the exact wording you…

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist