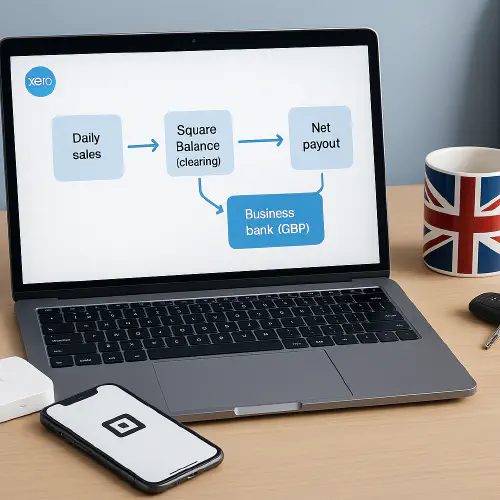

Square to Xero UK: daily sales, fees and payouts using the Square Balance clearing account

Jump To...

UK trades desk with Xero open and a Square reader next to a simple clearing flow diagram

Who this is for

- UK trades using Square to take card payments on site and Xero for accounts.

- Owners, office admins and bookkeepers who want first time reconciliation and correct UK VAT.

What you will set up

- The official Square ↔ Xero integration by Amaka configured for UK VAT.

- A Square Balance bank account in Xero acting as a clearing account for card takings.

- Clean payout matching from Square Balance to your real bank feed.

References

- Square + Xero integration (Xero App Store UK): https://apps.xero.com/uk/app/square

- Square UK help: Xero and Square: https://squareup.com/help/gb/en/article/5237-xero-and-square

- Amaka setup guide and taxes mapping: https://amaka.com/help/guide/square/xero/ and https://amaka.com/help/kb/setting-up-taxes/

10 minute setup

- Connect Square to Xero via Amaka

- Use Amaka’s Express setup to create the daily sales summary invoice and default accounts, or Advanced to map your own.

- Ensure Square taxes map to the right Xero VAT rates (20 percent, 5 percent, 0 percent, Exempt). See Amaka tax guide.

- Confirm the Square Balance clearing account in Xero

- The integration creates Square Balance as a bank type account in Xero. Don’t connect a feed. Don’t rename or delete this account. Amaka notes this can break the sync.

- Payment type mapping

- Card takings post to Square Balance. Map cash and other tenders to their own clearing accounts. In Xero, tick Enable payments to this account on those clearing accounts so they appear in receive payment dropdowns.

- Optional bank rule for faster matching

- In your real bank account in Xero create a rule.

- Condition: Reference contains SQUARE or SQC*.

- Action: Transfer to Square Balance.

Daily flow

What the Square → Xero sync posts each day.

- Daily sales invoice

- One invoice per day with lines split by VAT rates from your Square tax mapping.

- Payments recorded to Square Balance for card takings (and to other clearing accounts for cash/other tenders if configured).

- Fees

- The integration posts Square fees to a Merchant fees expense. Square processing fees are VAT exempt in the UK; a small SaaS component from Squareup International may be reverse charged. See VAT section below and code according to your fee invoices.

- Payout to your bank

- A transfer from Square Balance to your real bank for the payout. In the bank feed you match the deposit to this transfer.

Result: Square Balance should trend to zero per payout cycle, with only timing differences in transit.

Handy references

- Xero blog on improved Square integration for the UK: https://blog.xero.com/product-updates/square-xero-improved-integration-uk/

- Amaka clearing account notes: https://amaka.com/help/kb/the-square-balance-clearing-account/

- Reconciliation steps for payouts: https://amaka.com/help/guide/xero-bank-feed-reconciliation/

UK VAT on Square fees

- HMRC VAT Notice 701/49 treats card acquiring merchant service charges as VAT exempt. The Square processing fee from Squareup Europe Ltd generally shows no VAT.

- You may also see a separate SaaS line from Squareup International Ltd shown as zero percent, with the VAT accounted for by you under the reverse charge if you’re VAT registered. Use an appropriate reverse charge expense tax code in Xero.

- Hardware and subscriptions may be standard rated. Always follow your actual Square fee invoices.

Official references

- HMRC VAT Notice 701/49 finance: https://www.gov.uk/government/publications/vat-notice-70149-finance/vat-notice-70149-finance

- Square UK fee info and community explanation: https://squareup.com/help/gb/en/article/5068-what-are-square-s-fees and https://community.squareup.com/t5/Square-Online-Discussion/VAT-charged-on-fees/td-p/650786

Numbers example

- Sales taken today by card in Square: 1,500 including mixed VAT rates.

- Square processing fees: 24.75 (VAT exempt). SaaS reverse charge line: 1.65.

- Bank payout received tomorrow: 1,473.60.

- In Xero Square Balance: plus 1,500 sales payments minus 26.40 total fees minus 1,473.60 transfer to bank equals 0.

Flow summary

Daily sales -> Square Balance -> minus Fees -> Transfer -> Business bank

Troubleshooting

- Square Balance not zeroing

- Check the bank feed deposit was matched to the transfer from Square Balance.

- Confirm cash or other tender mappings are not pointed at your real bank account.

- Tax mapping off

- Review Amaka tax mapping to ensure Square taxes match the correct Xero VAT rates. Adjust and resync if needed.

- Payment type list empty in Amaka

- In Xero, open the clearing accounts and tick Enable payments to this account so they appear in mapping lists.

- Duplicate sales

- Don’t also import CSVs or use another POS integration for the same Square location.

See also: our Zettle and SumUp to Xero reconciliation guides for similar clearing patterns.

- Zettle: https://apps.xero.com/uk/industry/retail/app/zettle

- SumUp: https://apps.xero.com/uk/function/payments/app/sumup-accounting-integration

Video walkthrough

A short step by step from Amaka showing the Square → Xero setup and bank reconciliation.

Related articles

- Zettle to Xero UK: how to reconcile daily sales, fees and payouts with a clearing account

- SumUp ↔ Xero (UK): bullet‑proof reconciliation and VAT on fees for trades

- Stripe to Xero UK: reconcile payouts, fees and VAT the right way

What’s new for Square in 2025–2026

Square has released some useful new bits for UK trades and service providers:

- Next-day payouts for free: all Square sellers in the UK now get free next-day payouts as standard (no waiting for weekly batches if you don’t want to).

- Square AI (Beta): analyzes your real-time sales data and neighbourhood trends; chat with it from your Dashboard to spot patterns and tweak operations—useful if you’re on multiple sites.

- Voice ordering: AI-enabled voice ordering is now live, which could matter if you take phone orders on site.

For Xero reconciliation, these don’t change your clearing account setup. Your fees treatment and VAT coding stay the same. The quicker payouts just mean your Clearing account clears faster if you want daily settlement.

FAQs

Does Square charge VAT on processing fees in the UK

Square’s card processing fee is generally VAT exempt under HMRC rules. A separate SaaS component may be reverse charged. Check your monthly Square fee invoice to confirm.

Should I rename or delete the Square Balance account in Xero

No. Amaka advises not to rename or delete the Square Balance account as it can break the integration mappings.

How do I handle tips

Map tips in Amaka to a Xero revenue account and VAT code that reflect your policy. If tips are passed to staff, discuss PAYE implications with your payroll advisor.

What if a refund or chargeback happens after the payout

Code the bank outflow as a Transfer to Square Balance. In the clearing account, apply it against the related daily credit note or post a spend money to reopen the balance and add any chargeback fee to Merchant fees.

Can I pass on Square fees to customers on Xero invoices

Xero’s UK learning notes indicate passing on online payment service fees is not available in the UK. If you add surcharges in Square POS, map them carefully and check UK consumer rules.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist