Subcontractor onboarding checklist: right to work, CIS, induction and paperwork (UK construction)

Jump To...

UK construction site office desk with a subcontractor onboarding checklist, GOV.UK share code on phone, hard hat and hi‑vis

Quick answer

For each subcontractor and individual worker you bring on site, do these six things:

Right to Work: run the Home Office check using the worker’s share code or do a manual passport check. Keep evidence to get a statutory excuse. See Employer’s guide to right to work checks and Check a job applicant’s right to work.

CIS: verify the subcontractor with HMRC and use the deduction rate HMRC tells you (30 percent if not registered, 20 percent if registered, 0 percent for gross payment). See HMRC: Verify subcontractors.

Insurance: collect public liability and, if they employ staff, employers’ liability. Record expiry dates and set reminders.

RAMS: receive and sign RAMS suitable for your site and scope. If you’re issuing RAMS, make sure subcontractors acknowledge them.

Contract: confirm scope, day rates or price, variations process, and payment terms. Where you’re using JCT, line up with the main contract.

Induction: deliver a site‑specific induction covering key hazards, controls and site rules. See HSE: Site rules and induction.

What to collect before day one

Collect and file (digital is fine):

- Business details: legal name, address, UTR, VAT number if registered.

- HMRC CIS verification: capture the verification number and rate.

- Insurance: public liability, employers’ liability (if applicable), professional indemnity if design is involved. Note expiry dates.

- Contacts: director and site supervisor names, phone, email, emergency contact.

- RAMS: for tasks they’ll do on your site.

- Right to Work evidence for every individual who will physically work on site (see next section). Remember: a CSCS card is not proof of Right to Work.

Pro tip: Put all of this into a simple “Subcontractor Pack” folder template in your cloud drive with subfolders: 01‑Business, 02‑Right‑to‑Work, 03‑CIS, 04‑Insurance, 05‑RAMS, 06‑Induction.

Right to Work: how to check and what to keep

- Use the employer portal Check a job applicant’s right to work with the worker’s share code. Share codes for work start with W and are valid for 90 days. Run the check yourself and save the PDF result with the photo and expiry.

- For British and Irish citizens without online status, either do a manual document check or use a certified Identity Service Provider for digital verification of a valid passport. See the Employer’s guide to right to work checks and the Right to work checklist.

- If the candidate can’t show documents or online status, use the Employer Checking Service and keep the Positive Verification Notice.

- Record‑keeping: keep copies of checks securely, note any follow‑up dates where permission to work is time‑limited. Civil penalties for illegal working are up to 60,000 pounds per worker for repeat breaches. See the Home Office Code of practice.

CIS: verify the subcontractor and set the correct rate

- Verify each new subcontractor before you pay them, and again if they haven’t appeared on your CIS return in this tax year or the previous two. Use the HMRC CIS online service or your accounts software. HMRC will return the deduction rate and a verification number.

- Rates: 30 percent if not registered or not verifiable, 20 percent if registered, 0 percent for gross payment status. See Verify subcontractors and Make deductions and pay subcontractors.

- Cashflow tip from the trade: If you’re both a subcontractor and a contractor, plan for CIS deductions in both directions. Many firms aim for gross payment status to avoid cashflow pinch. See discussion in r/ukelectricians.

- Keep monthly CIS returns up to date even if you stop using subcontractors; HMRC still expects nil returns until you deregister as a contractor.

Contracts, RAMS and insurance

- Subcontract agreement: set scope, drawings/specs, programme dates, price or daywork rates, change process, payment terms, and retention if used.

- RAMS: either approve subcontractor‑supplied RAMS or issue your own. Make sure they reflect your site’s real conditions and interfaces.

- Insurance: minimum public liability cover agreed in the contract; check employers’ liability if they bring labour. Keep certificates on file with renewal dates.

Site induction: what HSE expects you to cover

Build a site‑specific induction that covers, at a minimum, the HSE items:

- Project overview and who’s in charge.

- First aid, incident/near‑miss reporting, toolbox talks.

- Worker H&S responsibilities and consultation.

- Significant risks on this site and how they’re controlled.

- Site rules: PPE, mobiles, restricted areas, hot works, traffic routes, housekeeping, fire prevention, permit‑to‑work systems, emergency arrangements.

Source: HSE site rules and induction.

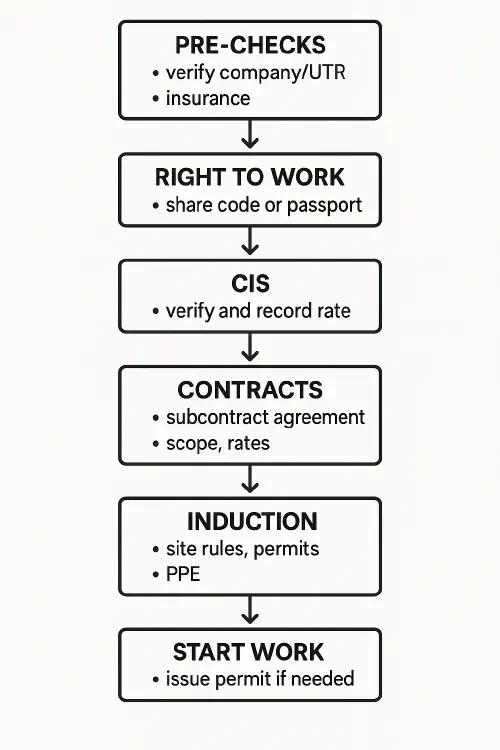

Simple flow you can copy

Flowchart showing subcontractor onboarding steps: pre‑checks, right to work, CIS, contracts, RAMS, induction, start work

What people are saying on Reddit

Recent threads from UK sparks echo two pain points: CIS cashflow and admin load. Worth a skim if you’re setting up your own supply chain:

- CIS Subcontractor using subcontractors: cashflow and registration steps. Thread

- Subcontractors: cash flow and CIS deductions experiences. Thread

Related articles

- Artex asbestos: how to test, NNLW vs non-licensed, safe drilling and removal steps

- Automate CSCS, CPCS and SMSTS renewals: simple rota holds and reminders that keep sites compliant

- CSCS digital skills passport: setup, site checks and a 30 day rollout plan

FAQs

Do I need to do Right to Work checks on self‑employed subcontractors?

Yes. Current guidance requires employers to prevent illegal working. The Home Office strongly encourages checks across supply chains, and proposals are progressing to extend legal duties to engagers of individual subcontractors in construction. See Employer’s guide and policy updates signposted in Construction Enquirer. Always follow the latest GOV.UK guidance.

Is a CSCS card enough for Right to Work?

No. CSCS cards are not proof of the right to work. You must run the official check. Source: CSCS.

What documents do I keep for a statutory excuse?

Save the online check result PDF or copies of acceptable original documents, record the date of the check, and note any follow‑up date. See the Home Office Right to Work checklist and Code of practice.

What info do I need to verify a CIS subcontractor?

Your UTR, PAYE reference and Accounts Office reference, plus the subcontractor’s details (UTR and NI for a sole trader, company UTR and Companies House number for a company). See Verify subcontractors.

When do I re‑verify a subcontractor?

If they have not been included on a CIS return in the current or previous two tax years. HMRC will tell you if their status has changed. Source: HMRC CIS.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist