Square to Xero reconciliation: clean UK setup with a clearing account and correct VAT on fees

Step-by-step guide for reconciling Square payments with Xero in the UK, covering the use of a clearing account and correct VAT handling.

Step-by-step guide for reconciling Square payments with Xero in the UK, covering the use of a clearing account and correct VAT handling.

Making Tax Digital for Income Tax requires self-employed individuals with qualifying incomes over £50,000 to submit quarterly updates starting from April 2026, using compatible software.

UK tradespeople with guidance on tracking their VAT threshold using a rolling 12-month calculator in Google Sheets to ensure compliance.

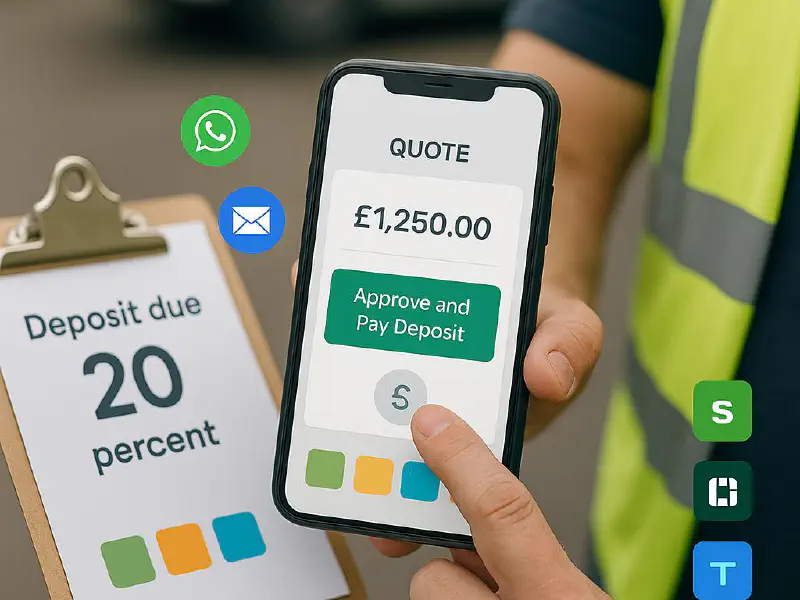

ServiceM8, Jobber, and Tradify offer various methods for automatically collecting deposits upon quote acceptance, integrating with accounting software like Xero and QuickBooks.

Guide on setting up VAT self-billing for CIS subcontractors using Xero and QuickBooks, including necessary agreements and automation options.

Guide for sole traders and small contractors on calculating their charge-out rates, including formulas, examples, and common pitfalls to avoid.

Construction contractors must file a CIS300 monthly return to HMRC by the 19th, even if no payments were made, to avoid penalties.

Guide on the Domestic Reverse Charge VAT for construction, covering its application, requirements, invoice wording, and VAT return procedures for UK firms.

How UK businesses using Zettle and Xero can efficiently reconcile daily sales, fees, and payouts through a dedicated clearing account setup.

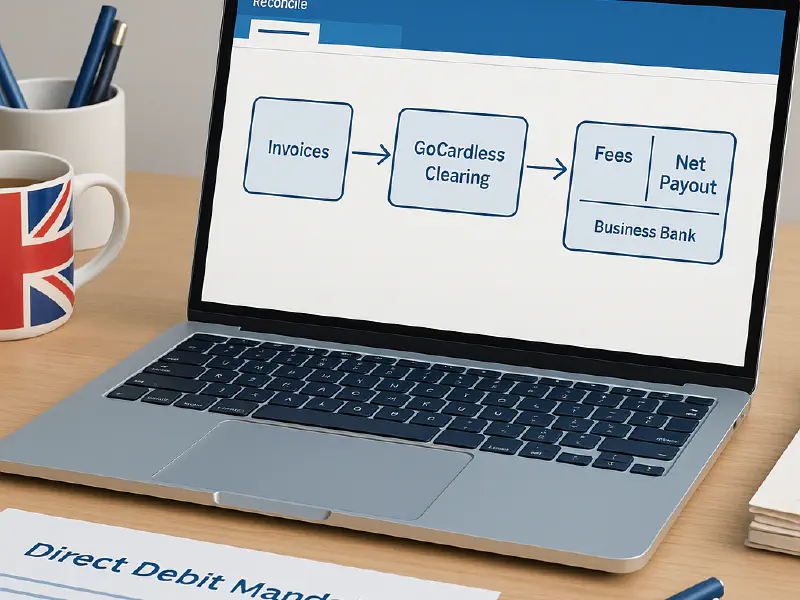

How UK trades firms can reconcile GoCardless payouts in Xero, keeping accurate VAT treatment and simple accounting processes.

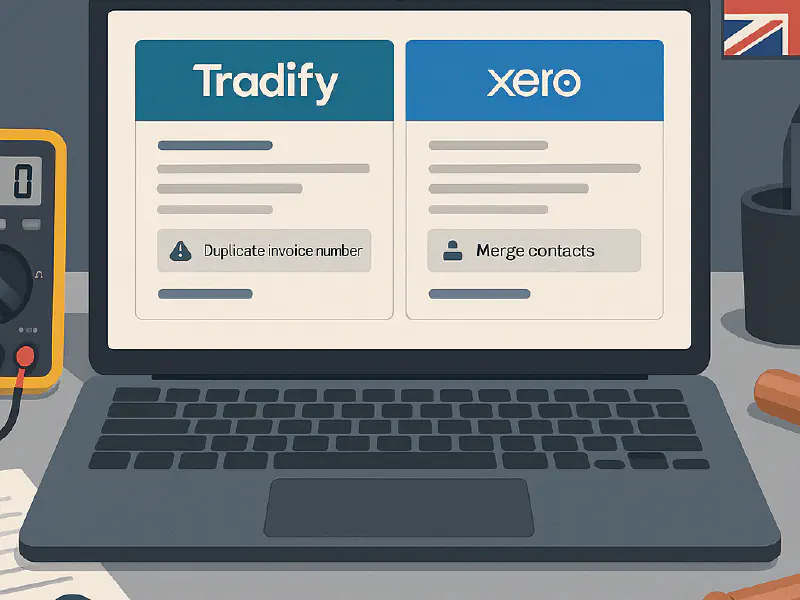

Best practices for UK trades teams using Tradify and Xero to prevent duplicate invoices, payments, and contacts, keeping simple job administration and accurate bookkeeping.

Correct workflows for UK contractors using ServiceM8 with Xero to ensure accurate Domestic Reverse Charge and CIS reconciliations.