Offline card payments on site with no signal: Square vs SumUp vs Zettle, limits and risks

Square and SumUp allow offline card payments with associated risks, while Zettle requires an active connection, making it unsuitable for areas with no signal.

Square and SumUp allow offline card payments with associated risks, while Zettle requires an active connection, making it unsuitable for areas with no signal.

Step-by-step guide for reconciling Square payments with Xero in the UK, covering the use of a clearing account and correct VAT handling.

How to use Square for card pre-authorisation, covering when to opt for pre-authorisation versus deposits, and providing setup instructions and best practices.

SumUp and Dojo for Tap to Pay on iPhone, covering setup, fees, and job reconciliation with accounting software like Tradify and Xero.

Effective scripts and strategies for requesting on-site payments, including timing, methods, handling objections, and automating the process via WhatsApp and payment links.

To minimise chargebacks, standardise evidence collection with photos, customer sign-off, and secure payment methods while maintaining clear communication and documentation.

Methods for processing offline card payments using various systems like Square, SumUp, and Zettle, covering their limitations and best practices.

How UK businesses using Zettle and Xero can efficiently reconcile daily sales, fees, and payouts through a dedicated clearing account setup.

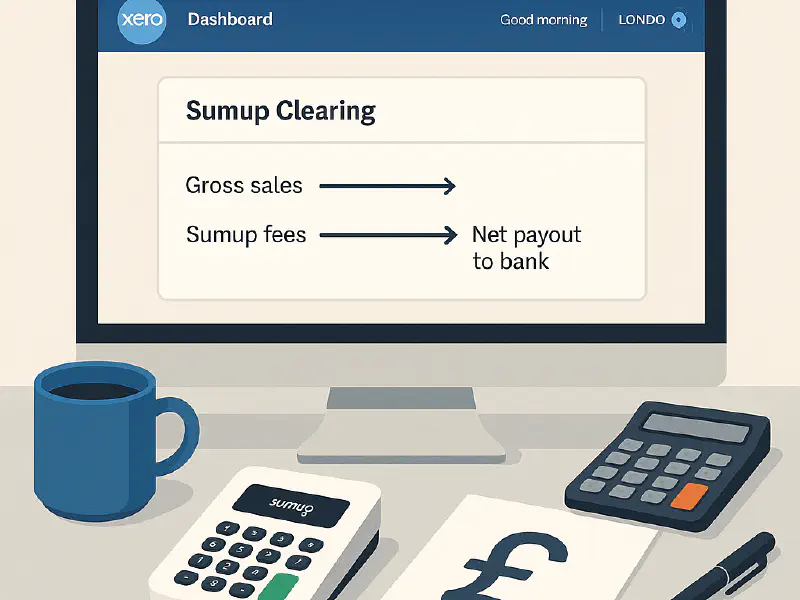

UK plumbing, electrical, and HVAC firms with a process for reconciling SumUp payments and managing VAT in Xero.