Chase unpaid invoices: scripts for email, SMS, WhatsApp and phone plus simple automations that work

Scripts and automation strategies for chasing unpaid invoices via email, SMS, WhatsApp, and phone, tailored for small businesses and contractors.

Scripts and automation strategies for chasing unpaid invoices via email, SMS, WhatsApp, and phone, tailored for small businesses and contractors.

Two financing options for tradespeople: self-funded interest-free plans under Article 60F and third-party lenders like Kanda, Vendigo, and Novuna, covering regulatory requirements and best practices.

Square and SumUp allow offline card payments with associated risks, while Zettle requires an active connection, making it unsuitable for areas with no signal.

Step-by-step guide for reconciling Square payments with Xero in the UK, covering the use of a clearing account and correct VAT handling.

How to use Square for card pre-authorisation, covering when to opt for pre-authorisation versus deposits, and providing setup instructions and best practices.

HMRC Advisory Fuel Rates for construction firms, covering distinctions between company cars and vans, EV charging rates, and compliant record-keeping workflows for Xero and QuickBooks.

Guidance for UK construction professionals on creating effective interim valuation evidence packs, covering necessary components, timelines, and photo protocols for JCT and NEC contracts.

Effective quote follow-up strategies include timely WhatsApp messages, automation tools, and compliance with UK regulations to improve customer engagement and conversion rates.

UK tradespeople with guidance on tracking their VAT threshold using a rolling 12-month calculator in Google Sheets to ensure compliance.

CIS reconciliation Google Sheet template assists UK contractors in efficiently tracking subcontractor deductions, HMRC payments, and reconciling accounts with Xero or QuickBooks monthly.

Guide on setting up VAT self-billing for CIS subcontractors using Xero and QuickBooks, including necessary agreements and automation options.

Builders should understand the difference between estimates and quotes, keeping accurate documentation to prevent price disputes and maintain clear communication with clients.

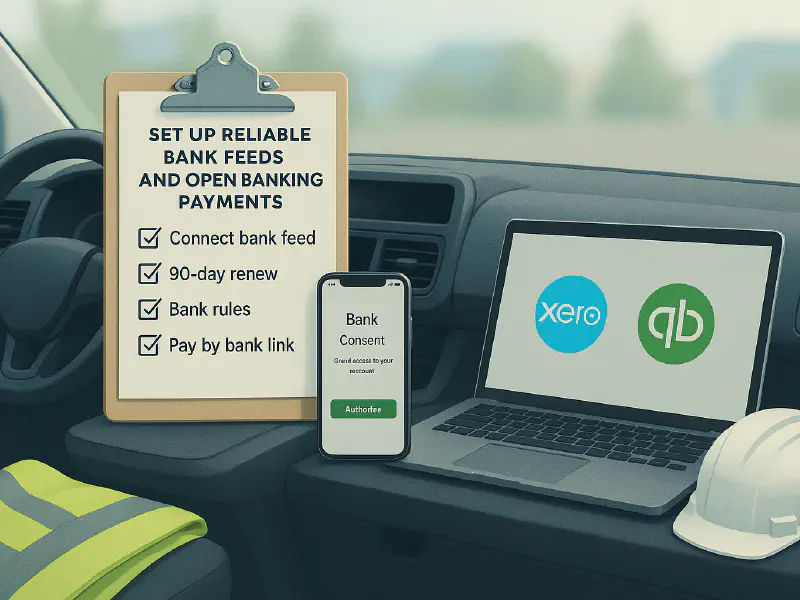

How to set up bank feeds in Xero and QuickBooks for UK trades, addressing the 90-day reconnection requirement and offering troubleshooting tips.

Requirements and procedures for issuing CIS payment and deduction statements to subcontractors using Xero and QuickBooks, including deadlines and common mistakes.

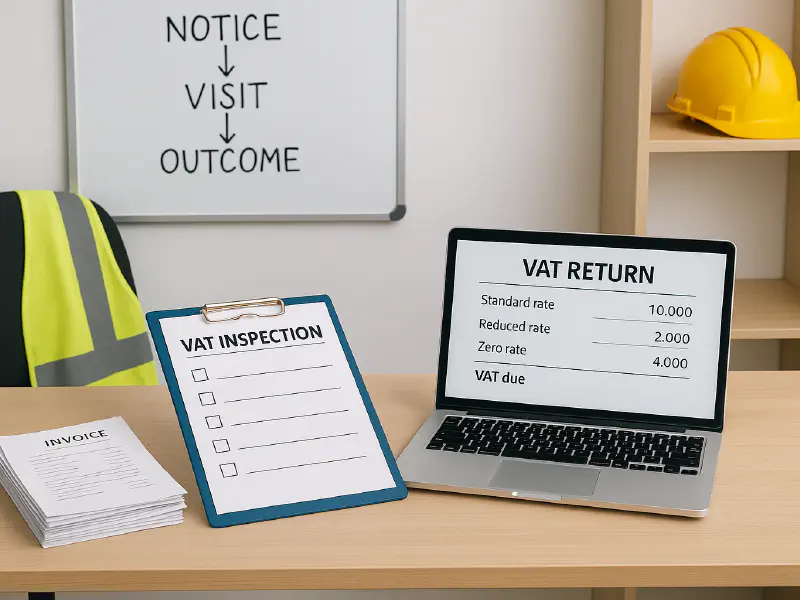

HMRC's VAT inspection requirements for construction firms, covering necessary records, compliance checks, and tips for successful inspections.

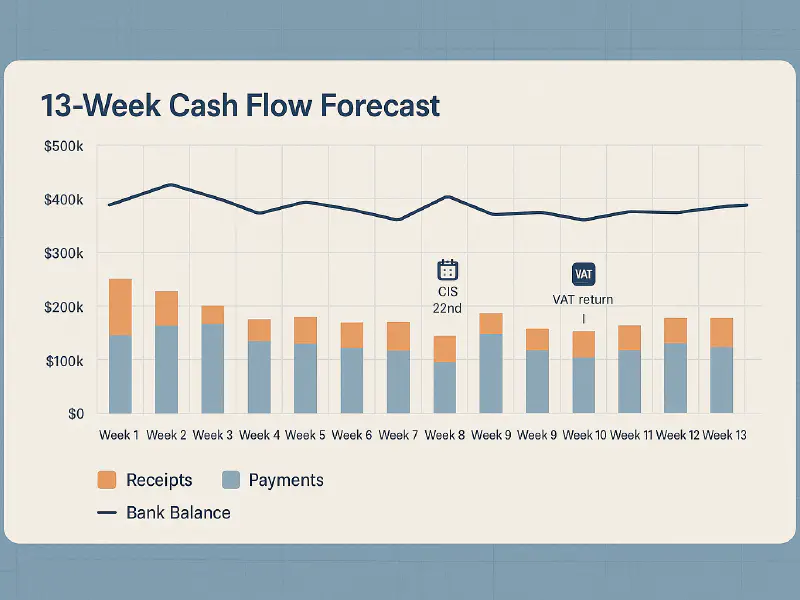

Guide for UK construction businesses on creating a 13-week cash flow template, covering essential components, setup, and weekly updates.

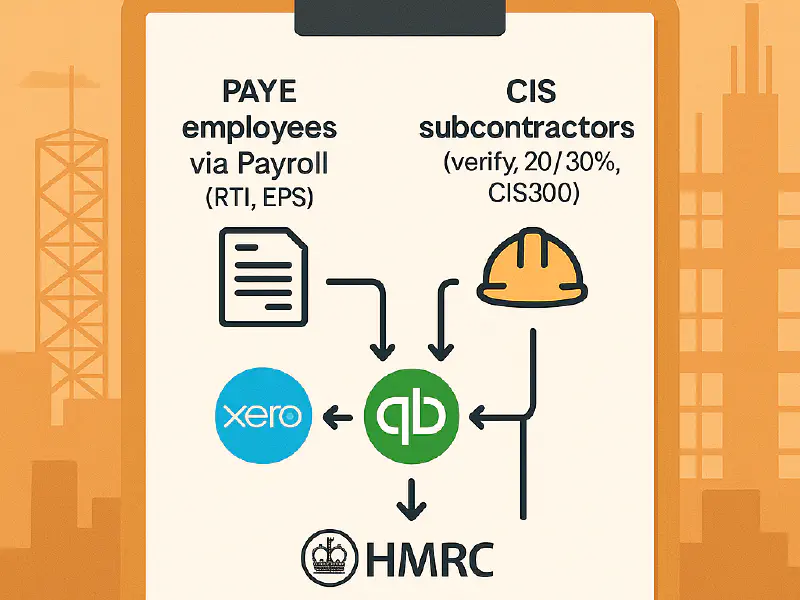

Differences between PAYE payroll for employees and CIS for subcontractors, covering setup processes in Xero and QuickBooks, and common mistakes to avoid.

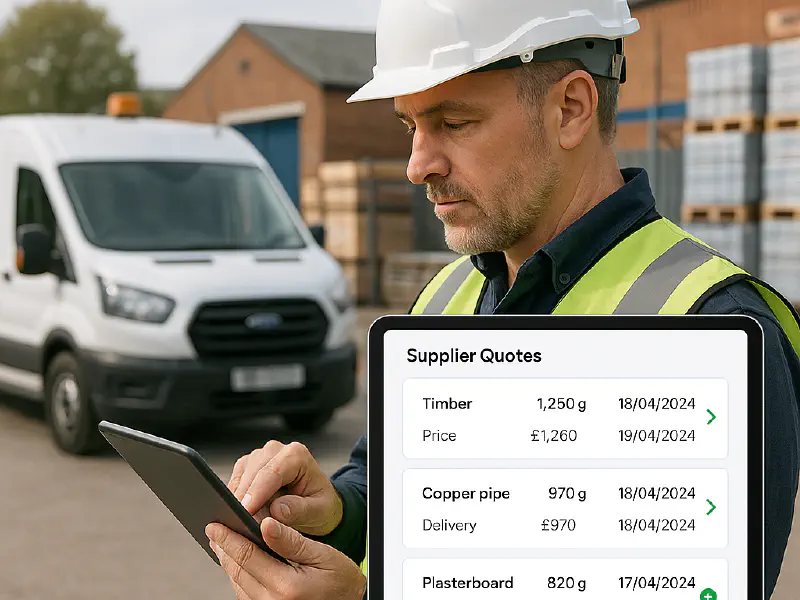

Xero automates supplier quotes and purchase orders, simplifying procurement processes, improving speed, and keeping accurate job costing for UK trades.

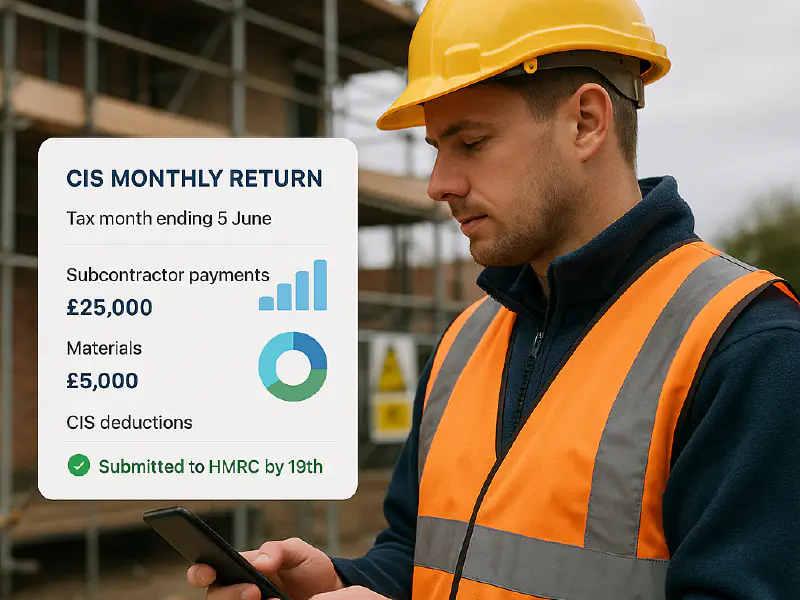

How to automate CIS returns using Xero and QuickBooks by capturing job data, setting up workflows, and keeping compliance with HMRC regulations.

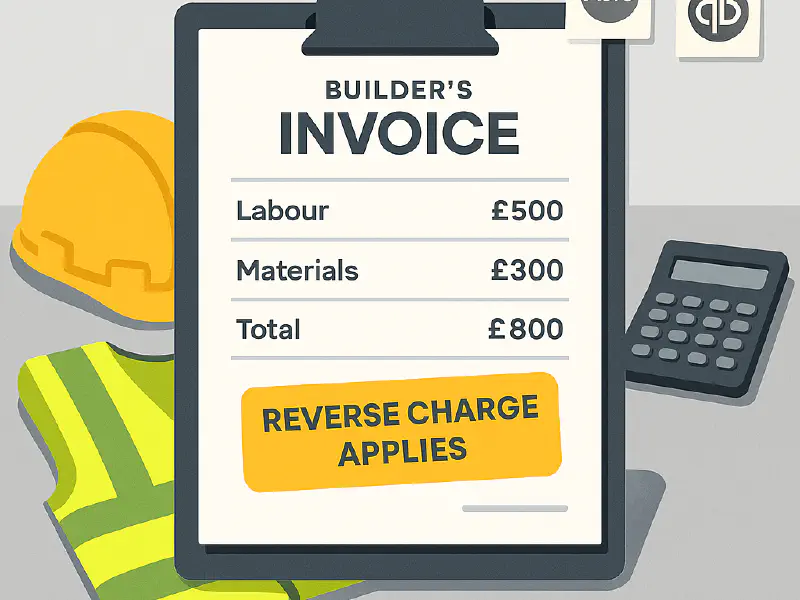

How to manage Domestic Reverse Charge VAT on mixed invoices in Xero and QuickBooks, covering invoice requirements, setup processes, and common mistakes.

Guide for sole traders and small contractors on calculating their charge-out rates, including formulas, examples, and common pitfalls to avoid.

From 1 April 2022 to 31 March 2027, the installation of qualifying energy-saving materials in homes and certain charities is zero-rated for VAT, reverting to 5% thereafter.

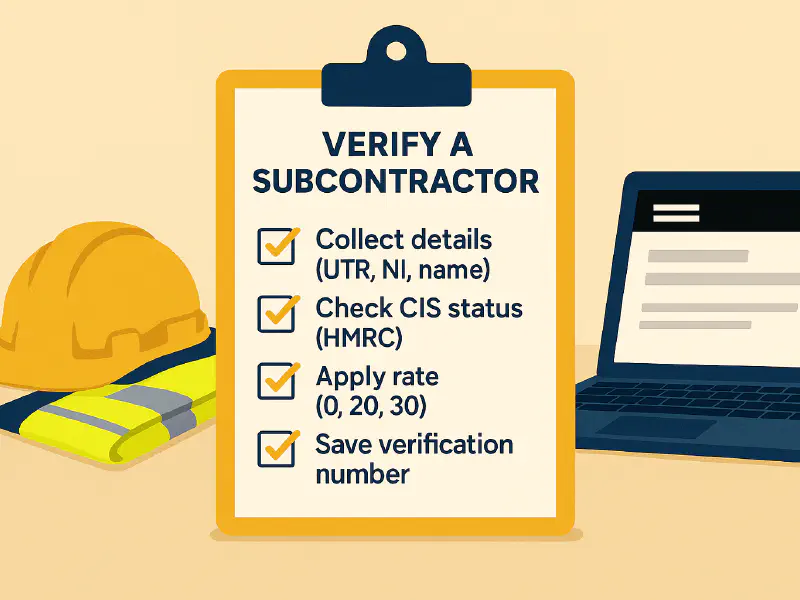

Process for verifying subcontractors under the Construction Industry Scheme, covering necessary information, verification methods, and automation options for record-keeping.

Small construction trades and subcontractors can legally charge late payment fees on B2B invoices, including statutory interest and fixed compensation, using provided templates and guidelines.

Construction contractors must file a CIS300 monthly return to HMRC by the 19th, even if no payments were made, to avoid penalties.

Learn how to calculate your day rate using the actual formula, benchmark against 2025 trade rates, and account for all your real costs—from van expenses to certifications—so you're not undercharging.