Offline card payments on site with no signal: Square vs SumUp vs Zettle, limits and risks

Square and SumUp allow offline card payments with associated risks, while Zettle requires an active connection, making it unsuitable for areas with no signal.

Square and SumUp allow offline card payments with associated risks, while Zettle requires an active connection, making it unsuitable for areas with no signal.

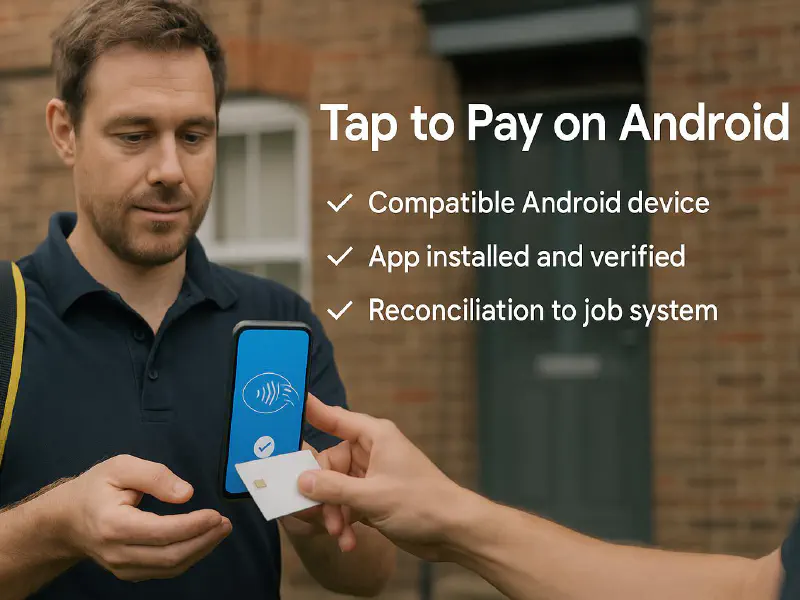

Guide for UK trade businesses on setting up and using Tap to Pay on Android, including device compatibility, setup instructions, and fallback options for poor signal areas.

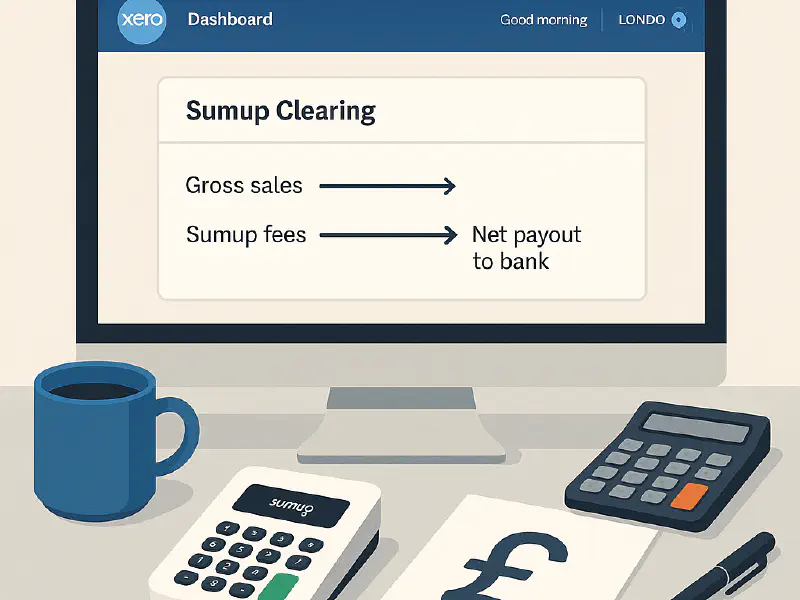

SumUp and Dojo for Tap to Pay on iPhone, covering setup, fees, and job reconciliation with accounting software like Tradify and Xero.

Effective scripts and strategies for requesting on-site payments, including timing, methods, handling objections, and automating the process via WhatsApp and payment links.

Methods for processing offline card payments using various systems like Square, SumUp, and Zettle, covering their limitations and best practices.

Tap to Pay enables sole traders and small firms to accept contactless payments via compatible iPhones or Androids without needing additional hardware, simplifying transactions.

UK plumbing, electrical, and HVAC firms with a process for reconciling SumUp payments and managing VAT in Xero.