Take card payments on your phone: Tap to Pay setup for iPhone and Android

Jump To...

Tradesperson taking a contactless payment on their phone using Tap to Pay

Who this is for

- Sole traders and small construction firms who want to get paid on the spot without a separate card reader.

- Teams doing callouts and small jobs where a fast card payment reduces invoice chasing.

Quick answer

You can accept contactless card and wallet payments using only your phone. On iPhone, use a partner app that supports Tap to Pay on iPhone. On Android, use Tap to Pay in a payments app. No extra hardware needed. All three major providers—Square, SumUp and Zettle—now offer Tap to Pay on both platforms (as of 2026). Typical in-person fees in the UK run 1.69 to 1.75 percent per transaction, though SumUp’s Business account can drop to 1.49%.

- iPhone compatibility: iPhone XS or newer with the latest iOS. See Apple’s overview: Tap to Pay on iPhone.

- Android compatibility: NFC-enabled phone on Android 9 or newer. All three major providers support it now. Square’s guide: Tap to Pay on Android.

How Tap to Pay works

Your phone’s NFC reads the customer’s contactless card or wallet. The payment app handles encryption and authorisation. You never see card numbers. Apps from Square, Zettle by PayPal and SumUp are PCI compliant.

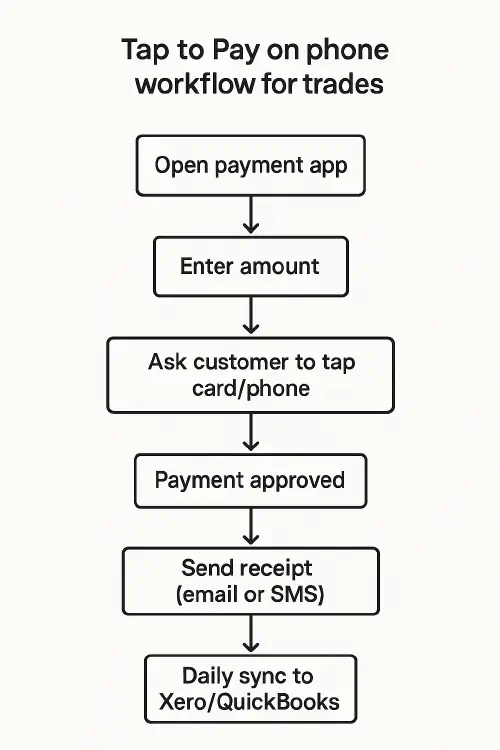

Tap to Pay workflow: open app, enter amount, tap, approved, send receipt, sync to accounts

What you need

- A compatible phone.

- A payments app account. Popular options for UK trades:

- Square: Tap to Pay on iPhone and Tap to Pay on Android. UK in-person fee is 1.75 percent. See Square UK fees.

- Zettle by PayPal: Tap to Pay at 1.75 percent. See Zettle payments and Zettle Tap to Pay.

- SumUp: Tap to Pay on Android at 1.69 percent PAYG. See SumUp Tap to Pay on Android. SumUp’s Payments Plus plan can lower some fees.

- Your bank details to receive payouts.

- Optional: your accounting package (Xero or QuickBooks) if you want daily sales to sync.

Notes on cards and wallets

- Accepts contactless debit and credit cards, Apple Pay and Google Pay. Issuers may request PIN after contactless thresholds are hit (normal under PSD2/SCA in the UK). See Barclaycard on PSD2.

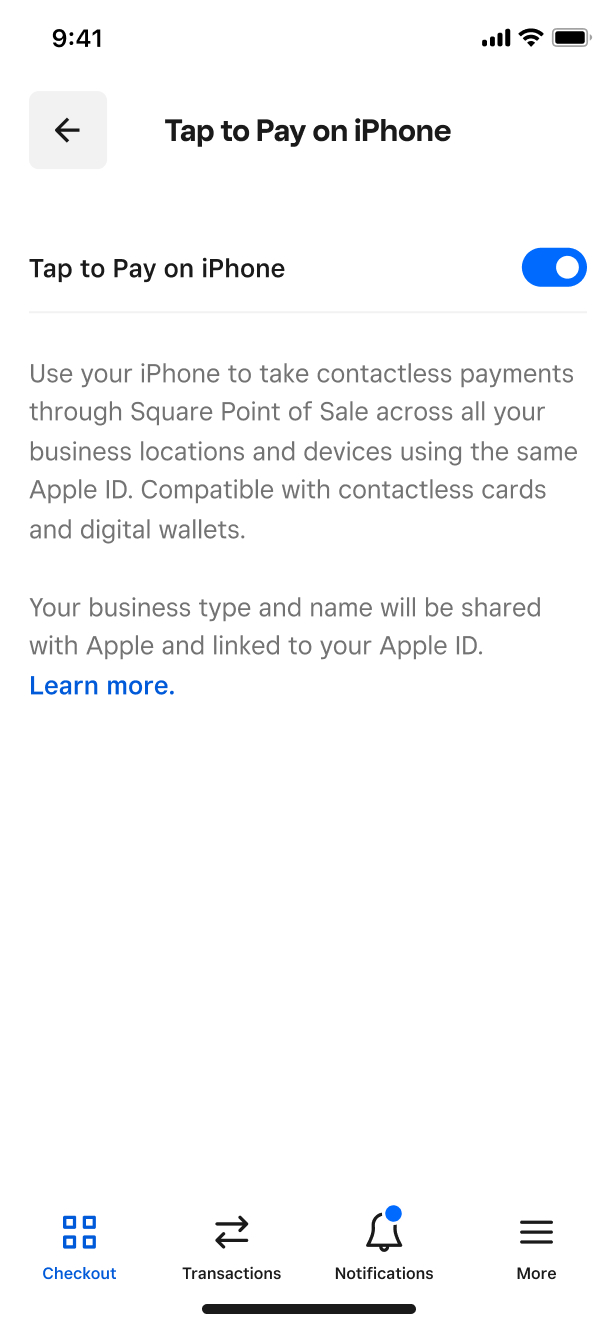

Step-by-step on iPhone

The flow is almost identical across providers. Example using Square (Zettle and SumUp steps are similar once enabled).

- Install and sign in

- Download the app, sign up, complete the ID checks.

- Enable Tap to Pay in the app’s settings when prompted.

- Take a payment

- Open the app and add the item or enter the amount.

- Choose Tap to Pay on iPhone.

- Hold your iPhone so the customer can tap their card or phone near the top edge.

- Wait for the tick and beep.

- Send a receipt

- Offer email or SMS. You can print later if you use a compatible printer.

Helpful links:

- Apple overview: Tap to Pay on iPhone

- Square: Get started with Tap to Pay on iPhone

- Zettle: Tap to Pay

Step-by-step on Android

Example using SumUp (Square and Zettle are similar).

- Install and sign in

- Install the app and complete the account setup.

- Ensure NFC is on: Settings, Connections, Contactless payments.

- Take a payment

- Open the app and enter the amount.

- Present the phone and ask the customer to tap their card or phone on the NFC area.

- Wait for the success message.

- Send a receipt

- Offer email or SMS. Add the job reference in the note so it appears on the receipt.

Helpful links:

- SumUp: Tap to Pay on Android

- Square: Tap to Pay on Android

- Zettle: Payments overview

Receipts and VAT (set once, save headaches)

- Square: Turn on UK VAT in Dashboard and set item VAT rates, inclusive or exclusive. See Square VAT settings and send digital receipts.

- Zettle: Sales reports include VAT detail. Configure products and VAT in Zettle. See About reports.

- SumUp: Configure tax rates in POS or Invoices so receipts show VAT correctly. See SumUp support.

Tip: Add the job address and PO number into the sale note so it appears on the receipt.

Connect to Xero or QuickBooks (optional but recommended)

- Square

- Xero: Official daily sales summary sync with VAT mapping. See Xero’s write-up: Square and Xero integration.

- QuickBooks Online: Use Intuit’s Connect to Square or partners. See QuickBooks integration.

- Zettle

- Xero: Native integration to post daily sales and fees. See Integrate with Xero.

- QuickBooks: Native integration. See Integrate with QuickBooks.

- SumUp

- Xero: Official app on the Xero App Store. See SumUp for Xero.

- QuickBooks: Use CSV export or a third-party connector if needed.

Related reading: If you prefer to send a link instead of taking the card on site, see our guide to Send invoices on WhatsApp: QuickBooks and Xero setup for trades.

Troubleshooting checklist

- NFC off or case too thick: Turn on NFC or remove a bulky case.

- Tap area: On iPhone it’s near the top edge; on Android it varies by model. Move the card slowly.

- PIN requested: The bank is asking due to contactless limits. Customer taps again and follows prompts.

- Declined: Try another card or a wallet. If the customer is remote, send a payment link or invoice.

- Receipts not sending: Check mobile data and the email or phone number typed.

- Duplicate entries in accounts: Make sure you only sync from one app to your ledger to avoid double posting.

Costs and which to pick

- Lowest PAYG in-person fee: SumUp at 1.69 percent. Their Business account drops to 1.49%. Good for light to moderate volumes.

- Strongest accounting options out of the box: Square and Zettle (now PayPal Point of Sale) both have native Xero and QuickBooks links that sync daily sales and VAT.

- Mixed in-person and online: Square’s online rates for UK cards can be competitive if you later add online checkout to your website.

Check current pricing pages before you decide:

Watch: Tap to Pay on iPhone (Square)

Related articles

- Tap to Pay on Android for trades: device checklist, setup and no‑signal fallbacks

- Card machine says no signal? How to take payments offline on site

- JCT application for payment: timeline, notices and how to record it in Xero or QuickBooks

FAQ

Do I need a separate card reader?

No. Tap to Pay lets compatible phones accept contactless cards and wallets without extra hardware.

Will it work if there is no signal?

Most providers need an active data connection to authorise. If you’ll be underground or on a remote site, plan to take payment later via link or invoice.

Can I add a service charge or callout fee?

Yes. Add a line item or adjust the price before you present the phone for payment. Make sure your VAT setting matches the item.

Does the customer ever enter their PIN on my phone?

Occasionally the bank will require extra verification after contactless limits. The app will guide the customer if a PIN is needed.

Which accounting setup is the simplest?

If you use Xero or QuickBooks, Square and Zettle have the most straightforward native syncs. SumUp works well with Xero; QuickBooks may need a connector.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist