UK Construction Payroll in 2026: PAYE Codes, Director NIC, CIS Crossovers, MTD Deadlines, and Software That Will Not Let You Down

Jump To...

Quick answer

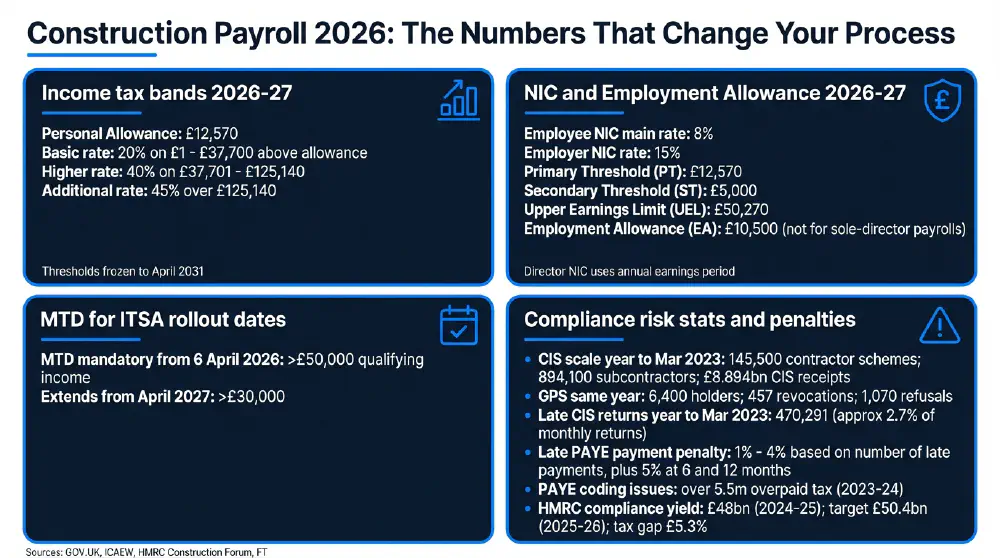

- For 2026-27, the UK Personal Allowance stays at £12,570 and the basic rate band is £37,700 - thresholds are frozen to April 2031, so more of your team will drift into higher tax over time (Annex A rates and allowances).

- Employer NIC is the big payroll cost change: Secondary Threshold is £5,000 and the employer rate is 15% from 6 April 2026, with Employment Allowance of £10,500 but generally not for one-person companies (Rates and thresholds for employers 2026 to 2027).

- Expect more PAYE code movement in 2026 because HMRC is stripping stale expenses and Gift Aid reliefs from codes - and coding errors already cause millions of overpayments and underpayments (ICAEW + FT coverage).

- CIS is tightening from April 2026: stronger fraud tests, GPS risks, and pressure on supply-chain due diligence - your admin process matters as much as your deductions (Tackling CIS fraud).

- If you (or your subcontractors) have £50,000+ gross self-employed/property income, MTD for ITSA becomes mandatory from 6 April 2026 with quarterly digital updates - start testing software now to avoid a chaotic first year (MTD for ITSA policy paper).

Who this is for

- Construction SME owners and directors (limited companies) deciding salary vs dividends and trying to keep payroll clean.

- Office managers and payroll admins running RTI, CIS300s, and monthly PAYE/CIS payments for 2 to 50 staff.

- Contractors with mixed labour models (PAYE employees plus CIS subcontractors) who want to avoid status mistakes.

- Builders, trades and landlords moving into Making Tax Digital for Income Tax Self Assessment from April 2026.

- Anyone dealing with tax code shocks, K-codes, or HMRC corrections mid-year.

What this guide covers

- The 2026-27 income tax bands that actually hit take-home pay on site.

- How PAYE tax codes work in practice in 2026, including the new removal of stale reliefs and why codes swing.

- Director NI mechanics (annual calculation, thresholds, and the payroll settings that trip small firms).

- CIS/PAYE crossover rules, including deductions, statements, offsets via EPS, and what changes in April 2026.

- MTD for ITSA deadlines and how construction businesses can move without duplicating admin.

- Software configuration realities (Moneysoft, KeyPay, Staffology, Xero, QuickBooks, BrightPay/BrightCIS) and where failures get expensive.

2026-27 tax bands: the squeeze is the freeze

Most construction payroll problems are not caused by exotic tax planning. They are caused by perfectly normal people crossing thresholds - and 2026 makes that more likely because the big numbers are frozen.

For the 2026-27 tax year, the Personal Allowance is £12,570, the basic rate is 20% on the first £37,700 above the allowance, higher rate is 40% up to £125,140, and additional rate is 45% above that (Annex A rates and allowances). The key operational detail for small firms is that thresholds are frozen until April 2031. Pay rises, overtime spikes, retention bonuses, and even back-pay for a snag list can nudge workers into higher tax or higher NIC bands without anyone noticing until the payslip argument happens.

Reddit is full of real examples where small reporting differences cause big tax code shocks. A thread on HMRC changing someone to a K484 code shows what happens when HMRC believes there is underpaid tax and recovers it through PAYE - and how quickly it can escalate if the estimated income is wrong (HMRC PAYE and wrong Salary Estimation). Your defence is boring but effective: accurate RTI submissions, a habit of checking notices, and a process for staff to update their Personal Tax Account when their income changes.

PAYE tax codes in 2026: why they move more than you think

In 2026-27, the standard code remains 1257L (with S1257L for Scotland and C1257L for Wales). Emergency codes still look like 1257L W1/M1/X, and in practice they behave exactly like the name suggests - they protect HMRC first and sort the history out later. The non-negotiable rule for employers is that you apply coding notices (P6 and P9) exactly as received and as soon as you receive them, even mid-year. The cleanest explanation for employers is in LITRG’s guidance on tax codes and what employers need to know.

The twist for 2026 is the coding run change: HMRC is auto-removing stale employment expenses and Gift Aid reliefs from PAYE codes unless they have been claimed recently. ICAEW flagged this in January 2026, and it is exactly the type of change that creates phone calls from your foreman on a Friday afternoon asking why take-home dropped (ICAEW tax code changes).

Layer on the bigger picture: PAYE coding issues are not rare edge cases. The Financial Times reported that over 5.5 million people overpaid tax due to coding issues in 2023/24, and HMRC is pushing more frequent, data-driven updates (FT report on coding overpayments). For construction employers, the practical takeaway is simple - expect more code changes, not fewer, and build a mini-process to handle them: document notices, update software, and be ready to explain the change to the worker using the HMRC notice date and your payroll audit trail.

Director salary and NIC in 2026: the setting that silently breaks your payroll

If you run a limited company, director payroll is where 2026 changes bite hardest because director NIC is calculated annually, and the employer NIC thresholds have moved.

HMRC’s rules for National Insurance for company directors are clear on the principle: directors have an annual earnings period for NIC. Your payroll software may offer the standard annual method (AN) or the alternative arrangement (AL) with a year-end reconciliation, and either can be correct if used consistently and reconciled. The numbers you must set up from 6 April 2026 are in HMRC’s rates and thresholds for employers 2026 to 2027: Primary Threshold £12,570, Secondary Threshold £5,000, Upper Earnings Limit £50,270, employee main rate 8%, employer rate 15%, and Employment Allowance £10,500.

This is where small firms get caught. A Reddit thread on director NI exemption confusion shows a common failure mode: the payroll package charges employer NIC unexpectedly because the director flag is not set correctly, or because thresholds were not updated for 2025/26 to 2026/27 logic (Director salary NI exemption confusion). In 2026, that mistake is more expensive because the employer rate is 15% and the Secondary Threshold is only £5,000.

On salary strategy: many advisers still land on £12,570 for directors for broader reasons (qualifying years, corporation tax relief, and clean optics), but it is not a law of physics. The research notes a legitimate alternative: a sole director may pick a lower salary such as the Lower Earnings Limit £6,708 in 2026/27 if Employment Allowance is not available - and National Minimum Wage does not apply unless they are also a worker under employment law (NMWM05140). The right move is to make it a deliberate decision with your accountant, then ensure the payroll configuration matches that decision. For more on this, see our guide to Hiring An Apprentice UK 2026 Pay Funding NICs Onboarding.

CIS and PAYE crossover: status first, deductions second (and April 2026 gets stricter)

Construction admin often breaks at the seam between employment status and how you actually pay someone. HMRC’s position is blunt: you do not choose between CIS and PAYE because a worker asked nicely or because it helps cash flow. You decide based on the engagement and status. HMRC’s CIS reform manual explicitly warns against muddling the regimes, and it is the backbone for defending your position in an inspection (CISR11060).

Operationally, as a CIS contractor you must verify subcontractors, deduct at 0%/20%/30%, file CIS300 returns, and issue deduction and payment statements within 14 days of month end (What you must do as a CIS contractor). If your company is a subcontractor suffering CIS deductions, limited companies reclaim via RTI using an Employer Payment Summary to offset PAYE/NIC - not through the corporation tax return (Pay tax and claim back deductions).

Now the 2026 pressure: HMRC is explicitly tightening on CIS fraud and supply chain due diligence. The policy direction includes harsher consequences for gross payment status where a business knew or should have known about fraud links, a tougher path back to GPS, and a push on umbrella and labour supply chains (Tackling CIS fraud). Combine that with the scale of the system - 145,500 contractor schemes and 894,100 registered subcontractors, with £8.894bn total CIS receipts for the year to March 2023 (ICAEW/HMRC Construction Forum) - and you can see why enforcement is getting more assertive.

One statistic should change behaviour: 470,291 CIS returns were filed late in the year to March 2023 (about 27% of monthly returns), and late filing starts at £100 and can escalate (ICAEW/HMRC Construction Forum). If you are one of the busy firms living close to deadlines, April 2026 is the year to systemise it. For more on this, see CIS Reconciliation Google Sheet Track Subcontractor Deductions HMRC Payments And Xeroquickbooks Checks.

MTD for ITSA from April 2026: the admin shock is quarterly, not annual

Making Tax Digital is not a payroll rule, but it will change how many construction businesses run their books - and that spills into payroll decisions fast (especially in firms where the same person does everything).

From 6 April 2026, MTD for Income Tax Self Assessment becomes compulsory for sole traders and landlords with qualifying income above £50,000, moving them to digital record keeping, quarterly updates, and a final declaration using compatible software (MTD for ITSA policy paper). The rollout extends to £30,000 from April 2027, and there is continuing discussion about lower thresholds later. In practice, a lot of subcontractors will be pulled in because the test is on gross qualifying income.

A common real-world issue is timing and messaging. A Reddit thread shows people confused because software pop-ups push early registration while HMRC guidance focuses on mandation dates and prior-year turnover logic (Make Tax Digital - should I register early or do I have to register now?). The sensible compromise most office teams land on is: do not register early unless you have to, but start running a parallel pilot now so quarterly reporting is not a cliff edge.

Another practical insight from the community is workflow. Tradespeople with job spreadsheets often prefer bridging tools that submit quarterly figures while letting them keep their existing job tracking - but transaction limits and duplicated admin can ambush you (MTD which free program is least involved?). Treat that as a software selection requirement: can you keep job-level data where it is, while still producing compliant quarterly submissions? For deeper step-by-step preparation, see MTD 2026 UK Trades Guide.

Software and process in 2026: prioritise automation where HMRC moves fastest

Software is not the compliance strategy, but it can either make compliance routine or turn it into a permanent firefight.

The immediate 2026 goal is boring: your payroll tool must be updated, connected to HMRC, and able to apply coding notices properly before the first April pay run. The research points out that vendors like QuickBooks, KeyPay, Xero and Staffology typically auto-update tax codes through HMRC integrations, but you still need to verify the mapping and run a controlled first payroll after the tax year change. Staffology positions its HMRC integration and certified tax code handling as a core feature (Staffology Payroll Certified webinar page). Moneysoft provides practical guidance on handling CIS and payroll year updates (Moneysoft CIS guidance). KeyPay is very explicit about CIS workflows within payroll (KeyPay CIS feature page). For hands-on setup guidance, see Xero And QuickBooks Set Up PAYE Payroll And CIS Subcontractors Properly.

If you use BrightPay, note the operational change: from April 2026, CIS management requires the separate BrightCIS module rather than being built into payroll (integration is in progress). That is not a deal-breaker, but it is the kind of detail that can create a missed return if you assume last year’s menu will still be there.

On selection: the construction payroll video research stresses a theme that matches what we see in real businesses. Cheap software that fails at filing, calculation, or support can be more expensive than a higher monthly fee if it causes penalties, staff churn, or late corrections. The video highlights reliability and responsive support as the differentiator for complex construction payroll.

Finally, do not ignore the penalty mechanics. HMRC charges PAYE late payment penalties of 1% to 4% depending on frequency, plus 5% at 6 and 12 months if still unpaid, and interest from the due date - and CIS late payment penalties mirror PAYE (Late PAYE/NIC/CIS payment rules). When HMRC is delivering £48bn compliance yield (targeting £50.4bn) and reporting a 5.3% tax gap, you should assume enforcement processes will keep getting sharper (HMRC performance update Q2 2025).

A practical 2026 checklist for construction offices (without turning it into paperwork theatre)

If you want fewer payroll surprises in 2026, aim for a system that anticipates where HMRC data changes and where construction workflows create ambiguity.

- Lock your 6 April routine: update payroll software, confirm tax tables, run a test payslip, and confirm HMRC connectivity before live payroll.

- Build a coding notice workflow: one inbox, one owner, logged application date, and a standard worker explanation script. Your goal is to avoid the K-code panic and the “you changed my tax” accusation.

- Treat director payroll as a configuration project: confirm director flag, NIC method (AN or AL), and Employment Allowance eligibility using EA eligibility rules. Document the decision so it survives staff changes.

- Tighten CIS discipline: verify, deduct correctly, file CIS300 on time, and issue statements within 14 days. If you are offsetting CIS suffered, do it through EPS with evidence retained.

- Prepare for MTD if you or key subcontractors are in scope: pick tools that do not force duplicate entry, and pilot quarterly processes before April 2026.

This is not about being perfect. It is about reducing avoidable errors in the exact places construction businesses are statistically most likely to slip: late returns, messy worker status decisions, and tax code or threshold updates that happen while you are busy building.

Common misconceptions (and the 2026 correction)

Misconception: You can pay someone partly via CIS and partly via PAYE for different jobs at the same time. Correction: HMRC expects each engagement to be treated under the correct regime - PAYE or CIS - based on status. Blending regimes for one role or engagement risks arrears and penalties (CISR11060).

Misconception: Directors must always take a salary at the Personal Allowance level (£12,570 in 2026). Correction: A sole director may choose a lower salary (for example at the LEL £6,708 in 2026/27) if not eligible for Employment Allowance. National Minimum Wage does not apply unless the director is also a worker under employment law (NMWM05140).

Misconception: Once you set a PAYE code for a worker, you do not need to update it until next tax year. Correction: Employers must apply P6/P9 coding notices immediately when received - even mid-year - or deductions become incorrect and disputes follow (LITRG employer guidance).

Misconception: CIS deductions are always reclaimed through the company tax return. Correction: Limited company subcontractors offset CIS suffered through RTI using EPS against PAYE/NIC, with supporting deduction statements retained (Claim back deductions).

Misconception: Employment Allowance is available for all companies with staff. Correction: Employment Allowance is not available to single-director payrolls and depends on having more than one employee or director earning above the Secondary Threshold (Employment Allowance eligibility).

FAQs

What is the standard PAYE tax code for 2026-27?

For most employees it is 1257L (S1257L Scotland, C1257L Wales), with emergency variants like 1257L W1/M1/X depending on circumstances.

Why did my worker’s tax code change when nothing changed on site?

In 2026 HMRC is removing stale employment expenses and Gift Aid reliefs from codes, and HMRC is also using more frequent data-driven updates. Your job is to apply the notice and help the worker check their Personal Tax Account if the estimate is wrong.

Do directors pay NIC the same way as employees?

Directors have NIC calculated on an annual earnings period. Payroll must be configured correctly (director flag and method AN or AL) or employer NIC can be miscalculated.

Can I reclaim CIS suffered through the company tax return?

No. Limited company subcontractors offset CIS suffered via RTI using EPS against PAYE/NIC, keeping deduction statements as evidence.

What do I actually have to do each month as a CIS contractor?

Verify subcontractors, deduct at the right rate, file CIS300, pay amounts due, and issue deduction/payment statements within 14 days after month end.

When does MTD for ITSA become mandatory for trades?

From 6 April 2026 if qualifying self-employed/property income is above £50,000, with extension to £30,000 from April 2027.

What happens if we pay PAYE or CIS late?

HMRC can apply penalties of 1% to 4% depending on late payment frequency, plus 5% at 6 and 12 months if still unpaid, and interest from the due date.

Useful communities

Training and resources

- GOV.UK: Annex A - rates and allowances

- GOV.UK: Rates and thresholds for employers 2026 to 2027

- ICAEW: Tax code changes for employment expenses and gift aid relief

- GOV.UK: National Insurance for company directors

- GOV.UK: Construction Industry Scheme - tackling fraud

- GOV.UK: Making Tax Digital for Income Tax Self Assessment for sole traders and landlords

- Moneysoft: CIS guidance

- KeyPay / Employment Hero: Construction Industry Scheme tool

- IRIS: Staffology Payroll Certified - Tax Codes and HMRC Integration

- GOV.UK: HMRC internal manual CISR11060

- LITRG: Tax codes - what employers need to know

- GOV.UK: Employment Allowance eligibility

- ICAEW: CIS continues to grow (ICAEW analysis/HMRC Construction Forum May 2024)

- GOV.UK: What you must do as a CIS contractor

- GOV.UK: What you must do as a CIS subcontractor

- GOV.UK: What happens if you do not pay PAYE and National Insurance on time

- GOV.UK: Employer Bulletin June 2025

- GOV.UK: HMRC National Minimum Wage Manual NMWM05140

- GOV.UK: Payroll technical specifications - National Insurance

- Financial Times: Overpayment due to PAYE coding errors (15 Jan 2026)

- GOV.UK: HMRC performance update July to September 2025

- Reddit: HMRC PAYE and wrong Salary Estimation

- Reddit: MTD Which free HMRC approved program have people found to be the least involved?

- Reddit: Director salary NI exemption confusion

- Reddit: Make Tax Digital - should I register early or do I have to register now?

- YouTube: Elizaveta Taylor | Beyond Books Solutions - The Best Payroll Software for Construction Companies in 2026.

- YouTube: Michelle Eames - Helpbox UK - The Smartest DIRECTOR SALARY Strategies Have Changed.

- YouTube: Tax2u Limited - Making Tax Digital For Income Tax Self Assessment - Everything You Need To Know.

Want to slash training times and increase revenue per Engineer? Join our Waitlist: https://trainar.ai/waitlist

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist