VAT bad debt relief for construction: step-by-step for Xero and QuickBooks (with templates)

Jump To...

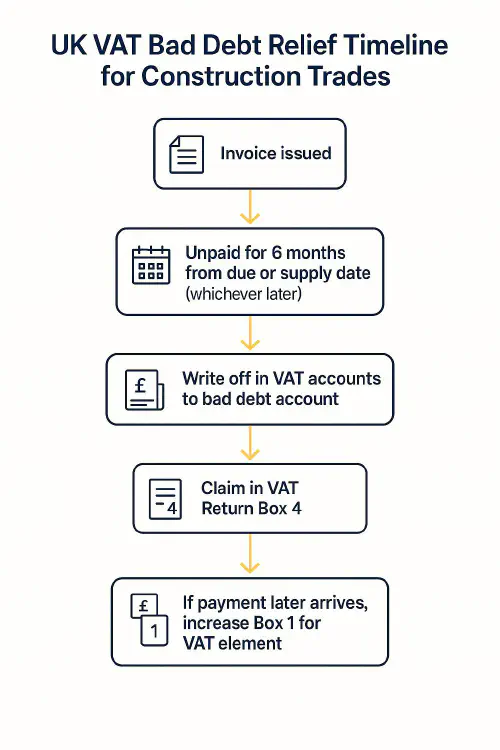

VAT bad debt relief hero image for UK construction trades

Quick answer

If a sales invoice stays unpaid for 6 months after the later of its due date or supply date, and you’ve already paid the VAT to HMRC, you can reclaim that VAT via bad debt relief. Put the reclaim in Box 4 of the VAT Return for the period when you first qualify. Keep a separate bad debt record. If the customer later pays, you increase Box 1 for the VAT element you previously reclaimed. See HMRC’s rules in VAT Notice 700/18.

VAT bad debt relief timeline flow for UK trades

Who this is for

- Contractors and subcontractors that invoice on standard or reduced VAT rates (not zero-rated works only)

- Businesses on standard VAT accounting or Flat Rate Scheme

- Anyone using Xero or QuickBooks and wants a clean, HMRC-compliant workflow

What HMRC actually requires

Key conditions (summarised from HMRC Notice 700/18):

- Debt unpaid for at least 6 months from the later of invoice due date or supply date

- You accounted for and paid the VAT on the original invoice

- The amount is written off in your VAT accounts and moved to a separate bad debt account

- Claim within 4 years and 6 months of the later of due or supply date

- Claim by including the VAT amount in Box 4 for the relevant period

- If a part payment later arrives, repay the VAT proportion via Box 1 in that period

Important nuances for construction:

- Domestic Reverse Charge (DRC) supplies: bad debt relief doesn’t apply because the customer accounted for VAT themselves. See HMRC’s DRC manual VATREVCON39300.

- Cash Accounting Scheme: usually no bad debt relief needed because you only pay VAT when you get paid.

- Flat Rate Scheme: you can claim bad debt relief; see Notice 733 for specifics on calculation method.

Xero: post a claim correctly

Goal: clear the customer’s invoice balance and reclaim the VAT in Box 4 without distorting sales totals.

Step-by-step:

- Write off the receivable (no VAT impact)

- Create an expense account called “Bad debts”

- Create a credit note to the customer for the net amount you’re writing off and use a No VAT tax rate so Boxes 1/6 aren’t touched

- Apply the credit note to the outstanding invoice to clear it

- Reclaim the VAT via a VAT Return adjustment

- When the 6-month point is reached, open the VAT Return for that period

- Add an adjustment to Box 4 for the VAT you’re reclaiming on the unpaid portion (at 20% VAT use gross × 1/6; at 5% use gross × 1/21)

- Use an adjustment account named “VAT bad debt relief” and include the invoice number, due date and claim calculation in the notes

- If you later receive payment

- Add a Box 1 adjustment for the VAT element of any cash received later (pro-rata if part payment)

Keep records required by HMRC (original VAT invoice, bad debt account entry, date entitlement arose, calculations). See Notice 700/18.

QuickBooks Online: post a claim correctly

Goal: same as Xero — clear the receivable, then claim the VAT in Box 4 when eligible.

- Write off the receivable (no VAT impact)

- Create an expense account “Bad debts” and a non-stock service item mapped to it

- Raise a credit note for the net amount using that item and set tax to No VAT; apply it to the invoice

- Make the VAT Return adjustment

- In the period you first qualify, open the VAT Return and click Adjust on Box 4

- Enter the VAT amount you’re reclaiming, post to a “VAT bad debt relief” account, add memo notes

- Later payment received

- Increase Box 1 in the VAT Return period you receive the money by the VAT element

QuickBooks help: Write off bad debt in QBO and Make VAT adjustments.

Automations that save you time

- Ageing alerts: Set reminders at 150, 170 and 182 days from due date so you file the claim in the right VAT period

- Auto-tag construction DRC jobs: Ensure you don’t try to claim BDR on DRC invoices

- Open banking rules: Flag part payments and auto-calc the VAT element you’ll need to repay if cash later arrives

- Job management sync: Default items as labour or materials with correct VAT codes so your relief calculations are accurate

- Template pack: Keep a standard “Bad debt account entry” note template and a “VAT BDR working” sheet ready for audit

Common mistakes to avoid

- Issuing a VAT credit note to reverse VAT for non-payment (not allowed for BDR)

- Claiming before 6 months have passed (clock runs from later of due/supply date)

- Forgetting to repay VAT in Box 1 if cash later comes in

- Trying to claim BDR on Domestic Reverse Charge invoices

- No separate bad debt account trail

Useful links

- HMRC: Relief from VAT on bad debts (Notice 700/18)

- HMRC: DRC manual – bad debt relief doesn’t apply

- HMRC: Flat Rate Scheme rules (Notice 733)

- TrainAR Academy: Domestic Reverse Charge checklist and invoice wording

- TrainAR Academy: DRC on mixed invoices in Xero and QuickBooks

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist