Work out your trade charge‑out rate: simple formula, examples and calculator links

Jump To...

Calculator, clipboard with formula, laptop spreadsheet and van silhouette for UK trades charge‑out rate

Who this is for

- Sole traders and small contractors (plumbing, electrical, heating, joinery, decorating, landscaping and more)

- Office managers or estimators who set rates for engineers

- Anyone reviewing day rates, call‑out fees, or maintenance pricing for UK jobs

Quick answer

Your charge‑out rate is the hourly price you bill customers for labour. It must cover:

- Your total annual business cost (wages, employer on‑costs, vans, insurance, software, rent, phones, tools, training, marketing, etc.)

- Only the hours you can actually bill

- Plus a profit margin so you can invest and grow

Simple formula:

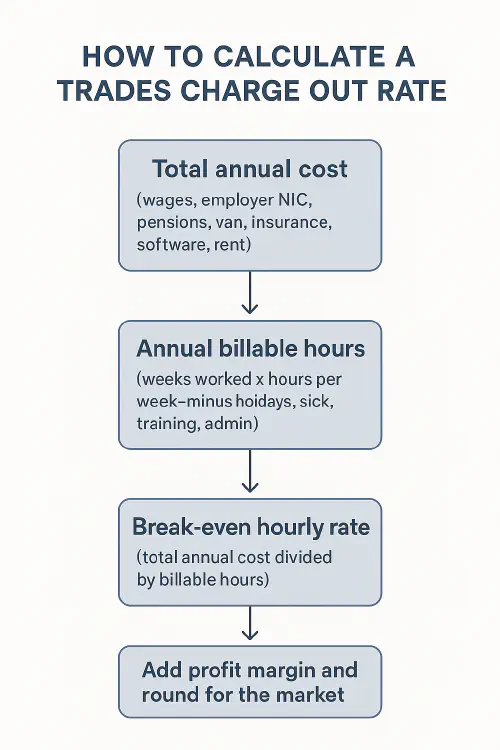

Break‑even hourly rate = Total annual cost ÷ Annual billable hours

Final charge‑out rate = Break‑even hourly rate + Profit margin

If you’re VAT‑registered, add VAT on top of your final rate.

The charge‑out rate formula

- Total annual cost: include wages/salaries, employer National Insurance and pension, vehicles and fuel, insurance, tooling, PPE, software, phones, rent, training, marketing, accountancy, contingencies.

- Annual billable hours: total working hours minus holidays, bank holidays, sick time, travel, quoting, admin and training.

- Break‑even hourly rate: total annual cost ÷ billable hours.

- Add profit: apply a markup or set a target net margin. Many firms land between 15 and 35 percent depending on risk and demand.

Flowchart: total annual cost → billable hours → break‑even rate → add profit

Useful references for current on‑costs:

- Employer NI and thresholds change each tax year. Check GOV.UK for live rates and allowances: Rates and thresholds for employers and National Insurance rates and allowances.

- Inflation moves material and wage expectations. See the ONS monthly release: Consumer price inflation, UK.

Step‑by‑step: prepare your numbers

1) List your total annual cost

Include all the following (estimate for the next 12 months):

- Wages or drawings for you and staff

- Employer on‑costs (National Insurance, pension). Use live HMRC thresholds via GOV.UK links above

- Vans, fuel, vehicle finance, MOT, tyres

- Public liability and professional insurance

- Tools, calibration, PPE and test gear servicing

- Software (job management, accounting), phones, cloud storage

- Office or lock‑up rent, utilities

- Training and certification (e.g., NICEIC, Gas Safe), CPD

- Marketing and website, ads, directories

- Bad debt provision and contingency

Add these up to get your total annual cost.

2) Work out annual billable hours

Start from the hours you could work, then subtract the time you can’t bill:

- Holidays and bank holidays

- Sick days and emergencies

- Travel between jobs

- Quoting, chasing suppliers, picking up materials

- Toolbox talks, training, audits, certification visits

Many small firms end up between 1,200 and 1,500 billable hours per engineer per year. If you’re new, be conservative.

3) Calculate your break‑even hourly rate

Break‑even hourly rate = Total annual cost ÷ Annual billable hours.

Example: if your annual cost is £72,000 and you can bill 1,400 hours, your break‑even is £72,000 ÷ 1,400 = £51.43 per hour.

4) Add profit and round for the market

Decide a target profit. Some use a multiplier (for example 1.2 to 1.6 on break‑even). Others add a fixed margin percent.

- Using the example above, with a 30 percent margin: £51.43 × 1.3 ≈ £66.86. Round to a clean figure that fits your market, for example £67 or £69 per hour.

5) Set your day rate and call‑out fees

- Day rate: hourly rate × planned hours on site. Keep a minimum charge for short visits

- First hour call‑out: commonly a higher first‑hour price that includes travel, then your standard hourly rate thereafter

- Out‑of‑hours: set a separate evening/weekend/overnight tariff

Worked examples

Solo electrician example

Assumptions:

- Total annual cost £68,000 (wage/drawings, employer on‑costs if applicable, van, insurance, software, rent, tools, training, marketing)

- Billable hours 1,350

- Target profit 25 percent

Break‑even = £68,000 ÷ 1,350 = £50.37.

Charge‑out rate = £50.37 × 1.25 ≈ £63.00 per hour.

Possible pricing:

- Standard hourly rate £63

- First hour on small jobs £85 (includes travel)

- Day rate £500 based on eight billable hours

- Emergency rate evenings/weekends £95 per hour

3‑person plumbing firm example

Assumptions (per engineer):

- Annual cost £74,000

- Billable hours 1,400

- Target profit 30 percent

Break‑even = £74,000 ÷ 1,400 = £52.86.

Charge‑out rate = £52.86 × 1.3 ≈ £69 per hour.

Team pricing you might publish:

- Labour £69 per hour plus VAT

- Day rate £540

- Boiler breakdown call‑out: £95 first hour, then £69 per hour

These are examples. Always use your own costs and demand.

Benchmark: what others charge

Latest 2025/2026 market data:

- Electricians: average £45–£60 per hour UK-wide, with £50–£60 typical for established firms. Emergency call-outs hit £75–£125 per hour. Day rates average £335. See HaMuch electrician rates and Checkatrade electrician rates.

- Plumbers: average £40–£70 per hour; self-employed typically £45–£75 per hour. Day rates £250–£500+ depending on location. See Checkatrade plumber cost guide and Gas Engineer Software rates guide.

- Regional uplift: London and South East typically run 15–30% higher than the rest of UK due to cost of living and stronger demand.

Use benchmarks as a sense‑check only. Your cost base and market are what matter.

Day rate vs hourly vs fixed price

- Hourly: good for unknown scope, fault‑finding, and small tasks. Always set a minimum charge and priced first hour

- Day rate: good for full‑day bookings where you control the schedule and access

- Fixed price: best for repeatable jobs you know well (for example, boiler service, EICR, extractor fan swap). Build a price book and include what’s and is not included

Related reading: Build a trade price book: step‑by‑step template, formulas and examples.

VAT, materials and travel

- VAT: if you’re VAT‑registered, the standard rate is typically 20 percent. Quote prices clearly as “plus VAT” or “including VAT”. See VAT rates on GOV.UK

- Materials: add a sensible handling margin to cover time sourcing, ordering, and warranty admin

- Travel: either include it in your first‑hour price or specify a per‑mile/per‑zone fee

Common mistakes and quick fixes

- Underestimating non‑billable time. Track travel, quoting and admin for two weeks to see the real picture

- Forgetting employer on‑costs. Use GOV.UK’s live thresholds before you finalise rates

- Never reviewing rates. Recheck every 6–12 months or when your costs jump

- One rate for everything. Publish standard, day, first‑hour and emergency rates

- No minimum charge. Short jobs can kill your day if you don’t cover travel and setup time

Tools and calculators

- Tradify’s guide and calculator: How to calculate charge‑out rate

- UK cost estimator: Calculate your charge‑out rate

- Quick day‑rate helper: Day Rate Calculator

- Background reading: Designing Buildings Wiki: Charge‑out rate

Video: UK perspective on hourly rates

A practical UK‑focused explainer on setting self‑employed hourly rates.

Template you can copy

Use these headings in a sheet and plug in your numbers.

Your business: _________________________ Review date: __________

Annual costs (£)

- Wages/drawings: _______

- Employer NI and pension: _______

- Vans and fuel: _______

- Insurance: _______

- Tools, PPE, calibration: _______

- Software and phones: _______

- Rent and utilities: _______

- Training and certification: _______

- Marketing and website: _______

- Other overheads/contingency: _______

Total annual cost: _______

Billable hours

- Weeks worked: __ × hours/week: __ = ______

- Less holidays/bank holidays: −____

- Less sick/training/admin/travel: −____

Annual billable hours: ______

Break‑even hourly rate = Total annual cost ÷ Billable hours = £____ / hour

Target profit margin: ____ %

Charge‑out hourly rate = £____ / hour (ex VAT)

Published rates: First hour £____, Standard £____/h, Day rate £____, Emergency £____/h

Related articles

- VAT threshold for trades: rolling 12‑month calculator and simple workflow to avoid fines

- Build a trade price book: step-by-step template, formulas and examples

- Domestic reverse charge VAT for construction: simple checklist, invoice wording and VAT return boxes

FAQ

What is a charge‑out rate?

It’s the hourly amount you bill customers for labour. It must cover your true business costs and include profit, and it’s different from an employee’s wage.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist