Finance & Tax

Xero and QuickBooks bank feeds: the simple setup for UK trades and how to fix the 90-day reconnect

TrainAR Team

4 months ago

5 min read

Jump To...

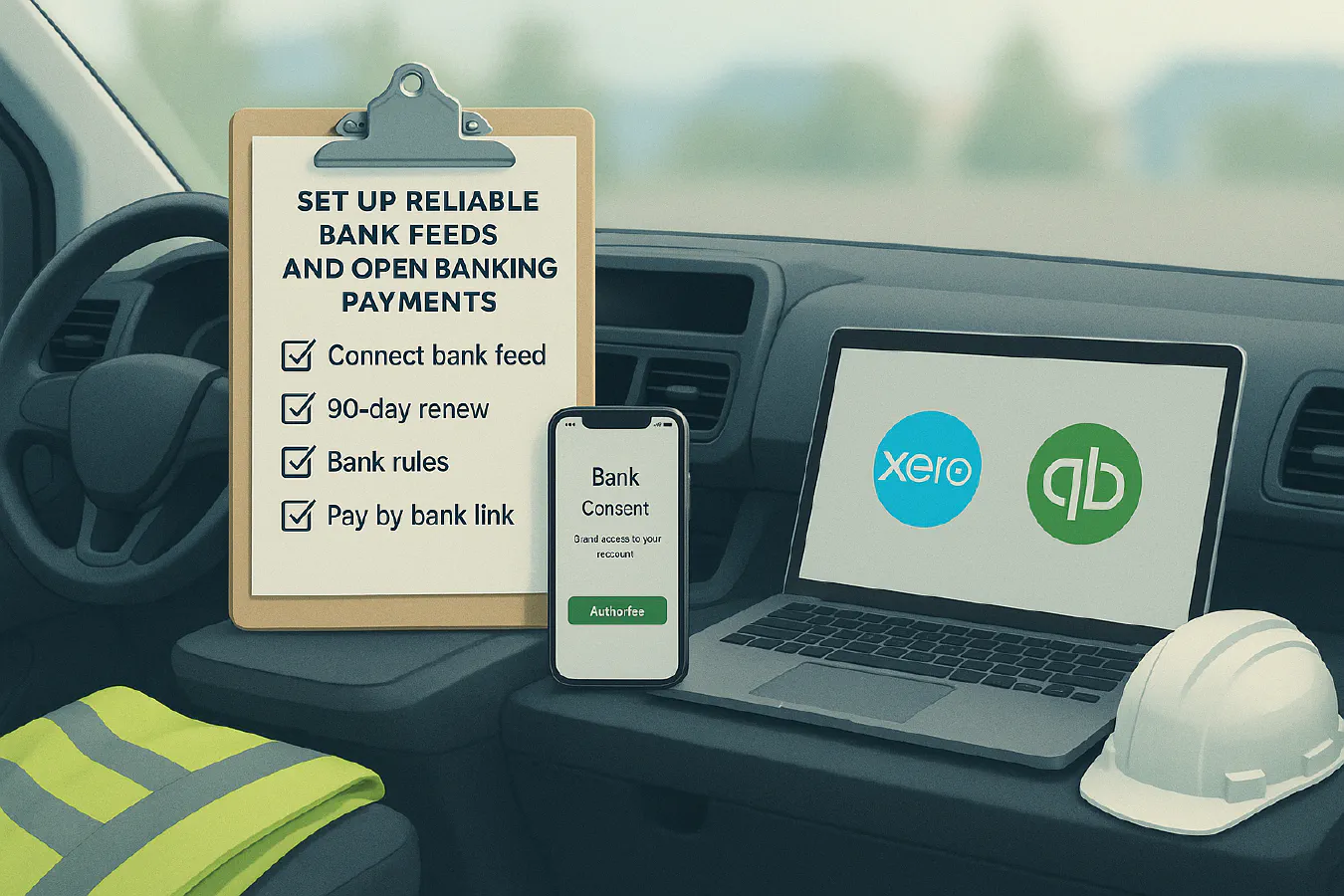

Van dashboard with bank feed checklist, phone showing open banking consent and laptop with Xero and QuickBooks icons

Quick answer

- Bank feeds pull transactions from your business bank into Xero or QuickBooks each business day using open banking permissions you approve at your bank.

- In the UK you must renew consent roughly every 90 days. Xero and QuickBooks send prompts; you log back in to your bank and reconfirm.

- Do these three things and reconciliation will stay painless:

- Create simple bank rules for fuel, parking, small tools and card processing fees.

- Do a weekly 10-minute reconcile and clear unmatched items.

- Add a Pay by Bank button to invoices so customers pay you the right amount, first time.

Open Banking overview (OBL) Xero open banking QuickBooks open banking

What bank feeds and open banking actually do

- A secure connection moves statement lines into your software, ready to match against sales, bills and spend money.

- You choose which accounts to connect and how far back to import history. Most UK banks allow up to 12 months on first connect.

- You can disconnect any time. Consent expires after 90 days if you don’t renew.

Helpful explainers from the vendors: Xero Central: Connect your bank QuickBooks: Connect bank feeds

Set up a bank feed in Xero

- In Xero: Accounting > Bank accounts > Add bank account. Search your UK bank and click Connect.

- Pick the exact accounts to connect, choose the start date and confirm.

- You’ll be redirected to your bank to authenticate and grant access. Approve the accounts and return to Xero.

- Back in Xero, transactions begin to flow. Reconcile daily or weekly.

Useful links: Xero open banking hub Bank feeds available in Xero

Time-savers in Xero

- Bank rules: Create rules for common suppliers like Shell, Screwfix, Toolstation and parking. In Xero: Accounting > Bank accounts > Bank rules.

- Find and recode: If a batch went to the wrong code, use Find and Recode to fix in one go (requires Advisor role).

- Attach receipts: Email receipts to your Xero files or use an app like Dext to auto-read them.

Set up a bank feed in QuickBooks

- In QuickBooks Online: Transactions > Bank transactions > Link account. Search your bank and follow the connection steps.

- Choose the accounts, confirm the history date, and complete your bank login and approval.

- Back in QuickBooks, review and add rules for the common spend you see every week.

Useful links: QuickBooks: Connect bank feeds Supported banks list

Time-savers in QuickBooks

- Bank rules: Create rules for suppliers and references you see a lot. Add auto-add sparingly; always review VAT codes.

- Batch actions: Tick multiple transactions to accept in one go when the rule hit is high-confidence.

- Attachments: Drag and drop photos of receipts so VAT evidence lives with the transaction.

Fix the 90-day reconnect without the headache

- Why it happens: UK open banking requires Strong Customer Authentication and a fresh consent about every 90 days.

- What to do in Xero: In the bank account tile, click the warning, then Update bank connection and follow your bank login. Xero: Disruptions to bank feeds Check if your feed is late

- What to do in QuickBooks: Use the banner on the Banking page to Reconfirm bank connection. QBO: Reconfirm your bank connection Fix connection errors

- Tip: Put a recurring calendar reminder for the first Monday of the month to check bank connections and run your 10-minute reconcile.

Bank rules that save hours each month

- Fuel and mileage: Use separate rules for fuel vs parking. Apply the correct VAT treatment and consider mileage claims separately.

- Small tools and consumables: Set a spending rule for Toolstation or Screwfix under small tools or materials.

- Card fees: Rules for Stripe, SumUp and Zettle. Post to bank charges.

- Subcontractors: If you pay subs weekly, create a rule to post to a CIS cost code. Keep CIS verification and statements on file.

Xero bank rules help QuickBooks bank rules help

Pay by Bank links that get you paid faster

- Xero options: Add a Pay now button using an open banking provider like Crezco or GoCardless Instant Bank Pay for instant bank transfers. Xero App Store: Crezco GoCardless Instant Bank Pay

- QuickBooks options: QuickBooks native GoCardless app supports UK Direct Debit for recurring payments; for open banking one-off payments, use a standalone link or your website checkout and record the payment in QBO.

- Why trades like it: No card numbers, fewer failed payments and lower fees than cards. Great for deposits and stage payments.

Related reading:

- Xero invoice reminders: settings and weekly routine

- AI invoice chasing with WhatsApp

- 13-week cash flow for trades

Proof and controls your accountant will love

- Monthly bank reconciliation to the statement closing balance.

- Keep VAT evidence with each transaction. HMRC can and does ask.

- Separate a drawings account from business costs to keep your P and L clean.

- For limited companies, use two-step approval on larger payments in your bank and keep user roles tight in the accounting software.

Troubleshooting and known issues

- Feed is late today: Check vendor status pages and bank feed disruption pages first. Xero Status Xero: Feed late? QBO: Bank Connection Toolkit

- Stuck or error in QBO: Reconfirm connection and clear browser cache or try incognito. If needed, disconnect and reconnect. QBO: Fix connection errors

- Duplicates or missing days: Scan back a week in your bank against the software. If needed, import a small CSV for the missing day, then reconcile.

- Barclays, Lloyds, NatWest quirks: Some banks throttle overnight. Do your refresh mid-morning on a business day.

Optional video: refresh a Xero bank feed

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist