Xero and QuickBooks: set up PAYE payroll and CIS subcontractors properly

Jump To...

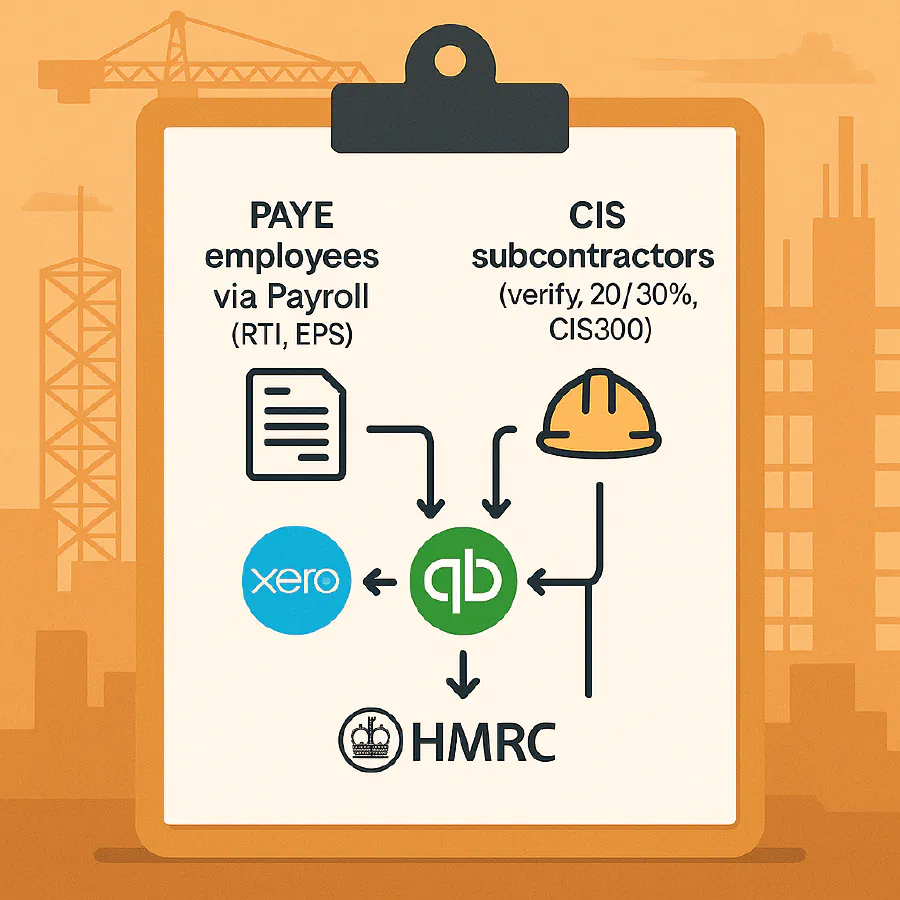

A lot of UK contractors search for “CIS payroll” and get stuck. Here’s the simple truth: PAYE payroll is for your employees; CIS is for subcontractors, and it doesn’t run through Payroll. You manage the two side by side and report to HMRC in different ways.

Diagram showing PAYE employees via Payroll and CIS subcontractors via CIS return, with Xero and QuickBooks feeding HMRC

Quick answer: PAYE vs CIS

- PAYE payroll is for employees. You run payslips, submit RTI (FPS/EPS) and pay PAYE/NIC to HMRC.

- CIS applies to subcontractors (self‑employed or companies) you pay for construction operations. You verify each subbie, apply 0 percent, 20 percent or 30 percent deduction on labour only, submit CIS300 monthly and give Payment and Deduction statements.

- Don’t put subcontractors through Payroll. Keep payroll for employees only. Handle subcontractors in CIS.

Useful official guidance: HMRC overview for contractors, verification and deduction rates gov.uk and the CIS guide CIS340 gov.uk.

The workflow at a glance

Employees (PAYE) → Run Payroll (FPS/EPS) → Pay staff → Pay HMRC PAYE/NIC

│

└─ EPS can include CIS suffered (Ltd Co only)

Subcontractors (CIS) → Verify (HMRC) → Pay net of 0/20/30 on labour → CIS300 return → Pay HMRC CIS

- Deduct CIS on the labour element only, excluding VAT and allowable materials/plant/fuel for plant.

- Domestic Reverse Charge VAT can apply to many B2B construction invoices. Handle VAT coding separately from CIS.

Before you start: HMRC basics and what to verify

- Verify each new subcontractor before first payment, and again if they haven’t appeared on your CIS returns in the current or previous two tax years. HMRC confirms 0 percent gross, 20 percent net or 30 percent.

- Have the right details ready: your UTR, Accounts Office ref, PAYE ref and the subcontractor’s UTR plus NI/Company number as relevant. Details must match HMRC records.

- How to calculate CIS: start with the gross labour amount, subtract VAT and allowable materials/plant/fuel for plant, then apply the rate.

References: HMRC contractor steps gov.uk and verification rules gov.uk.

Xero setup: PAYE payroll and CIS side by side

Payroll (PAYE employees)

Use Xero Payroll for your employees. Submit RTI (FPS/EPS) as normal. If you’re a limited company reclaiming CIS suffered, you’ll enter the CIS suffered total in the EPS each tax month.

Help: File payroll information with HMRC (includes reporting CIS suffered in EPS) Xero Central.

CIS (subcontractors)

Enable CIS in Xero to access CIS codes and reports. Guide: About CIS in Xero Xero Central and how to enable CIS Xero Central.

Add each subcontractor as a Contact and record their UTR and deduction status (gross/20 percent/30 percent). If you’ve the CIS Contractor add‑on, verify subs directly from Xero and file CIS300 in‑product.

Post bills from subcontractors as usual:

Put labour on CIS labour accounts so Xero calculates the deduction.

Put materials/plant/fuel for plant on non‑CIS lines so they’re excluded from the deduction.

Apply correct VAT codes, including Domestic Reverse Charge where it applies.

File the CIS300 and issue Payment and Deduction statements by the 19th of the following month.

Related Academy reads:

- Automate CIS returns from job sheets: Xero and QuickBooks setup, rules and statements

- Domestic Reverse Charge VAT for construction: simple checklist, invoice wording and VAT return boxes

QuickBooks setup: PAYE payroll and CIS side by side

Payroll (PAYE employees)

If you use QuickBooks Payroll for employees, run RTI as normal. Limited companies can reclaim CIS suffered through the monthly EPS in Payroll by entering the CIS suffered amount for that tax month.

CIS (subcontractors)

Turn on CIS: Settings → Account and settings → Advanced → Construction Industry Scheme (CIS).

Add subcontractors: mark as CIS, enter UTR and business details, then verify with HMRC from within QuickBooks.

Post supplier bills/expenses:

Labour lines as CIS‑applicable (QuickBooks will calculate 0 percent/20 percent/30 percent on labour only).

Materials/plant/fuel for plant as non‑CIS so they’re excluded.

Apply VAT correctly, including the Domestic Reverse Charge when applicable.

File the CIS300 monthly in Taxes → CIS and send Payment and Deduction statements to subs by the 19th.

Helpful guides: Set up CIS and file returns in QuickBooks QuickBooks Help and submit CIS returns QuickBooks Help.

CIS suffered: how limited companies reclaim via EPS

- If your business is a limited company acting as a CIS subcontractor, you can offset CIS suffered against your PAYE/NIC liability via the EPS each tax month.

- In Xero: enter CIS suffered in Payroll → RTI filings → Update CIS (see Xero Central).

- In QuickBooks Payroll: enter the CIS suffered figure on the Employer Payment Summary before you submit for that month.

- Sole traders and partnerships usually reclaim CIS suffered through Self Assessment, not the EPS.

Common mistakes and how to avoid them

- Putting subcontractors through Payroll. Keep subcontractors in CIS; employees in Payroll.

- Applying CIS to materials/plant. CIS applies to labour only, after excluding VAT and allowable materials/plant/fuel for plant.

- Skipping verification or re‑verification. Verify new subs before first payment and re‑verify if they’ve dropped off recent CIS returns.

- Missing the Domestic Reverse Charge. Handle VAT codes correctly and keep VAT separate from CIS.

- Missing deadlines: CIS months run 6th to 5th. File CIS300 and issue statements by the 19th; pay HMRC by the 22nd if paying electronically.

Handy links

- HMRC: Contractor obligations and verification gov.uk

- HMRC: Make deductions and pay subcontractors gov.uk

- HMRC: CIS340 guide gov.uk

- Xero: CIS in Xero Xero Central

- Xero: Enable CIS Xero Central

- Xero: File payroll returns, update CIS suffered in EPS Xero Central

- QuickBooks: CIS guide and returns QuickBooks Help

- QuickBooks: Submit CIS return QuickBooks Help

Internal Academy links:

- Automate CIS returns from job sheets: Xero and QuickBooks setup, rules and statements

- Domestic Reverse Charge VAT for construction: simple checklist, invoice wording and VAT return boxes

What people are saying on Reddit

- CIS subcontractor using subcontractors: cash flow and compliance discussion (r/ukelectricians) reddit

- Subcontractors: handling cash flow and CIS deductions (r/ukelectricians) [reddi…

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist