Xero invoice reminders UK: best settings, copyable chase emails and a 30‑minute weekly routine for trades

Jump To...

Laptop showing a UK invoice with Pay now button, a calendar and a reminder email on phone

Who this is for

- UK plumbing, electrical, HVAC and building firms using Xero

- Owners and office admins who want fewer late payers without extra software

Quick wins

- Turn on automated reminders and add a pre‑due nudge

- Add Pay now with Stripe or GoCardless to cut friction

- Put your right to charge statutory interest and fixed‑sum costs on every invoice and in your terms. See GOV.UK guidance: https://www.gov.uk/late-commercial-payments-interest-debt-recovery/charging-interest-commercial-debt

Set up reminders step by step

The settings below reflect how UK trades customers actually pay. You can tweak later.

- Turn on invoice reminders

- In Xero: Business > Invoices > Invoice settings > Invoice reminders > Turn on

- Create up to five reminders. Suggested schedule:

- 3 days before due (friendly nudge)

- On the due date (morning)

- 7 days overdue (firm but helpful)

- 14 days overdue (state next steps)

- 28 days overdue (final notice)

- You can exclude small balances and stop reminders per customer or invoice. Xero how‑to: https://central.xero.com/s/article/Set-up-invoice-reminders

- Add a Pay now button

- Enable Stripe for cards and Apple Pay, or GoCardless for Direct Debit. Xero overview: https://www.xero.com/uk/accounting-software/accept-payments/

- For repeat clients, Direct Debit collects on due date and reduces chasing. GoCardless setup notes: https://support.gocardless.com/hc/en-gb/articles/17144750241820-Customer-settings-GoCardless-for-Xero

- Make your invoice clear and payable

- Include job/site reference, work dates, correct PO, and bank details

- Add a footer line about statutory interest and fixed‑sum recovery under Late Payment rules

- Xero now tracks when customers open your invoice, so you can tell if they’ve viewed it or are ignoring it – check the invoice status dashboard before sending another reminder.

- UK checklist: Small Business Commissioner guidance: https://www.smallbusinesscommissioner.gov.uk/

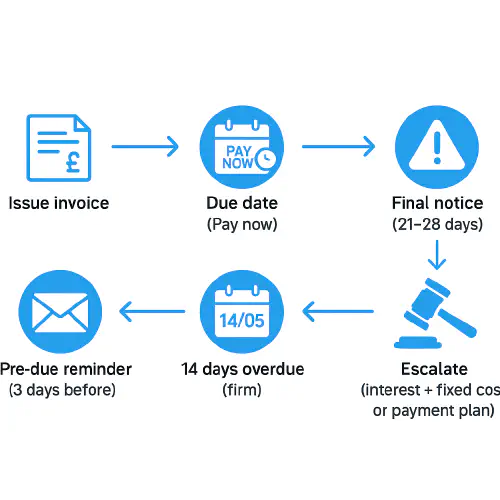

Simple UK credit control flow using Xero from issue to escalation

Copyable chasing emails

Paste these into Xero reminder templates. Replace [brackets]. Keep subject lines simple.

Pre‑due, 3 days before Subject: Due [DD/MM] – [invoice #] for [site] Hi [Name], quick reminder invoice [invoice #] for [job/site], [£amount], is due [DD/MM]. Pay here: [Pay now link]. Any questions, just reply. Thanks, [Your name].

Due today Subject: Due today – [invoice #] [£amount] Hi [Name], invoice [invoice #] for [£amount] falls due today. To keep your account up to date, please pay here: [Pay now link]. If there’s a query, let me know and I’ll sort it.

7 days overdue Subject: 7 days overdue – [invoice #] Hi [Name], invoice [invoice #] for [£amount], due [DD/MM], is now 7 days overdue. Please pay here: [Pay now link]. If you need a PO or have a query, tell me and I’ll help.

14 days overdue (state next steps) Subject: Action required – [invoice #] 14 days overdue Hi [Name], invoice [invoice #] for [£amount], due [DD/MM], remains unpaid. Unless settled by [date + 3–5 working days], we may add statutory interest and fixed‑sum recovery costs under UK Late Payment rules. Please pay here: [Pay now link] or reply with a payment date.

Final notice (21–28 days) Subject: Final notice before escalation – [invoice #] Dear [Name], despite reminders, invoice [invoice #] for [£amount], due [DD/MM], remains unpaid. Please arrange payment by [final date]. Otherwise we will add statutory interest and fixed‑sum costs and may commence formal recovery. If there’s an issue with this invoice, contact me today.

Phone script for office staff “Hi [AP/contact], it’s [Your name] from [Company]. Checking everything’s in place for invoice [#] for [job/site], due [date]. Do you’ve the PO and invoice copy, and is there anything you need from us to get this paid on time?”

Weekly 30‑minute routine

A repeatable routine your office can run every Monday.

0–5 mins: Open Xero > Business > Invoices > Aged receivables. Filter by Overdue and sort by amount and customer.

5–15 mins: Send statements to the top 10 overdue customers. Add short note: “Statement attached for your records. Please confirm payment dates on highlighted invoices.”

15–25 mins: Call the top 3 balances. Use the phone script. Log notes on the Xero contact and add a reminder task.

25–30 mins: Check any disputed invoices and assign next action. If an invoice is 21+ days overdue, prepare the Final notice email and set a calendar reminder for the final date.

Troubleshooting

- Reminders not sending: check the customer or invoice isn’t excluded. See Xero guide: https://central.xero.com/s/article/How-invoice-reminders-work

- Emails go to spam: send from your domain, add SPF/DKIM, keep subject lines simple, avoid attachments over email limits

- Want more control? Xero now lists award-winning apps in their store – several offer AR Automation with Email & SMS Reminders and won recognition as Small Business Apps of the Year 2026. Check the Xero App Store under Credit Control and Invoicing.

- Customers paying late anyway: switch them to Direct Debit with GoCardless so invoices collect automatically on due date

- Unsure what you can legally add: GOV.UK explains interest and fixed‑sum recovery amounts you may charge on late commercial debts: https://www.gov.uk/late-commercial-payments-interest-debt-recovery/charging-interest-commercial-debt

Video walkthrough

A short UK walkthrough on setting automated reminders in Xero.

Related TrainAR Academy guides

- Stripe to Xero UK: reconcile payouts and VAT on fees: https://academy.trainar.ai/stripe-to-xero-uk-reconcile-payouts-fees-and-vat-the-right-way

- GoCardless to Xero UK: clean reconciliation and VAT on fees: https://academy.trainar.ai/gocardless-to-xero-uk-how-to-reconcile-payouts-properly-with-a-clearing-account-and-get-vat-on-fees-right

- Zettle to Xero UK: daily sales and payouts with a clearing account: https://academy.trainar.ai/zettle-to-xero-uk-how-to-reconcile-daily-sales-fees-and-payouts-with-a-clearing-account

FAQ

Can I add a pre‑due reminder in Xero

Yes. In the reminders schedule, add a reminder set to before due date. You can have up to five reminders.

What if I only want reminders on invoices over a certain amount

Use the minimum invoice amount setting in Xero’s reminders screen to exclude small balances.

Will adding Pay now change my fees

Card payments via Stripe and Direct Debit via GoCardless have processing fees. Most firms find the faster payment and lower admin cost outweigh the fee.

Do late‑payment interest rules apply to domestic customers

The Late Payment legislation applies to business‑to‑business debts. For homeowners, you can only charge what your contract allows. Take advice for consumer work.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist