Zettle to Xero UK: how to reconcile daily sales, fees and payouts with a clearing account

Jump To...

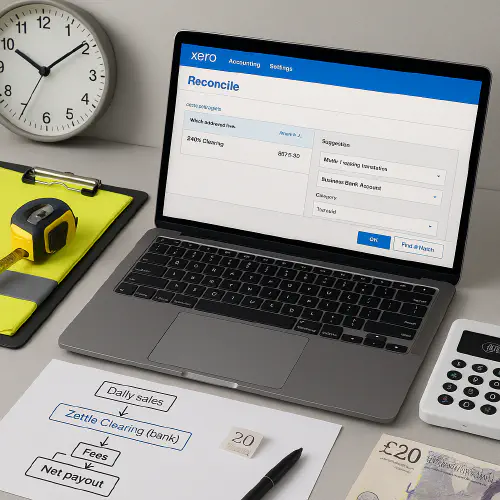

UK trades desk with Xero bank reconciliation and a simple Zettle clearing flow diagram

Who this is for

- UK trades businesses using Zettle by PayPal to take card payments on site and Xero for accounts.

- Owners, office admins and bookkeepers who want first time reconciliation and correct UK VAT.

What you will set up

- A dedicated Zettle Clearing bank account in Xero for daily sales and fees.

- Correct VAT code mapping for Zettle VAT rates to Xero tax codes.

- A clean payout match from Zettle Clearing to your real bank feed.

10 minute setup

- Create the clearing account in Xero

- Accounting -> Bank accounts -> Add bank account -> Add it anyway.

- Name: Zettle Clearing (GBP). Type: Bank. Don’t connect a feed.

- Connect Zettle to Xero and map VAT

- In Zettle Backoffice -> Integrations -> Xero.

- Liquid account: choose Zettle Clearing (the Xero bank account you just made). Zettle recommends a Xero bank account for this.

- Deposit account: your real business current account which receives Zettle payouts. Must be different from the liquid account.

- VAT mapping: map each Zettle VAT rate to the matching Xero tax code (20 percent, 5 percent, 0 percent, Exempt).

- Official guide: https://www.zettle.com/gb/help/articles/1904954-integrate-with-xero

- Optional bank rule for faster matching

- In your real bank account in Xero create a rule.

- Condition: Reference contains ZETTLE or PAYPAL ZETTLE.

- Action: Transfer to Zettle Clearing.

Daily flow

What the Zettle -> Xero sync posts each day when configured as above.

- Daily sales invoice

- One invoice per day with lines split by VAT rate you used that day.

- Zettle records payments against this invoice into Zettle Clearing per tender type.

- Zettle fees bill

- One supplier bill per day for merchant fees.

- The bill is auto paid from Zettle Clearing so the clearing balance reflects net takings.

- Refunds and voids

- Daily sales credit note for refunds by VAT rate, plus matching refund entries against Zettle Clearing.

- Payout to your bank

- A transfer from Zettle Clearing to your real bank. In the bank feed you match the payout line to this transfer.

Result: Zettle Clearing should trend to zero per payout cycle, with only small timing differences in transit.

Handy references

- Zettle Xero integration overview and account mapping: https://www.zettle.com/gb/help/articles/1904954-integrate-with-xero

- Xero App Store listing for Zettle: https://apps.xero.com/uk/industry/retail/app/zettle

- Community chat on the Zettle liquid account setup: https://www.reddit.com/r/xero/comments/16fakin/

VAT on Zettle fees (UK)

- Per HMRC VAT Notice 701/49 finance, the merchant service charge paid by retailers to card acquirers is an exempt financial service. Many UK Zettle merchants therefore see no VAT added on per transaction fees.

- Coding in Xero: if your Zettle fee bill shows no VAT, use the Exempt VAT code on the expense line. Don’t use Zero rated unless your invoice explicitly shows zero percent VAT.

- If your Zettle statements show VAT on a fee, use the stated rate. If they show Reverse charge, use a reverse charge code so Boxes 1 and 4 are grossed up on your VAT return.

- Hardware is different: Zettle readers and accessories are standard rated at 20 percent and will show VAT on the invoice.

Official references

- HMRC VAT Notice 701/49 finance: https://www.gov.uk/government/publications/vat-notice-70149-finance/vat-notice-70149-finance

- Zettle pricing overview: https://www.zettle.com/gb/help/articles/1084775-pricing

Numbers example

- Sales taken today by card: 1,200 including multiple VAT rates.

- Zettle fees: 18.00 (Exempt).

- Bank payout received tomorrow: 1,182.00.

- In Xero Zettle Clearing: plus 1,200 sales payments minus 18 fees minus 1,182 transfer to bank equals 0.

Flow summary

Daily sales -> Zettle Clearing -> minus Fees -> Transfer -> Business bank

Troubleshooting

- Clearing account not zeroing

- Check you created the Zettle Clearing as a Xero bank account and selected it as the liquid account in Zettle. Don’t point it at your real bank.

- Confirm the payout transfer was created and matched to the bank feed line.

- Sales doubled

- If another POS also posts daily sales to Xero, turn off Zettle sales sync and only sync fees to avoid duplication.

- VAT mapping errors

- Add missing VAT codes in Xero first, then refresh the mapping in Zettle.

- First payout not matching automatically

- Match it manually once. Xero learns and will suggest it next time.

See also: our SumUp to Xero reconciliation guide for a similar clearing pattern and UK VAT notes on card fees.

Short video: clearing accounts in Xero

A quick refresher on how clearing accounts work in Xero, which is exactly how Zettle reconciliation is designed.

Related articles

- SumUp ↔ Xero (UK): bullet‑proof reconciliation and VAT on fees for trades

- Square to Xero UK: daily sales, fees and payouts using the Square Balance clearing account

- GoCardless to Xero UK how to reconcile payouts properly with a clearing account and get VAT on fees right

What’s new for Zettle/PayPal Point of Sale in 2025–2026

Zettle has been rebranded to PayPal Point of Sale in the UK, though the core features and Xero integration stay the same. Here’s what’s current:

- Simplified branding: PayPal brought Zettle into their ecosystem officially; you’ll see it called PayPal Point of Sale on new signups, but your existing Zettle account works unchanged.

- Same fee structure: 2.29% + 9p for in-person, 3.49% + 9p for manual entry (no monthly software fees).

- Contactless, digital wallets and QR: accepts Mastercard, Visa, Amex, Discover, Apple Pay, Google Pay, Samsung Pay, PayPal, Venmo.

For your Xero setup, Zettle Clearing, VAT treatment and reconciliation patterns don’t change. You’re still posting daily sales split by VAT rate and fee bills daily. The rebranding is just PayPal tidying up its product family—your books stay clean the same way.

FAQs

Does Zettle charge VAT on fees in the UK

Generally no. The per transaction merchant service charge is usually VAT exempt under HMRC Notice 701/49 finance. Always follow what your actual Zettle fee statement shows.

Should the Zettle liquid account be a bank account or a nominal account in Xero

Use a Xero bank account for Zettle Clearing. It makes transfers and bank reconciliation straightforward.

Where do I see the Zettle fees in Xero

Zettle posts one daily bill for fees and pays it from Zettle Clearing. Code it to Merchant fees with Exempt VAT unless your invoice shows VAT or reverse charge.

What if I get a refund or chargeback after the payout

Code the bank outflow as a Transfer to Zettle Clearing. In the clearing account, apply it against the related daily credit note or post a spend money to reopen the balance and add any chargeback fee to Merchant fees.

Exempt vs Zero rated on fees in Xero

Exempt is correct for most card acquiring fees. Zero rated is for taxable supplies at zero percent. Use the wording on your Zettle invoice to decide.

Ready to Transform Your Business?

Turn every engineer into your best engineer and solve recruitment bottlenecks

Join the TrainAR Waitlist